Very Good Food Company Ousts Founders, Ex-CEO Says Share Price was ‘Unsustainable’

The co-founders of plant-based food brand The Very Good Food Company were dismissed from the company last week as its board of directors seeks to reverse stock price declines.

The board offered the choice to resign or be fired to both CEO Mitchell Scott, and James Davison, the company’s chief R&D officer. Scott said he picked termination, while Davison voluntarily stepped down.

Combined, the two still are the largest shareholders in VGFC, owning 20% to 23% of the company. The company makes plant-based meat, dairy, and other food products.

“Very Good is at an important juncture, and we are taking decisive steps,” said Ana Silva, President of VGFC, in a release. “Our focus is to continue to build on our brand and reputation and grow our market share in the plant-based meat segment while optimizing our operations towards a path to profitable growth. As announced on March 16, 2022, VERY GOOD is implementing cost improvement measures as it transitions from a focus on top line growth, to a focus on achieving sustainable, profitable growth.”

VGFC executives declined to comment, and the company’s fourth quarter scheduled earnings call last week was postponed as a result of the management changes.

Scott said investors pressured the board to make management changes based on the share price. Independent board members “turned on me,” he added.

It’s not just VGFC that is having problems with it’s share price, he said, adding many early investors “ don’t see that Beyond Meat is tanking, and all these other plant based stocks are suffering.”

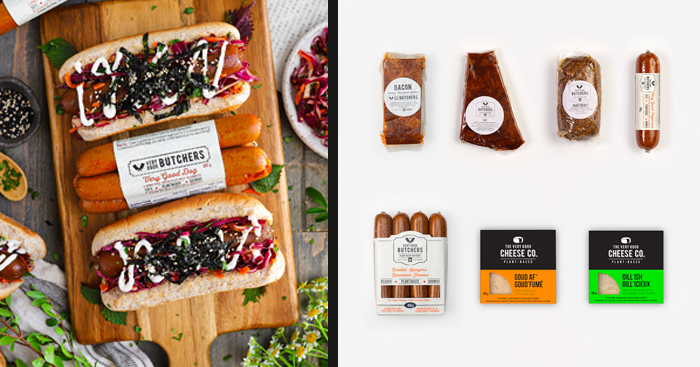

Founded in 2016, the Canadian company began as a line of plant-based meats under The Very Good Butchers brand. Davidson, a chef by training, created the company and partnered with Scott. The duo opened what they claim was the country’s first “vegan butcher” in 2017, then later established the packaged food line.

The company’s visibility has been boosted considerably by investor interest in the plant-based meat category. Initially, the pair relied on Kickstarter and equity crowdfunding campaigns, which raised about 650,000 in Canadian dollars. But in June, 2020, unable to find an investor to lead a larger raise, the partners took the company public.

Shares on the Canadian Security Exchange began trading at a price of $0.25 per share, raising just over $4 million CAD. Ultimately the stock hit its high at just over $9 CAD, Scott said, valuing the company at close to a billion dollars. Since then, however, the stock has continued to drop, and is trading at $0.48 CAD per share as of April 11.

“[It] was insane,” Scott said. “We were trading at like 300 times sales. And so it just kind of got, I think, an unsustainable [share price]… when it did start to go down and level off, you know, over the past six months. It just made it very challenging to try and manage the business and expectations.”

In total, Scott estimates the brand raised $70 million on the public markets, capital it used to purchase and renovate a production plant and to acquire alt-cheese brand The Cultured Nut, which has since been rebranded as The Very Good Cheese Company. VGFC also brought on Silva, formerly CFO of Daiya Foods, as President in 2020.

Scott said problems began to emerge once the facility came online, with VFGC still holding a smaller plant as well as its newly acquired alt-cheese facility. While the alt-meat products are frozen with a one year shelf life, retailers wanted 70% of that to be while the product was on shelves.

“We went from one end of one extreme to the other. So [from] not enough production capacity strained, bringing weekend shifts, all hands on deck to this thing being so efficient, and well operated that we unfortunately had too many staff and too much production capacity.”

Meanwhile, Scott added, privacy changes to Apple’s iOS system made targeting shoppers for sales on the company’s ecommerce site more expensive and difficult. Scott said he tried to stem stock declines by cutting costs and reducing heat count, but ultimately the board felt a new leadership team would be better able to achieve these goals.

A search for a new CEO is underway, with the day-to-day business being managed by a temporary executive committee of senior executives, including Silva.

Despite the current outcome, Scott said that if given the chance he’d take the company public again, noting that without the cash infusion VGFC could not have expanded or would have lost even more control to a venture capital firm even earlier on. The management changes come as other publicly traded plant-based meat brands have also struggled with the market’s expectations, finding themselves under similar scrutiny.

“We’ve got an incredible team, we’ve got really great products, we’ve got a really awesome brand and, everything we’ve built over the past six years, there’s a lot of great stuff there,” Scott told NOSH. “I would really hate for this kind of thing to, to at all contribute towards, it not doing well.. we’re both, you know, still incredibly supportive of most of the stuff going on there.”