Distribution: Mooski Roams To New Regions; Cometeer Continues Brick And Mortar Push

Mooski Roams To New Regions

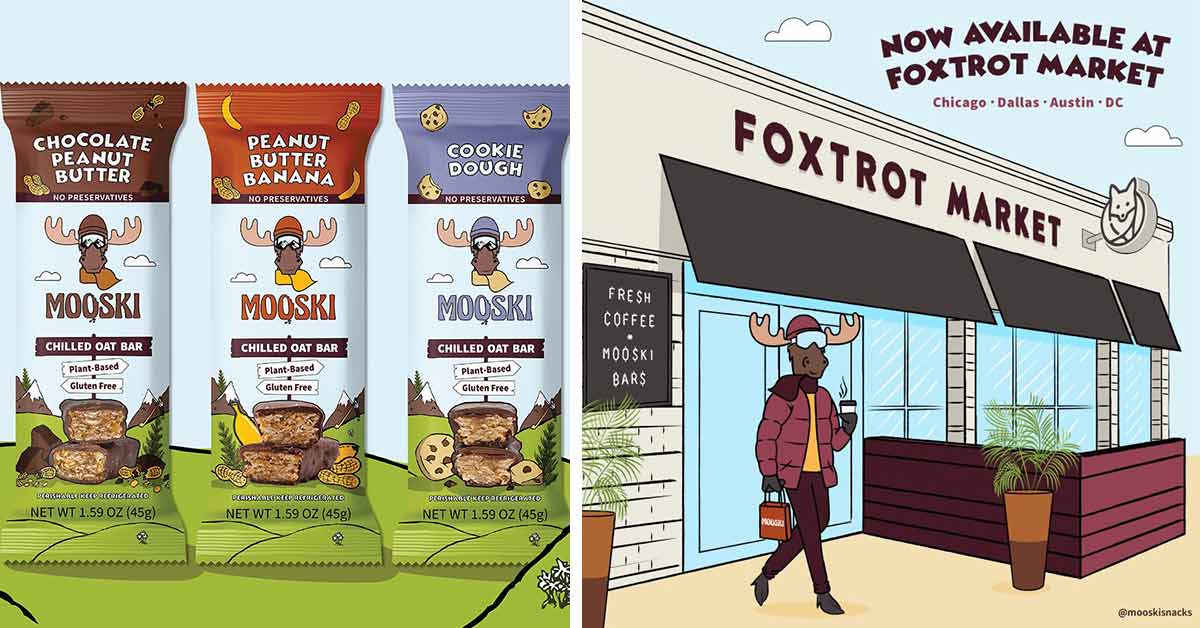

Fresh granola bar maker Mooski is reaching new regions after inking deals with Foxtrot (Chicago, Dallas, Austin and D.C.), Fresh Thyme Market (Midwest) and Central Market (Texas) over the past two months. The new retail partnerships will bring the California-based brand to East Coast stores for the first time and bumps its presence to around 300 points of distribution.

A shift in manufacturing strategy – from self-producing in San Diego to a contract manufacturer in the Midwest – was key in allowing Mooski to sell beyond its backyard. With the refrigerated bars now manufactured and warehoused in the center of the country, Mooski can accelerate its regional growth strategy, said founder and CEO Robert Broome.

“We did not sell into East Coast [stores] – we could never have sold into Foxtrot in D.C. – when we were still shipping from San Diego,” he said. “It would have cost almost as much for shipping as the [purchase order] we would have received. That handicapped us in a way for a bit but we know the logistic lanes coming out of the Midwest are a lot better.”

The brand is aiming to build awareness and adoption in the natural channel before entertaining conventional outlets. Mooski currently sells three SKUs over chocolate coated, oat-based bars in Cookie Dough, Peanut Butter Banana and Chocolate Peanut Butter flavors for $2.99 per bar. Broome praised Fresh Thyme, which is adding Mooski to 71 doors across nine states, as a “big early adopter for innovative natural brands,” especially for consumers in the upper Midwest.

Instacart has also become an important and effective tool, Broome noted. Once he figured out how to “set the algorithm,” began paying for some sponsored slots and bidding on search terms commonly used by typical granola bar consumers, Mooski’s products were elevated on the platform’s search and are now selling nearly 100 units per week with very little lift, he said.

That granola bar customer conversion has become a sticking point with grocery buyers. While the refrigerated snack space has seen numerous brands go the “Perfect Bar route,” focusing on fitness and protein, Broome believes no other company has tried to position themselves as a fresher granola bar.

“[Buyers] see the appeal of basically taking a center store shopper, who shops granola bars, and bringing them to their [fresh bar] category… and adding incremental dollars to their set, which is really appealing.”

In addition to retail expansion, Broome said that RxBar co-founder Jared Smith has also joined as an investor and advisor to the brand which he believes has brought additional credibility and validation to the brand and business.

“He’s seen what it takes to get there and we take everything he says very seriously,” said Broome. As small bar brands, having someone who has succeeded, albeit in the shelf stable bar category, that gives us [an element of] ‘Hey, Jared believes in us – you guys should too.”

Cometeer Lands More Freezers Amid Retail Push

DTC-native frozen coffee brand Cometeer has announced a slew of new points of distribution amid its continued push into brick and mortar retail, bringing its total door count to over 500 stores nationwide. This month, the brand is piloting a launch at 10 Los Angeles-area Target stores where it will be slotted in its own dedicated freezer end cap.

“We are confident this opportunity will be a major step in establishing Cometeer as a key player in the retail world, and ultimately as a household name,” said CEO Matt Roberts.

Cometeer is also expanding with its existing partners including rolling out a larger, 16-count pack at Costco stores in the Southeast, Los Angeles and Texas regions. It has ramped up its presence at Sprouts with in-aisle cookers up from 10 to now over 94 locations. The brand continues to expand in all channels and has recently onboarded with Central Market, Gelsons, New Seasons Market, Nugget Market, Berkeley Bowl and Mom’s Organic Markets.

According to Roberts, many retailers have expressed a strong interest in placing Cometeer-provided branded freezers in coffee aisles. When the product is not in a standalone freezer, it is often slotted in the Frozen Breakfast set. The frozen coffee pods are sold in 8-count boxes for about $2 per pod.

Voyage Travels To Walmart

Voyage Foods is bringing its Peanut-free and Hazelnut-free spreads to over 1,200 Walmart stores nationwide this month and to Walmart.com. The food tech company makes its top nine allergen-free spreads with natural and upcycled ingredients including seeds and legumes.

In line with Voyage’s mission to make allergen friendly food more accessible, both products are priced at $4.98; the Peanut-free spread comes in a 16 oz. jar while the Hazelnut-alternative spread comes in a 13 oz. format. For comparison, a 16 oz. jar of low sodium, natural JIF peanut butter costs $4.95 at Walmart.

“We are proud to offer options that are allergy-friendly and more affordable than traditional nut spreads but still deliver on exceptional quality and flavor,” said Adam Maxwell, founder and CEO of Voyage Foods.

Stumptown Takes Off On Alaska Airlines

Stumptown Coffee Roasters has created a custom coffee for Alaska Airlines “specially crafted to be enjoyed up in the air,” according to a press release this week. The medium-dark blend is modeled from Stumptown’s top selling Holler Mountain coffee but with more “mellow acidity” and “just enough toastiness.” The partners conducted in-flight taste tests to ensure the blend maintained the intended flavors and notes at 30,000 feet.

“We wanted a crowd pleaser – something that would delight folks who enjoy milder coffees and also speak to guests who enjoy medium-bodied roasts,” said Stumptown president Laura Szeliga, in a press release.

That’s it. Takes Truffles To Target

Fruit forward snack maker That’s it. is rolling out two SKUs of its Dark Chocolate Truffles in Fig and Banana flavors to select Target stores. The brand will also launch its Probiotic Mini bars in Blueberry and UNSTUCK co-branded Mango flavors at the retailer. That’s it. has a well established relationship with the mass retailer and currently sells a wide range of its limited ingredient fruit bars at the Target.