Deloitte: Profitable Growth Will Drive 2023 CPG Industry

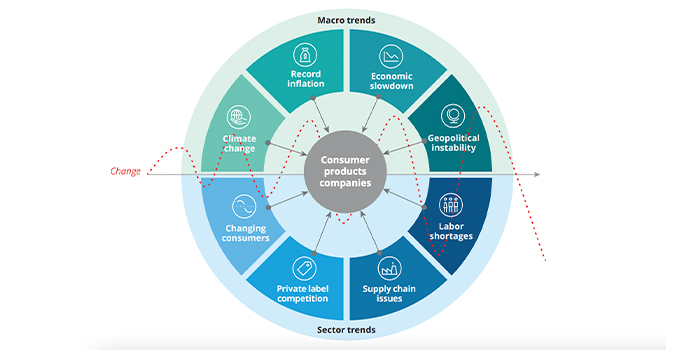

Maintaining profitable growth is the top priority for food and beverage companies this year as brands continue to navigate supply chain disruptions and economic uncertainty, according to a report by global accounting firm Deloitte.

In the report, titled 2023 Consumer products Industry Outlook, Deloitte surveyed 150 CPG executives to gauge how multinational companies are approaching the market in 2023. With recession fears rising, many respondents signaled that the best way to survive an economic downturn and a possibly challenging consumer environment is to focus on profitability, rather than a growth at all cost strategy that fueled some emerging brands before and during the pandemic.

“To pull that off, [brands] must now solve a more complex objective function—investing to keep consumers engaged while finding ways to do more with less,” the report stated.

Underscoring the uncertainty currently permeating the industry, eight in 10 respondents said they were “neutral or leaning pessimistic about the global economy and geopolitical stability,” while about three-fourths were optimistic about their specific company’s performance (74%) and strategy (80%).

Digging deeper into the data, Deloitte separated out “profitable grower” companies versus “all others” to better understand why certain companies are more optimistic and successful than others. The report highlights five meaningful areas where profitable growth companies have successfully invested attention and financial resources: Embracing the changing consumer, gaining market share, creatively transforming, driving data through supply chains and prioritizing ESG.

Profitable companies are distinguished by being flexible in how they reach prospective customers by leveraging digital investments in DTC as well as personalizing the buying experience using predictive analytics or AI technology to recommend new products.

According to the survey results, 85% of profitable growth companies see an opportunity in 2023 to increase their market share. Some respondents are using pricing to undercut category competition while softening the effects of inflation: 80% reported plans to raise prices in 2023 in an effort to boost revenue expectations, with 83% expecting higher revenue in the year ahead.

Other strategies include offering additional product promotions and increased marketing campaigns and expansion via acquisition, the survey said. Divestitures, portfolio optimization and vertical integration were also listed in Deloitte’s research as creative ways to transform businesses this year.

Over 90% of companies surveyed were improving supply chains by investing in data capabilities. This data can be used to optimize business processes and traceability efforts in addition to helping consumers understand their buying habits.

Although costly, Deloitte chief global economist Dr. Ira Kalish wrote that a changing geopolitical and business environment could make the supply chain stronger. It could force global companies “to reinforce supply chain resilience and redundancy, partly by diversifying supply chain processes and no longer depending on just one country or supplier.”

Kalish warned that the pandemic moved the goalposts for the consumer products industry and “the coming decade, therefore, will be different than before.”