SPINS: A Look Into The 2024 Trends Crystal Ball

What trends are bubbling to the surface this year and which might be hitting their ceiling?

On Monday, natural CPG products research company SPINS released its “2024 Trends Predictions” chock-full of insights on where the natural products industry might be heading this year. Pertaining to food, the data company predicted an elevated reliance on promotional pricing to drive sales, the rising influence of sustainability claims on shopping behavior, increased demand for products that decrease weight and prolong lifespan, the evolution of global flavors, and the state of plant-based eating.

Buy The (Price) Dip

After the pandemic put incredible strain on supply chains and directly affected pricing, inflation became the main topic of conversation in retail. Now, as the economy moderates (as well as pricing), the residual effects are playing out as brands and retailers are pushing product discounts to drive higher unit sales.

In the 52 weeks ending December 3, the percent of dollars sold on product promotions was above 30%, a significant uptick from pre-pandemic years, according to SPINS data.

Despite a decline in the rate of price hikes, consumers are still eager for discounts. SPINS anticipates that softer pricing strategies and promotions will continue to be used as a means to encourage more volume growth across the store.

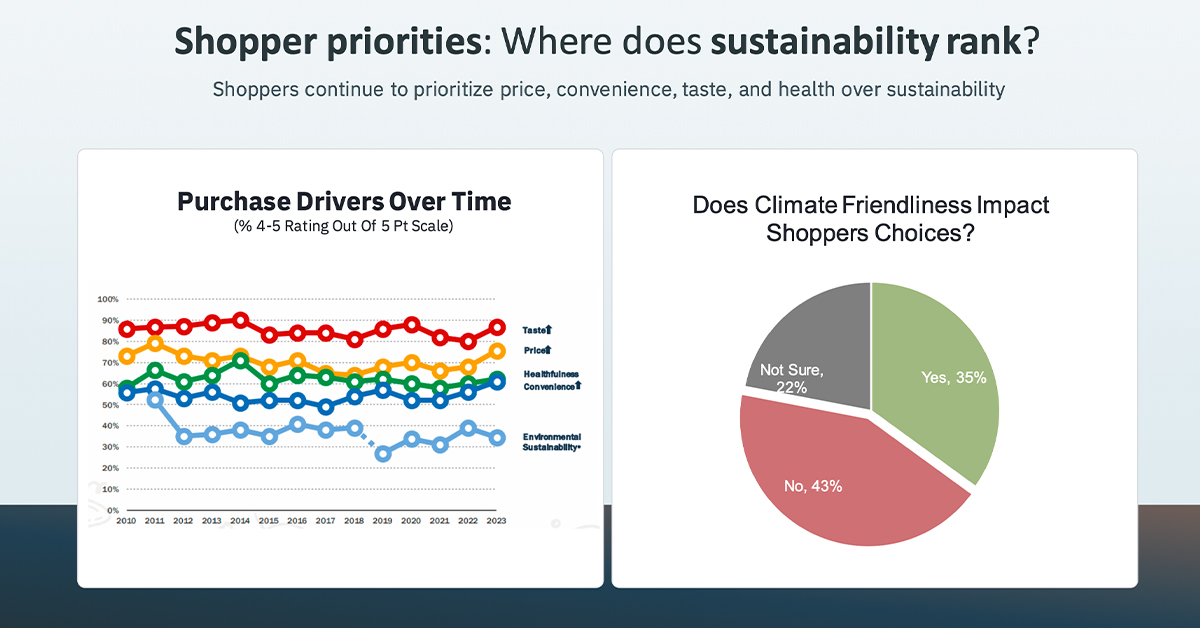

Peaks And Valleys Of Sustainability Claims

According to the SPINS report, sustainability metrics can be categorized in three ways: Animals (welfare, biodiversity), Planet (environment) and People (labor practices, corporate responsibility, diversity).

Yet not all these categories are driving sales growth among consumers because “sustainability has not yet reached a tipping point,” the report noted.

Labels and certifications that are seeing double-digit unit performance growth are focused on animal welfare’ like Greener World (+13%) and ecological recovery like Certified Regenerative Organic (+39%) as well as labels messaging “pasture raised” (+11%) and “grass fed” (+10%). On the other hand, there has been a decline in performance from certifications like Fair Trade USA (-26%), Certified Plant Based Foods Association (-12%), B Corp Certified (-6%) and Non-GMO Project Verified (-3%).

SPINS pointed to Upcycled Certified and Regenerative Organic as two key growth areas of sustainability call-outs to keep an eye on this year.

Focus On Decreasing Weight & Increasing Lifespan

The impact of consumer interest in GLP-1 drugs for weight loss has already been driving the narrative of wellness in CPG food. Even as more consumers are opting for Ozempic and other similar drugs to decrease appetite, a growing cohort of brands are aligning with the GLP-1 craze that aim to be an off-ramp for the drugs’ users or an alternative for those who can’t afford to get a prescription.

“In a world where people might eat less but want every bite to matter, we could see more brands offer less empty calories and more nutrition, but hopefully with the same taste,” the SPINS report said.

Not only is the role of weight control drugs and diets continuing to dominate what consumers choose to buy but there is a growing interest in foods that “increase physical longevity.”

This trend is not only related to Blue Zone type foods but are also using functional ingredients to improve their diets. Whether it is the use of vinegars to help control glucose levels, more mushrooms to produce calm or energy, adding collagen-rich foods for anti-aging benefits or choosing nut-based over oat-based dairy alternatives to decrease carbohydrate intake, consumers are prioritizing lifespan in their food choices.

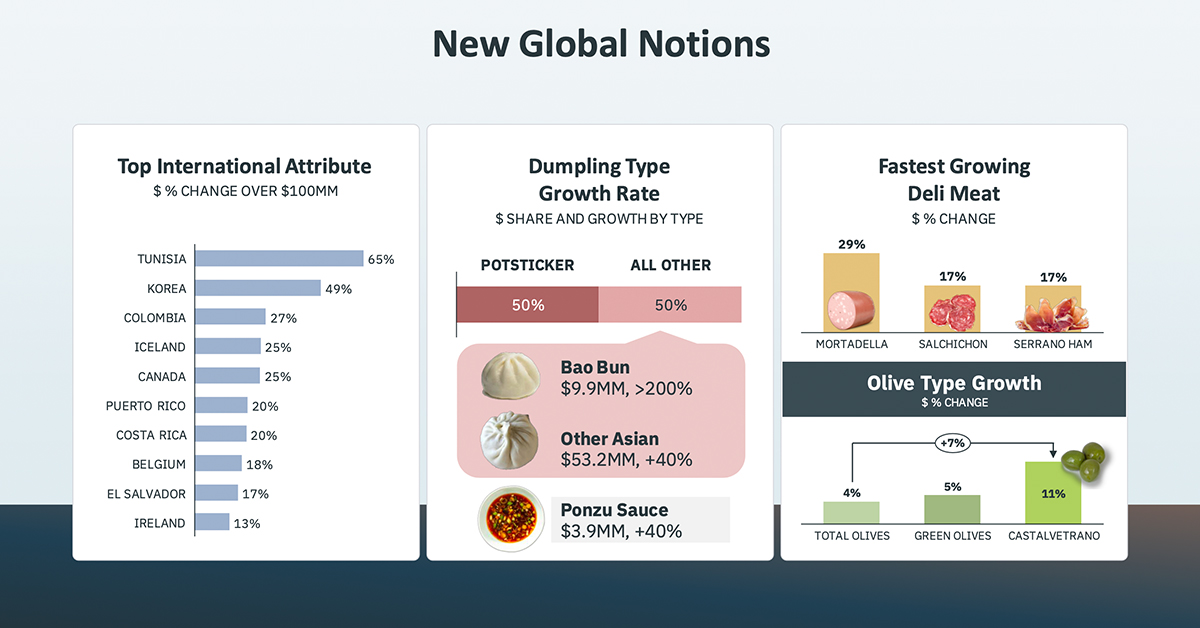

New Reaches For Global Flavors

As Vietnamese and Korean food graduates into the mainstream, Americans are searching for new global cuisines to latch onto. SPINS pointed toward CPG brands finding new consumers by differentiating from familiar regional cuisines with the culinary traditions of Northern Africa (Tunisia), Asia (Burma) and South America (Colombia) capturing U.S. shopper interest.

According to SPINS, demand is rising for innovative products that meet a changing American palate that is searching for more authenticity in flavor that challenge conventional products in their respective categories. The report highlights an interest in spice (i.e. chili crisps from Fly By Jing), dumplings (i.e. Mìlà or Laoban) or deli meats like Mortadella and Iberico Pork.

Plant-Based Foods Reaches Its Peak

It might come as no surprise that plant-based food growth has stalled with many consumers as the market over-saturated and people soured on flavor or texture of some varieties. The meteoric rise of some brands experienced before and during the pandemic has softened in the last two years and although the plant-based eating trend is not expected to fail, there will be an “evolution” of the category in 2024, SPINS predicts.

Ultra-processed food brands will continue to see the sun at their backs while “cleaner” and “greener” brands in plant-based meat and dairy will experience growing consumer demand. SPINS did note a bright spot when it comes to plant-based baking. Animal-free ingredients are beginning to take-off at-home and in foodservice as nut milk-based chocolate chips and ready-made, eggless doughs have become more available.