IRI: Inflation Remains High But Slowing; Shoppers Adjust Buying Habits

Grocery inflation continued to rise in September, hitting 13.3% versus a year ago, according to a recent report from retail data firm IRI. Yet, a smaller 1% inflation increase in September compared to August, which rose 1.6%, shows signs that prices might be starting to moderate towards the end of the year.

The report “September 2022 Price Check: Tracking Retail Food and Beverage Inflation” showed that though year-over-year (YOY) inflation remained high, it seems to be “plateauing” even as consumers shift to cost-saving measures.

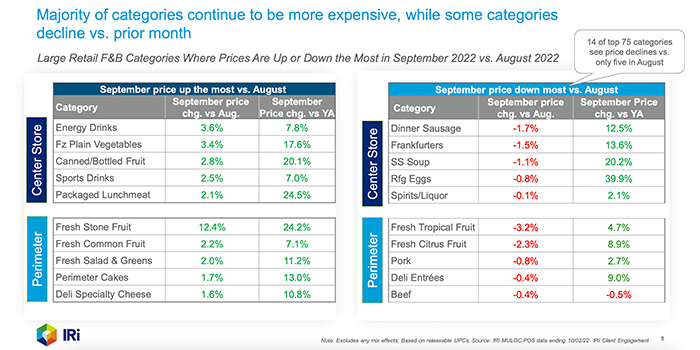

Around the Supermarket, Inflation Fluctuates

The slow moderation of inflation is not being seen evenly throughout the grocery store. Inflation in the center of the store (frozen and shelf-stable commodities) is up; whereas, refrigerated sections like alcohol (4.2%), produce (9.8%) and deli (12.5%) have experienced slower price increases YOY.

Categories feeling the most price pressure YOY were dairy (19.6%), frozen meals/ingredients (18.4%), bakery (17.3%), snacks (17.2%), shelf-stable meals/ingredients (17%) and baking (16.9%).

Some reprieve has started to slowly creep into certain categories as summer wound down. When comparing price changes in September versus August, refrigerated eggs (-0.8%) and shelf-stable soup (-1.1%) were down; yet, the two categories have experienced some of the largest price increases within food and beverage over the past year, up 39.9% and 20.2% respectively.

“September data revealed some welcome news for consumers: Price inflation is slowing down for the first time this year in the perimeter categories that account for nearly $200 billion in annual retail sales,” said President of Thought Leadership for CPG and Retail at IRI and NPD Krishnakumar Davey in a press release. “However, overall grocery bills are still significantly higher than this time last year, causing shoppers to shift their purchase habits.”

Consumer Shift Buying To Account For Higher Prices

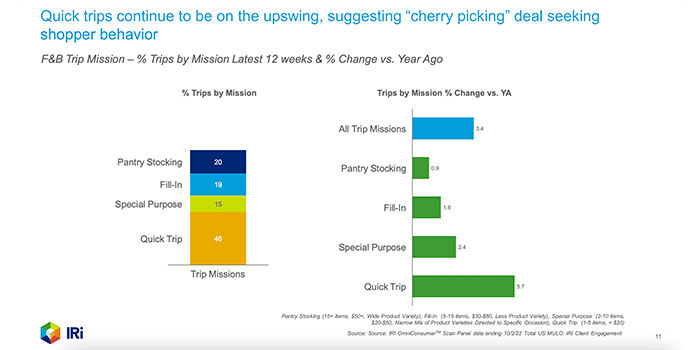

IRI research pointed to consumers changing their shopping behavior as a signal to how the price pressure is impacting buying trends.

This year, consumers returned to the early pandemic habit of buying more products in bulk. In 2020, average pack size (volume/unit) rose to 2.2% as shoppers tried to decrease the number of shopping trips they needed to make, but bulk-buying fell in 2021 to -0.1% as people returned to shopping regularly in stores. Now, the percent change in average pack sizes is rising again to 1.1%. This reflects a change from when consumers reduced trips to the market as a cost-saving technique and to avoid potential exposure to COVID.

Now, shoppers appear to be going to the store more frequently during this high inflationary period in order to “cherry-pick” in-store sales and deals.

In the 12-week period ending October 2, 46% of grocery trips were considered “quick trips” (defined by IRI researchers as one to five items purchased for less than $20) representing a 5.7% change from the previous year.

Food manufacturers are finding ways to offer these types of deals by leaning into a common inflationary CPG tool – reducing pack sizes.

According to the report, many food companies are providing more affordable product prices in spite of inflation by practicing “shrinkflation,” or shrinking pack sizes to keep unit costs steadier even as other costs rise.