Low Carb’s Next Generation of Loaves Rise in Retail

Over the past five years several new brands have come to the bread aisle (and freezers), looking to capitalize on the keto and low-carb movements. Unbun, Hero Bread, Carbonaut and Better Brands all believe that by creating brand identities and innovation strategies around low-carb breads, bagels and rolls, they can cater to rising consumer interest to unlock new revenue opportunities.

There’s a lot at stake: according to a Mintel report in 2021, the packaged bread category is valued at $21 billion. While It’s true that low-carb bread has been around for decades, a new generation of founders claim their products can match the original product on taste and texture.

Sugar free and low-carb claims have come to take over stores in recent years – so why has low-carb bread taken so long to perfect? Developing a new recipe for something like bread takes time, brands say, a process only recently made easier as large grain producers have started to provide new ingredients for erstwhile manufacturers. For example, Ardent Mills, a flour-milling and ingredient company, debuted a new Keto Certified Net Carb flour in 2018.

“In the past decade we have made considerable advances,” said Ken Ruud, director of innovation for Ardent Mills, “When food manufacturers have tried [in the past] to create low-carb or low net carb products, they were met with production challenges that may require new equipment and processes, or compromise taste or texture.”

There has also been some regulatory change: the FDA has in recent years increased the list of ingredients that can count towards fiber levels, allowing brands to market a lower number of total “net carbohydrates.” For example, the FDA added MGP’s Fibersym to the approved list of dietary fibers in 2019. followed by glucomannan (or Konjac Fiber) in 2020. It plans to add acacia (also known as gum arabic), to the approved list of dietary fibers in the coming year.

A Baker’s Dozen

The newest brand to enter the market is Hero Bread, which debuted a low-carb sandwich roll late last year. Founded by food allergy sufferer Cole Glass, the startup positions its bakery items as the “Beyond Meat” of bread – and it’s attracted an investor base that includes everyone from Tom Brady to Lil Baby. The brand’s rolls are sold in select Subway stores in Idaho (Boise), Colorado (Colorado Springs), Iowa (Des Moines) and Georgia (Atlanta and Savannah)for an additional charge of $ 0.75 to $1. Sliced bread will launch in the coming weeks via the brand’s own ecommerce platform.

Better Brands went online first, selling its $3.75 low-carb bagels in June of last year. The company reached a $1 million run rate three months into the business, said founder Aimee Yang, who expects to expand into foodservice and brick and mortar this year.

There are larger players in the space as well. Privately held bakery company Silver Hills was founded in 1989 with a portfolio of brands that now includes Silver Hills Sprouted Breads, Little Northern Bakehouse and One Degree Organic Foods brands. The company launched Carbonaut, a line of low-carb breads in 2020.

Finally the category has a number of brands who have been around for under a decade. While Base Culture first launched in 2012, Unbun is a relatively newer entrant, having debuted in 2017. Rather than using the fibers and modified flours other low-carb breads include, Unbun relies on clean label ingredients such as eggs and almond meal in its line of flatbreads, bagels and breads.

Baking Up Sales Strategies

For some of the new brands, the path to greatness lies in foodservice. Hero Bread has staked out Subway while Better Bagel hopes to parlay its investor connections (which include the grandson of Wendy’s founder Dave Thomas) into food service placements.

“With Subway it really was an opportunity for us to shine,” Glass said. “[D2C doesn’t] have the same kind of distribution and awareness right away…and it does take a much longer cycle to end up getting on a store shelf.”

D2C is important, though, as ardent followers of diets regularly search out products that meet their needs — and pay high shipping costs. The common method is to ship these frozen breads at an ambient temperature, with the product arriving thawed, either for immediate consumption or refreezing.

Investor Interest Rises

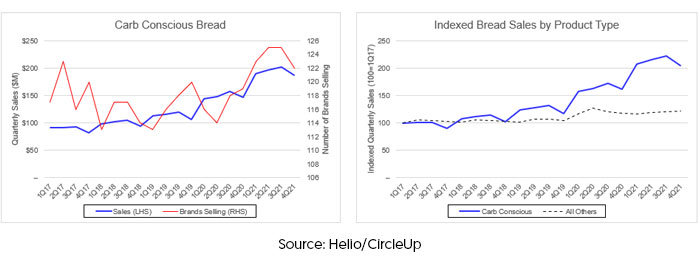

Motivated by the success of low-carb products in other categories, such as candy, it seems investors want in.

“I think it’s [the] combination of the category being ripe for disruption and the other categories in food starting to be disrupted by food tech, ” Glass said, “The quality of the products and the ingredients [has also improved] with the eating experience looking, tasting, smelling, and feeling identical to the normal version.”

Like the brands themselves, investors have observed plant-based meat’s flashy growth, and are wondering which category is next. Just as veggie burger sales soared higher when they went from “vegan” to “plant-based,” could the swap from “keto” to “low-carb” also motivate shoppers?

Given the ingredient angle, tech oriented investors are also jumping into the fray. Hero Bread raised $32 million before it even launched from investors including GreatPoint Ventures, DNS Capital, Future Positive, Marc Benioff’s TIME Ventures, Kevin Durant and Rich Kleiman’s Thirty Five Ventures, The Weeknd and Lil Baby. Better Brands has raised roughly $4 million from Alexis Ohanian’s Seven Seven Six ventures, Soma Capital, VERSO Capital, Cruise founder Kyle Vogt, and actor/investor Patrick Schwarzenegger.

“Better Brand is revolutionizing the foods we love by making major advancements in food tech,” Alexis Ohanian, Founder of Seven Seven Six, said in a press release. “With the exponential growth we’ve seen in the plant-based sector, there’s clear demand for alternatives to foods considered unhealthy and unsustainable.”

Larger bakeries are also investing rather than innovating from within. Unbun counts “one of North America’s largest bakery companies” as an investor, though Unbun CEO and founder Gus Klemos could not disclose the name of the investor.

Will Challenges Leave the Category Half Baked?

The ingredients that go into a low-carb bread can be expensive, said Karen Howland, managing director for CircleUp Funds, and those costs are passed on to consumers. Beyond Better Brand’s nearly $4 bagel, she pointed out, Unbun retails for two times Whole Foods’ own private label bread products. Relying on limited ingredients can also pose challenges. Better Brand had to reformulate its bagels to move from chicory root fiber to agave inulin as poor chicory harvests drove up costs.

These brands hang their hat on being low-carb, but they also loudly proclaim that they are high in protein and fiber (largely due to formulations). This can be confusing for shoppers, who are left wondering “what’s the hero of that product,” according to Kevin Ryan, founder of innovation and research firm Malachite Strategy.

Some macronutrient profiles may also backfire — too much fiber, for example, can cause gastrointestinal distress (at least temporarily). Carbonaut’s U.F.Oat Loaf, for example, has 30% of a consumer’s daily fiber in one 34 gram slice, while one Better Brand bagel has 61% of the recommended levels of dietary fiber.

Also, many of these low-carb items are highly perishable and have to be sold in the freezer aisle, which requires investment in field marketing and sales.

“There’s a reason why we still go and squeeze the bread,” Ryan said. “It’s going to be difficult to retrain people that…if I’m going to buy bread, it’s going to be in the frozen section.”

Meanwhile, another challenge may be the unpredictability of the entire low- and no-carb trend, which has seen the fortunes of companies like Atkins and Halo Top rise and fall. Ryan forecasts that though low-carb is in vogue now, a consumer movement away from highly processed products means that the next trend could be towards “clean keto.”

Klemos said Unbun is rebranding to decrease emphasis on carb counts as well as paleo and keto buzzwords. For him, the category is already getting too crowded with brands relying on “unclean” ingredients mixed into a “chemical slurry.”

“We’re really focused around shifting from saying ‘keto bread,’ to ‘we are the healthiest bakery company, period,’” Klemos said. “There are people that buy our product because of low-carb, but our biggest market is clean label…we don’t want to be competing with people on the lowest net carbs.”