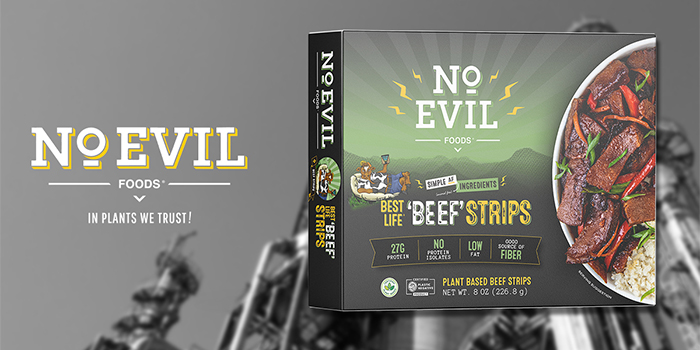

No Evil Foods Rebuilds With Regional Strategy And Frozen Pivot

“It’s been pure hell and you can quote me on that,” stated Sadrah Schadel, co-founder and CEO of plant-based meat company No Evil Foods.

Two years after the North Carolina-based company shuttered its in-house manufacturing, switched to a co-packing model and worked to rebuild the brand with a leaner team, No Evil is once again retooling its growth strategy to emphasize a more regional and focused channel strategy, as well as a pivot into the frozen aisle

The company onboarded with a new, fully vegan co-packing facility last month and recently shipped 30,000 units of product to “refill the pipeline” for its retail partners.

“It feels amazing to be able to align our values with our manufacturing again, but there was a dead period of about six months where there was no manufacturing going on so that ultimately meant zero dollars coming into the business,” explained Schadel. “Calling it a fight does not even sum it up, but we are here and we’re survivors because we’re so committed, passionate and believe in this brand so much that we will keep pushing.”

The production move was a necessity, explained Schadel, who assumed the role of CEO earlier this year from fellow co-founder Mike Woliansky. After the initial switch from self-manufacturing, the brand worked with a co-packer who was “only ever able to produce 20%” of the capacity needed to fulfill demand from retailers, leading to out-of-stocks and extremely limited availability.

“We struggled through that for probably longer than we should have because we had made such a significant investment in the pivot in the first place, had got into Sprouts and just really wanted to make that a successful launch for us,” she said. “But the output just wasn’t there… [and] it was more risky to continue manufacturing.”

The limited production also hindered the company’s ability to re-stabilize its balance sheet from pandemic-induced financial challenges in late 2020 that lead to its pivot away from self-manufacturing and layoffs that impacted 45 of its then 60 employees.

Despite its production challenges over the past two years, No Evil is still distributing to nearly 1,500 retail doors nationwide including selling its newest beef alternative product at Sprouts and an assortment of its five other SKUs at select Whole Foods in the South. Schadel believes the key to now “making this work” will be executed by a focused regional distribution strategy in key markets and increased attention on natural and independent retail partners.

“Rather than going really wide, like what we did before, we’re going to go really deep,” said Schadel. “We’re gonna focus on a few key accounts and a few key regions and really build that out in a big way. We’re also going to be focusing on category management. I think that overall as an industry it is something that we ought to be paying a lot more attention to.”

Previously, No Evil products have largely been merchandised in the fresh set. Schadel said the brand will now focus on realigning its products for the frozen aisle. Category leader, Beyond Meat, also recently announced it would be putting additional focus and resources behind pursuing placement in frozen, despite its previous battles to secure a spot in the butcher case alongside animal meats. That new position in-store will support No Evil when it looks to new categories down the road, she said, including healthy snacks and appetizers.

However, in the near term Schadel is focused on reaching No Evil’s core consumers. The brand launched a crowdfunding campaign on NuMarket this week which, unlike platforms such as GoFundMe or Patreon, operates on a “downpayment” model. Consumer contributions are then converted to a credit equal to 120% of their original donation to go toward purchasing the brand’s e-commerce platform once the campaign closes.

Proceeds will be used to relaunch No Evil’s e-commerce platform which was closed down amid the brand’s initial production woes in 2020. This crowdfunding model also ensures No Evil will see demand once it gets its online distribution back up and running. Schadel emphasized that while online distribution is not a revenue driver, citing the high costs of cold-chain shipping, it will allow the brand to support its customers and make sure they “feel taken care of” while the brand works to rebuild.

“We have created this opportunity and we want to make sure that we see it through,” Schadel said. “We owe a lot to the people who have supported us, I don’t just mean financially. People have believed in us. People have been patient with us. We owe it to them to continue to push because there’s so many people rooting for us.”

“We have fought tooth and nail to build the brand and we are being very honest about what we’ve been through because we know we aren’t the only ones,” she continued. “The more that we can be honest with our community and our industry, the better we can all help each other succeed.”