Amid Competition, Online Marketplace Hubba Shuts Down

It was one of the first companies to offer food and beverage brands an online wholesaling platform, but pioneering e-marketplace Hubba announced last week it would cease operations, cutting brands off from a popular way to introduce and supply their products to small, independent retailers.

Emailing its customers last week to say it was no longer operating, Hubba left few answers as to why it was closing. Brands said they believe the closure will be a loss for the food and beverage ecosystem.

Hubba CEO and founder Ben Zifkin not did not respond to a request for comment, and other employees indicated that they were also not able to answer questions. In its email to its members, Hubba said that in-progress transactions could be completed until February 12; nevertheless, some brands reported issues with retailers attempting to complete transactions before the deadline.

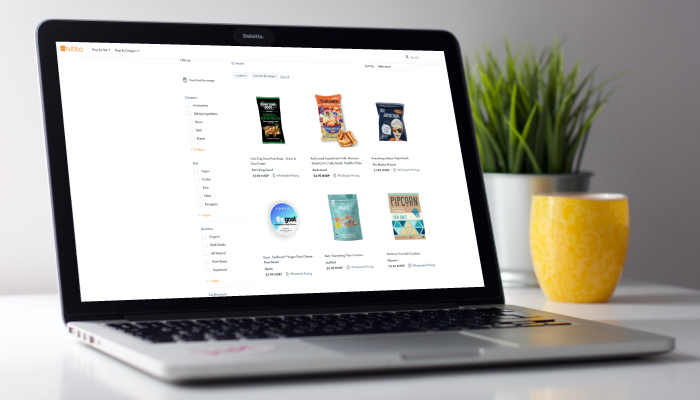

Based in Toronto, Hubba launched in 2011. According to its website, the company had 25 employees and over 100,000 brands and buyers (largely for small retailers) that used the platform. The company did not charge brands to list their products, but rather took a 10% commission on all orders and charged a processing fee of 2.9% per transaction.

Using the platform, buyers could reach out to brands to request samples, and then place an order through the website. Orders and shipping labels were processed via Hubba, which allowed the platform to run promotions such as free shipping.

The company had raised a reported $60 million from investors including Goldman Sachs Investment Partners, Real Ventures, Kensington Venture Fund and Brightspark Ventures and had told other media publications that it had hopes for an IPO in 2020.

While Hubba was one of the first companies to offer an online wholesaling platform, competition has increased in recent years, with companies likeFaire, Abound and Mable joining the trade. Hubba, however, had a strong presence at trade shows, with brands sporting Hubba signs at their booths, Renewal Mill COO and Co-founder Caroline Cotto told NOSH that the baking mix brand signed up after seeing the company advertised at booths at the 2019 Fancy Food Show.

While Cotto said she was “shocked” Hubba had closed, she said the increase in competition had been noticeable, with other platforms offering better user interfaces, promotional deals or content creation opportunities. For example, she said, Faire offers a zero commission structure if a company brings a new buyer to the platform, while Mable has allowed Renewal Mill to host blog posts on its site.

“[Other wholesaler platforms] seemed to be doing more marketing of their platforms,” Drink Simple Co-founder Kate Weiler said of the competition. “Faire in particular was constantly communicating and providing marketing assets to help us market our brand.”

Still, Hubba’s pioneering status allowed it to establish an early group of retail buyers, many of whom preferred not to work with larger distributors. Alex Duong, the CEO of snack brand Ancient Provisions (and himself a buyer for retailer The Goods Mart) said that online wholesalers such as Hubba give brands access to “less specialized” buyers where food may not be the main focus of sales such as medical centers or online stores. Cotto also noted there were many subscription or gift box platforms that utilized Hubba. Those retailers, because they are smaller, also tend to give an emerging brand placement on their blog, social media or other marketing platforms.

While Hubba tended to attract smaller retailers, the sales could add up. Jason Goodman, CEO of Antithesis Foods, said Hubba accounted for 8% of the snack brand’s sales in 2020, with orders as large as 400 units at a time. Still, despite the benefit of Hubba, many brands (including Goodman’s) reported they have profiles on several wholesaler sites, rather than just one platform.

“We look at these as more brand discovery platforms,” Goodman said of the strategy.

During the pandemic, the benefits of wholesaler platforms increased, especially as trade shows closed their doors. Baking Mix brand Sweet Logic, which had previously been only direct to consumers, rebranded in March 2020 with an eye toward new retailers; CEO and co-founder Allison Escovedo Owen credited the platform with helping to get purchase with retailers at a time when buyers were not apt to take new meetings.

While there are other options to consider, Goodman said that the loss of Hubba will be felt by the entire food and beverage ecosystem. Less competition, he said, means other platforms could add surcharges or raise commission costs. But the model remains beneficial and it will be up to another player to make the concept thrive, according to Weiler.

“I love that these online platforms are a more cost effective way for brands to be discovered by retailers and independants versus the astronomical spend of tradeshows and tabletop distributor shows,” Weiler said. “[I] like to see disruption in the space so brands don’t feel so beholden to feeling obligated to spend money to attend every show if they want to connect with new customers.”