To Move Merger Forward, Kroger, Albertsons Unveil $1.9B Divestiture Plan

Kroger and Albertsons today announced they have entered into a $1.9 billion divestiture agreement with C&S Wholesale Grocers intended to appease antitrust regulators reviewing the companies’ proposed $24.6 billion merger.

“A critical component of the [merger] plan was to identify a well-qualified buyer who would be able to operate as a fierce competitor […] and [we’ve] reviewed dozens of buyers spanning from private to public,” Kroger CEO Rodney McMullen told investors during the company’s Q2 earnings call today.

He continued, “We are proud to announce the conclusion of that process, which has led to C&S, a well-qualified buyer that meets all the necessary criteria necessary to complete our transaction.”

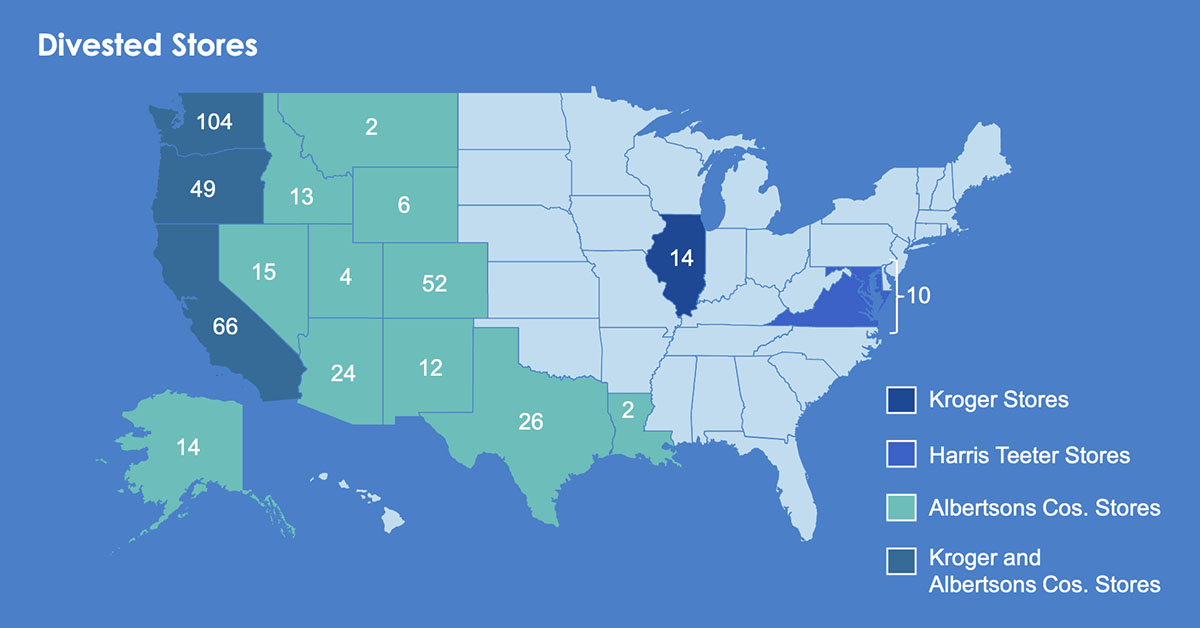

The deal includes the sale of 413 stores, eight distribution centers, two regional headquarters and five private label brands across 17 states plus Washington, D.C. As part of the agreement, C&S will acquire the QFC, Mariani’s and CARRS brand names and assets, along with the exclusive licensing rights to the Albertson’s brand name in Arizona, California, Colorado and Wyoming. Upon the merger’s completion, stores operating under those banners that are retained by Kroger will be re-branded.

The impacted stores are primarily located in Western states including Washington (104 stores), California (66 stores) and Oregon (49 stores), among others. According to the announcement, no stores will shutter as part of the plan and frontline associates will remain employed.

The newly-announced deal will expand New Hampshire-based wholesaler C&S’s retail footprint well beyond the 160 stores it currently operates, including Grand Union supermarkets and Piggly Wiggly franchise and corporate-owned locations in the Midwest and Carolinas. The wholesaler has been seeking to build up its store presence since losing major client Arnold Delhaize in 2019 when that chain shifted to self-distribution.

C&S also supplies more than 7,500 independent supermarkets, chain stores, military bases and institutions with over 100,000 different products.

“Today’s announcement is another exciting opportunity for C&S to further expand into the retail market, which is an important component of our growth and future success,” said Eric Winn, COO and incoming CEO (effective Oct. 2) of C&S, in a press release. “We look forward to providing a superior shopping experience that delivers both quality and value to our customers.”

The number of divestitures outlined in the C&S sale is higher than the original projections included in Kroger and Albertsons’ merger announcement, which included between 100 and 375 stores. In addition to the 413 planned stores, Kroger said the deal may ultimately require C&S to purchase up to an additional 237 stores in certain geographies, which would bump up the acquisition cost for C&S.

The news comes after discount retailer Aldi announced last month announced it will acquire Southeastern stores Winn-Dixie and Harveys from Southeastern Grocers (SEG), marking another step in grocery industry consolidation.

On the earnings call, Kroger also announced that total revenue in Q2 fell 2.3% year-over-year to $33.9 billion after the company was hit with a $1.4 billion charge ($1.54 loss per share) for a nationwide opioid settlement. Payments will be made over the next 11 years.

Despite the setback, the Cincinnati, Ohio-based grocer reaffirmed its full-year outlook. Kroger expects identical sales of 1% to 2% with underlying growth of 2.5% to 3.5%. Adjusted net earnings per diluted share are projected to be between $4.45 and $4.60.

When asked by an investor what the impact of the proposed merger would be from an investor standpoint, McMullen said that “in terms of what [the company] would expect from a cash flow perspective [is] that it would be 30% accretive by year four.”

Since the deal was first announced last October, shoppers, union members, brands and federal regulators alike have voiced concerns about the monopolistic potential of the Kroger/Albertsons fusion. However, both grocery chains maintain the merger will increase competition by allowing the mega-corporation to lower prices for shoppers and increase investments in its labor force.

The heavily criticized mega-merger remains on track to close in early 2024 subject to required regulatory approvals, according to Kroger.