Report: Alt. Deals in CPG Rising Amidst Economic Squeeze

Despite rising inflation and a grim economic forecast, CPGs can still access growth capital thanks to a “much broader toolkit” of alternative M&A options, explained analysts from Bain & Company during a webinar this week.

According to Maria Kurenova, partner and co-lead for Global Consumer Products M&A, 2022 represented a “reset” for the global M&A market, specifically in its second half. During the first five months of the year, dealmaking remained around pre-pandemic levels, but that changed in June after interest rate hikes by the Federal Reserve pushed M&A activity down by around 50%. Consumer goods fared better relative to the whole, though value (-10%) and volume (-5%) were still both down. Over the 12-month period, multiples dropped from historically high deal levels (around 19x) to a 10-year low of 12x.

Yet optimism remains higher in consumer products than any other sector, according to Bain’s survey of CP practitioners. While large deals are fewer and further between, respondents voiced confidence that a steady pace of smaller transactions will continue this year. With valuations down across the board, targets that were previously out of reach may potentially come into play as well.

That reframing may also be an opportunity for prior experience to inform and improve best practices by examining better execution in integrating acquisitions, adjusting operating models and refocusing value on both revenue and cost synergy.

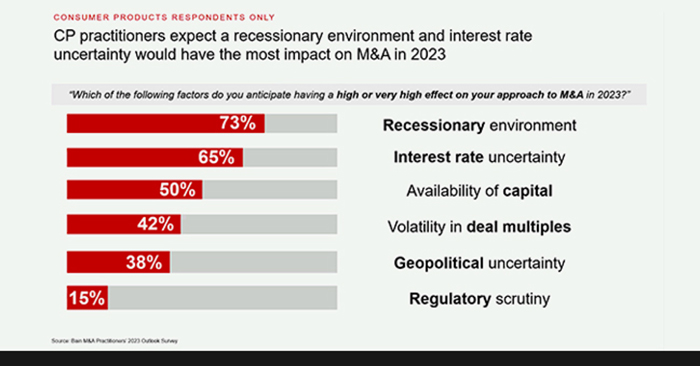

Within consumer products, M&A practitioners said economic recession and inflation are their chief concerns, with availability of capital, deal multiple volatility and geopolitical uncertainty coming in second. In contrast, worry over regulatory scrutiny over potential deals was lower in CPG than in the broader M&A space.

Learning From History

Despite dealmaking becoming more challenging, Pete Horsely, partner and EMEA Lead for M&A and Divestitures, said investors should be confident that M&A during an economic downturn can still create significant value. Looking back at data from the Great Recession (2008 to 2009), he noted that companies that made more than one acquisition during that period outperformed those that did not by about 120 basis points of total shareholder return.

“Even though deals are more difficult to get done — the risk aversion in the credit markets, the uncertainty and the different scenarios that you need to model through corporate due diligence and get right in the valuation, the geopolitical instability, not knowing what’s going to happen to the supply chains… and the regulatory pushback — this really is a unique window to steal the march competitively,” he said.

The opportunity centers around several areas. First, companies with strong cash reserves or access to capital will face less competition from private equity or corporate rivals. That may give potential acquirers more time to scrutinize how acquisitions fit in their own portfolios with an eye on maximizing cost synergies and scaling for the next strategic cycle. Though multiples are down on average, Horsley said, that could increase the value of companies that are profitable and have a compelling deal thesis. Distressed assets may also be on the market as inflation and recession continue to spread.

“Our view is that the winners will be those who stay in the game,” he said. “They don’t lose 18 months to a recession, and they learn how to play the M&A card well during this period.”

The “Bigger Toolbox”

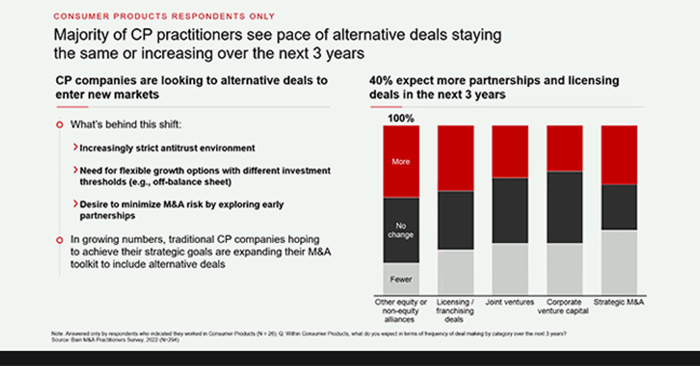

Though overall deal size and volume may be falling, CPGs have a “much broader toolkit, a much broader set of instruments, and you don’t need to outright own these assets to accelerate your strategy,” explained Sam Rove, partner, Consumer Products M&A and Divestitures. As access to cash gets tougher, these deals can bring many of the benefits of traditional M&A while mitigating risk.

Joint ventures have gained traction for M&A because of their versatility, he noted. The 50/50 partnership with General Mills and Nestlé to sell cereal outside of the U.S. is a more straightforward example, but JVs can also help manage divestment actions, such as with Pepsi staying on to help manage Tropicana’s transition to its new private equity owner. The structure may also appeal to companies with complementary needs, like NotCo (brand building expertise) and Kraft Heinz (AI technology).

The overall use of such alternative deals is increasing among top CPGs, particularly in terms of strategic alliances and corporate venture capital. The former has taken share away from traditional joint ventures, according to Bain data, while the number of newly-formed JVs and alliances among the top 15 CPGs has grown at around 20% CAGR from 2016 to2021.

“It’s hard to not be blown away by the sheer volume of these strategic alliances,” Ravit said, noting that the top 15 companies have over 100 alliances between them.

Will alternative deals continue at this pace, or have they peaked? According to a survey of CP practitioners, the majority expects levels to stay the same or increase over the next three years, with partnerships and licensing deals being of particular interest. But more deals doesn’t mean more satisfaction; according to Bain, more than 35% of those surveyed said that these deals did not meet or exceed expectations.

To increase the chances of success, a more sophisticated approach to dealmaking may be needed, Ravit explained. That means clearly articulating how the deal advances broader strategic goals and creating a governance framework, regulatory timelines and performance metrics that can be incorporated across organizations. Cultural fit should also be closely examined early on, and parties should be prepared to walk away if issues can’t be reconciled.