Report: Despite Record Spending, Consumers Remain Worried About Rising Prices

As concerns about inflation and rising prices plague consumers and investors alike, CPG investment firm Coefficient Capital and online publication The New Consumer have released a 2023 Consumer Trends report, based on several surveys of more than 3,000 U.S. consumers.

Heading into the new year, the report found that GLP-1 weight-loss users are spending less on food and snacks, while Gen Z and Millennial consumers are fueling trends like native shopping on TikTok and sustainable goods. Below are some of the key takeaways.

Despite Record Spending, Rising Prices Remain Top Concern

Although a majority of shoppers entered 2023 fearing a potential recession, U.S. consumer spending set new records that year. Most recently, global Black Friday weekend spending reached $9.8 billion on the Shopify network alone, up 24% y/y.

Even so, consumer financial optimism remains flat, with just 36% of surveyed consumers saying they feel “moderately” or “very” optimistic about their current financial situation, down from 37% last year. A large number of respondents (42%) cited rising prices and inflation as the most important issue facing the country today, ranking ahead of violent crime (28%) and poor government leadership (28%). About 64% of survey respondents said prices have increased “a lot” over the past six months, down from 73% in February.

Entering the Ozempic Era

A majority of the dialogue surrounding the spike in the use of GLP-1 drugs aiding weight loss has been focused on the impact it will have on the food and beverage industry. Currently, there are roughly 8-15 million Americans using these drugs to manage diabetes or to lose weight. In its most recent survey, Coefficient Capital polled 388 of those consumers.

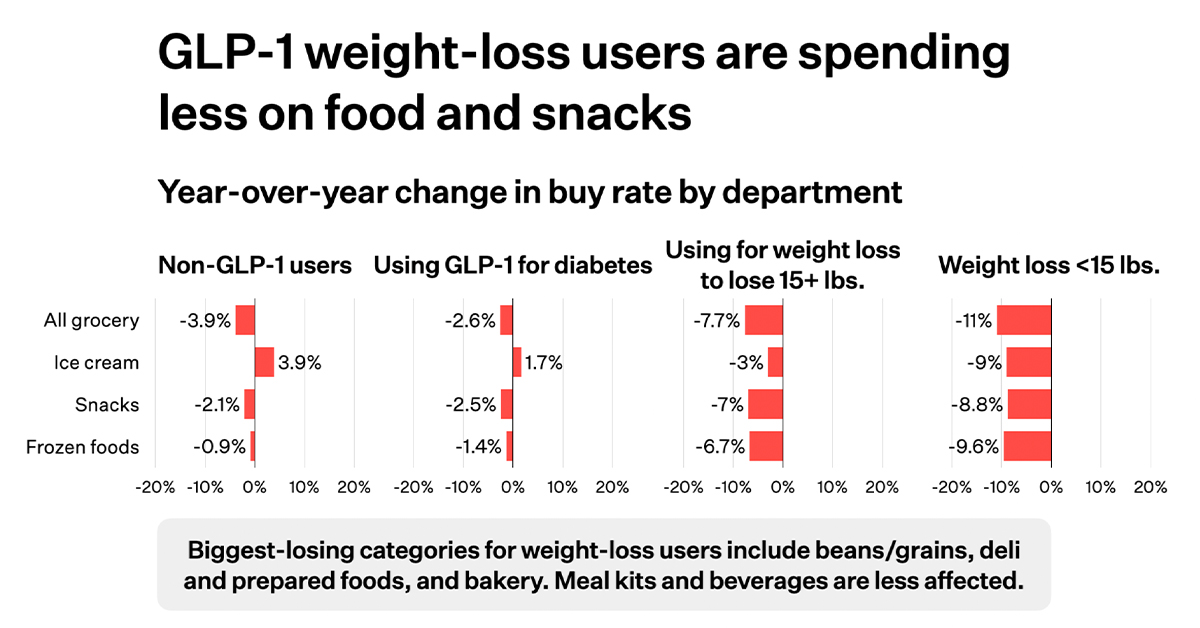

In what surely comes as a shock to no one, 43% of GLP-1 users say they’re eating more protein, 45% report consuming less sugar and 36% say they’re drinking less alcohol. As a whole, these consumers are spending less on food and snacks, with all grocery spending down -2.6% and snack spending down -2.5%. According to the survey, the biggest-losing categories for weight-loss users include beans/grains, deli and prepared foods and bakery. Meal kits and beverages are less affected.

TikTok Shop Sees Strong Start

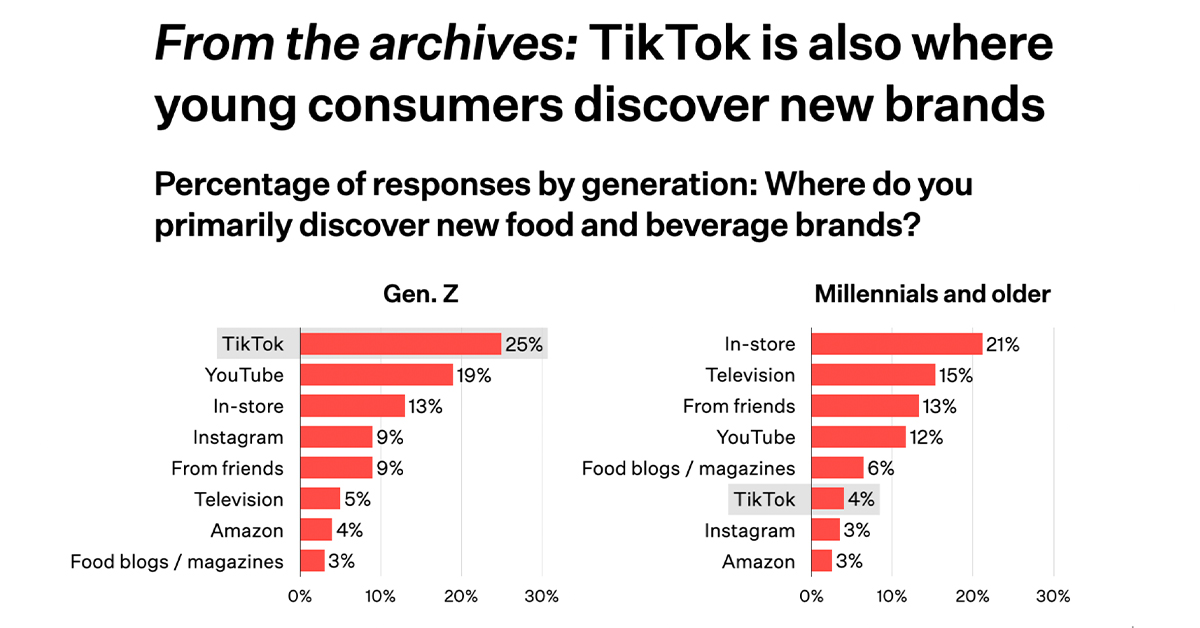

Earlier this year, TikTok officially rolled out its shopping feature to all 150 million users across the U.S. in hopes of becoming one of American consumers’ go-to ecommerce destinations. Sixty-four percent of respondents who use TikTok once a month or more say they are aware of TikTok Shop, while 28% of consumers say they have already made a purchase. The shopping feature captured $260 million in gross merchandise volume in October 2023, according to YipitData estimates for U.S. consumers, up 43% from September.

Though TikTok Shop is still in its early stages, Coefficient Capital believes the feature “is the next Amazon. Or at least the next Temu” especially for consumers under 35, who account for 55% of purchasers.