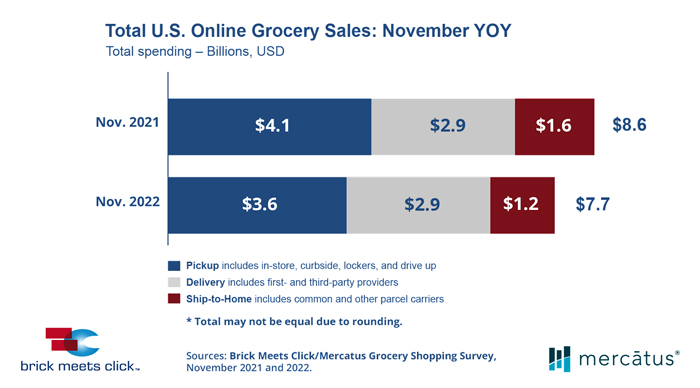

Report: E-Grocery Sales Down 10% YOY

As inflation continues to impact prices at the supermarket, U.S. consumers are spending less money buying groceries online, according to last month’s Brick Meets Click/Mercatus Grocery Shopping Survey.

Online grocery sales fell 10% year-over-year to $7.7 billion in November, representing a 10.1% share of total grocery sales. The slowdown comes as fewer households do their grocery shopping online, and as monthly active users (MAUs) spend less money and order less frequently. The total number of households that ordered groceries either via delivery, pick-up or ship-to-home, fell 7% year-over-year through November.

The survey was conducted November 29-30, 2022, with 1,749 adults, 18 years and older, who participated in the household’s grocery shopping.

The report defines delivery to include all orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees. Pickup indicates orders that are received by customers either inside or outside a store or at a designated location, like a locker. Ship-to-Home statistics reflect orders that are received via common carriers including FedEx, UPS, USPS and DHL.

The numbers reflect how the overall picture around grocery e-commerce has evolved since 2020, when pandemic-induced shutdowns helped supercharge demand for online platforms and services. Yet in the wake of in-person restrictions being lifted, the Brick Meets Click report indicates that declines were driven by “a dramatic drop” in the 60-plus age demographic, combined with a “significant” slide among 30-44 year olds.

Within the mix, Grocery and Mass channels are moving in opposite directions, thanks in large parts to consumer concern over expenses. In last month’s survey, costs were cited as the top factor in choosing where to shop online by 42% of Delivery and/or Pickup MAUs, a 5% increase from August 2020. The size of the Grocery MAU base contracted 5% while the Mass base expanded by 6%.

Meanwhile, the rate of Grocery MAUs that also bought groceries online from a Mass retailer during the same period was 30%, a 6% increase from last year. At the same time, that group is also reporting an 11% drop in orders completed in November compared to one year ago — in contrast to Mass MAUs, who saw that metric rise 8%.

Depressed by falling Ship-to-Home numbers and flat Pick-Up growth, overall order frequency rates, defined as the number of orders received by MAUs during the period, declined just under 4% versus the prior year. Average order value (AOV) was also down 5% across both segments.

Delivery, however, posted several gains: Order frequency was up in low single-digits, while AOV increased 4% from last year.

“When it comes to shopping online – especially for Delivery or Pickup – cost considerations include more than the price paid for a basket of products,” said David Bishop, partner at Brick Meets Click. “Many customers also evaluate the total cost associated with using the service, which can include special charges, standard fees, and tips. And, when comparing the total of these costs to the customer, there’s a sizable gap in favor of Mass versus Grocery.”

In addition to those other factors, online grocery is also facing challenges in retaining users: according to the report, Mass (65%) continues to outperform Grocery (59%) in composite repeat intent level, which measures the likelihood that an online grocery customer will use the same service again with the next 30 days.

“Given that many shoppers are becoming more cost conscious, grocers should consider offering a tiered fee structure based on when a customer wants to receive their order and reduce some of the additional costs customers face when shopping online,” stated Sylvain Perrier, president and CEO at Mercatus. “We know that if offered the choice between shorter cycle times and lower fees, a significant share of online customers will select a time later that day or even the next day to save at least a couple of dollars.”