Dealmaker Survey: Confidence Lags for Food Brand Fundraising

Since the onset of the pandemic, a volatile economic climate has harshly impacted consumer-facing businesses’ ability to raise funding due to increased cost of capital and unpredictable product demand. Against that backdrop, M&A and capital raising platform Axial recently surveyed 26 consumer-focused dealmakers about current challenges and opportunities in the market.

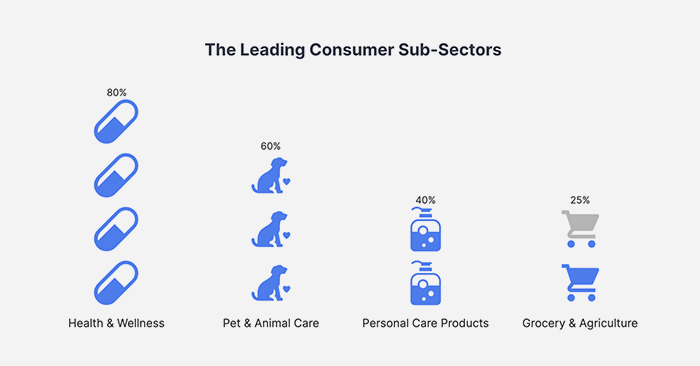

According to the survey, grocery ranked as the fourth leading subsector (behind health and wellness, pet and animal care and personal care products, respectively), with just 25% of respondents expressing confidence in the market.

So how can emerging food brands successfully capture the attention of investors and move their companies forward in today’s challenging environment? Here are three key takeaways from the survey:

Businesses Must First Address Ongoing Operational Challenges

Though supply chain issues and inflationary pressures have eased slightly, investors expect brands to pull back on spending and improve their margins. Products that can maintain consumer demand, therefore weathering a volatile market, will be most likely to receive capital.

In the report, Sally Anne Hughes, Partner of M&A advisory firm Hughes Kabler said, “[There is an] opportunity to tweak operations, look for new pockets of distribution growth and execute plans to ensure business is well positioned for growth in 2024 and beyond.”

Investors Placing Heightened Focus On Understanding Forward Demand

One of the biggest challenges for investors is accurately determining which products, and brands will be most successful and whether pandemic-induced highs or lows (depending on the business) will be repeated. However, Ben Rudman, CEO of Charis Consumer Collaborative, in the survey said that if investors are willing to put in the work to better understand the business, they can find where the opportunities lie.

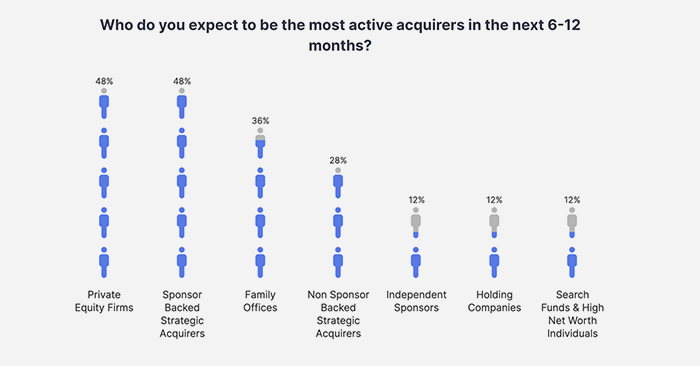

PE Firms, Family Offices and Sponsor-Backed Strategics Will Be Most Active

Based on the survey results, Axial predicts that private equity firms, family offices and sponsor-backed investors will be the most active investors in consumer M&A in the next 6 to 12 months.

In the report, Bo Stump, partner of investment bank Stump & Company, said he anticipates sponsor-backed investors will attempt to keep growing “inorganically” prior to exit. “Many [PE-backed] companies are looking to acquire complementary businesses for a relatively lesser value than 1-2 years ago, bolster the combined portfolio and then pursue a successful exit in 2025,” he said.