Solving The Problem Of Investment For Food And Beverage Brands

Any entrepreneur or founder in the food and beverage space will say that finding investors can be the most difficult part of launching a new brand. Ryan Williams, the former VP of Finance and Ops at RISE Brewing Co., knows this struggle all too well. For the last five years, after getting home from working for the coffee company, he has been brewing up a tool to help new entrants navigate the complicated world of fundraising.

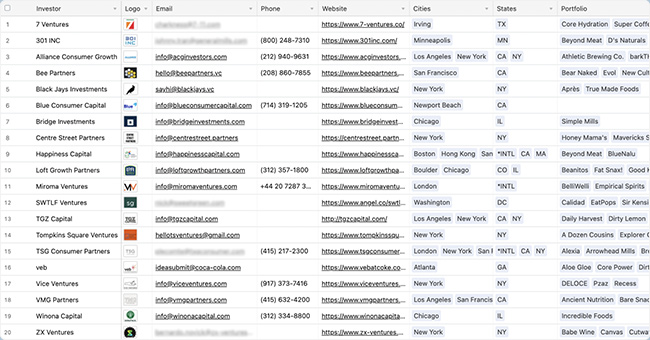

The Food and Beverage Investor Database (FABID) quietly launched this past week, giving brands, investors, food writers and others a comprehensive resource for understanding the food and beverage investment space.

It started as a passion project when Williams moved from investment banking into an operational role in the beverage industry. At the time, he often thought that it would make an entrepreneur’s job a lot easier if they just made three lists when preparing to launch a new brand: Who can make it, who can fund it and who can sell it.

“I was really curious because, at the time, there weren’t that many VCs investing in food and beverage brands. It was all tech,” Williams said. “And so I put this list together of who’s financing all these cool brands that I’m starting to see in the grocery store. And then over the years, it’s just evolved from being a list of just the investors to a true database that intersects almost 1000 investors and all of their information in a really granular way.”

The database offers subscribers a multitude of information from basic contact info of venture capitalist firms and investors to the more detailed data points like stage focus, revenue targets, other brands in an investor’s portfolio and the other minutiae that can help guide a founder’s fundraising process.

Williams has monetized the database in a subscription-based model that has three tiers. The first (Target Investors) gives a subscriber access to the investor list while leaving out the investors’ other portfolio brands. The second level (All Investors) adds in portfolio brands and the final tier (All Investors + Brands) gives a subscriber access to the full brand list as well.

For now, pricing for the different levels is a little ad-hoc depending on a potential subscribers need but Williams is pricing level one at around $1000. He hopes he can find a way to make the information available to anyone who needs it though.

“I’d love to get to a scale where we can make the pricing as accessible as possible. My default is to want to help people,” he said.

FABID is not the only thing occupying Williams’ time these days. He joined JPG Resources recently as a part-time entrepreneur helping emerging brands fill in the “who can make it” part of launching a new product.

He has found that his experience working for five years at RISE managing multiple rounds of funding has given him a wealth of knowledge in this area of CPG food and beverage. He found that fundraising involved more than just finding an investor, but was also about understanding the best investment fit for where a company was in its growth.

Finding investment can be a tedious and painful process for startups that FABID is trying to solve, Williams noted. “That’s what’s cool here. In one place you can see the portfolios of every investor and get a sense of where they play and what types of brands they understand.”

Not only will this tool be useful to emerging food and beverage brands but is a valuable resource for the investors themselves. It can be used to see where investment is lacking – where there is white space in specific segments or emerging trends and technology.

The database is user-friendly in that it can break down the wide landscape of food and beverage into sub-categories and segments so subscribers can find more information about industry niches like upcycling, cultured protein or cold brew coffee.

Categories, investors and brands can be filtered with different parameters to make the data searchable. Users can use the data to see how much investment over time there has been in certain segments or better track the progression of a brand’s funding. It can be compared to Crunchbase or Pitchbook but specific to how the food and beverage industry is shaped and innovating.

Over time Williams hopes to continue to upgrade and improve the database so it becomes part of a suite of tech-enabled resources that allow entrepreneurs to understand how to price products with different retailers and avoid getting arbitraged on Amazon.

Williams joked that his long term rebranding plan is to turn the FABID – the Food and Beverage Investor Database – into the Food and Beverage Information Database.

“I obviously would like this to be big and successful and have many customers but I think I’m also pretty focused on just trying to help founders, entrepreneurs, VC firms and organizations that are writing about it [food and beverage],” he said. “I think that’s a digestible amount to start and if it can grow from there, then great.”