J.M. Smucker: Coffee, Uncrustables Fuel 10% Q4 Earnings Growth

The J.M. Smucker Co. reported 10% sales growth year-over-year in its Q4 FY2023 earnings call this morning, touting the strength of its coffee portfolio, the Uncrustables brand and its strategy navigating a challenging macroeconomic environment as the drivers behind the company “exceeding expectations” during the period.

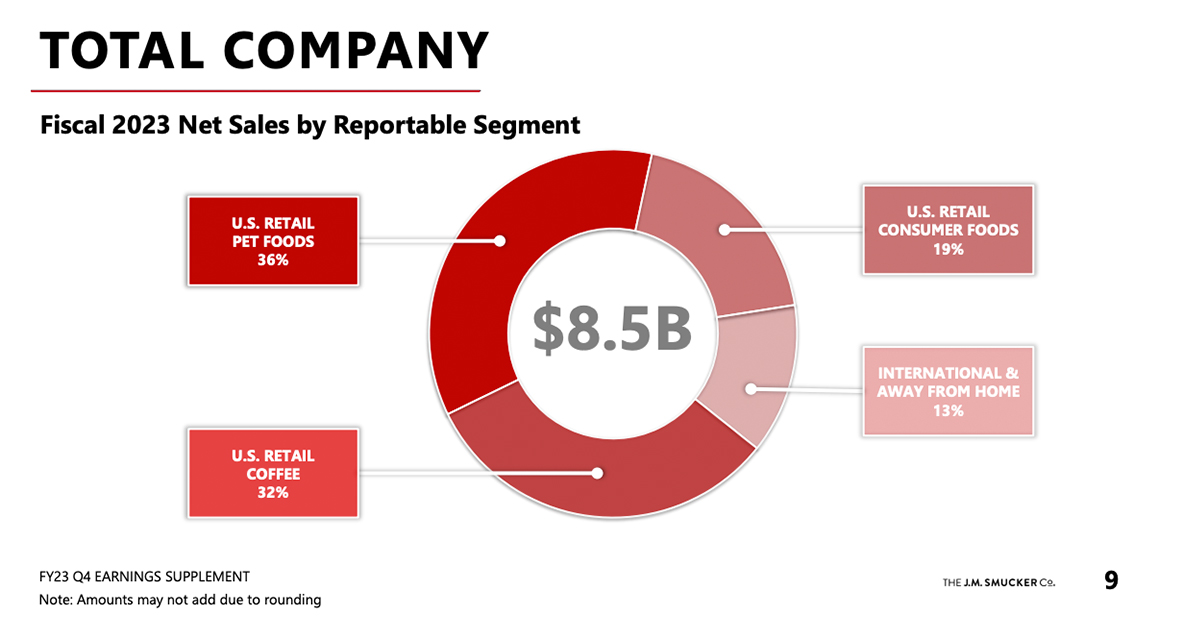

Net sales were up $2.2 billion this quarter compared to $2 billion in Q4 2022. Gross margins came in at 35.5% slightly higher than 32.8% in the same period last year. For the full fiscal year 2023, net sales were $8.5 billion, compared to $8 million in FY2022 and gross margins were just 1% lower than FY2022 finishing 2023 at 32.8%.

“Looking ahead to fiscal year 2024, we are focusing on sustaining our business momentum by investing in growth platforms, such as Uncrustables sandwiches,” said president and CEO Mark Smucker in prepared statements Tuesday morning. “We are confident in our long-term strategy of leading in the attractive categories of pet, coffee, and snacking and delivering shareholder value.”

The Orrville, Ohio-based consumer products maker announced 8.5% to 9.5% in net sales growth and 36.5% to 37% in gross margins for its full-year guidance for 2024.

Initially built on the back of its jam, jelly, fruit preserve and peanut butter brands, J.M. Smucker has seen increasing consumer demand for its coffee portfolio (Folgers, Café Bustelo, and Dunkin’), frozen food (Uncrustables) and pet foods (Milk-Bone and Meow Mix) businesses.

Pet foods now make up 36% of the company’s net sales with Coffee trailing at 32% and U.S. Retail Consumer Foods accounting for 19%. Coffee – as a segment – grew net sales 7% year-over-year leading Smucker’s profit margins at 28.9%.

“Acknowledging that the coffee market has been generally volatile, we have seen sequential improvement in our coffee costs which should continue through this fiscal year,” Smucker said during the question-and-answer period. “When we think about the cost, we do try to manage for the full year and our coffee business continues to be extremely healthy in all three of our brands.”

Although the portfolio accounts for a smaller share of total sales compared to previous years, Smucker’s food brands remain an important piece of the business. The Uncrustables brand delivered “exceptional growth,” with net sales increasing 43% during the quarter driven by Away From Home business channels, Smucker said.

The company has added more production capacity in its McCalla, Alabama manufacturing facility to meet demand for Uncrustables in Away From Home channels like K-12 schools.

The year did have its challenges with a voluntary recall of Jif peanut butter in May 2022 that created costly headwinds for Smucker’s peanut butter business which accounts for 37% of the food maker’s Retail Consumer Foods Segment (including other peanut butter brands Adams, Santa Cruz Organic and Laura Scudder’s). Smucker’s leadership voiced confidence that Jif was on the path back to leading the category and expects the brand to reach double-digit net sales growth in 2024.

J.M. Smucker’s aggressive pricing strategy and reduced volume mix across its portfolio accounted for a 12 percentage point increase to net sales. The company is betting that higher pricing will carry it through the challenging economic environment.

At the time of publication, J.M. Smucker Co. stock was down about 2% on the day, trading around $145.75 per share.