IRI Says Variety and Impulse Are Driving Growth While U.S. Snacking Swings In A ‘Seesaw State’

Market research firm IRI hosted a webinar yesterday, titled “Solving the Seesaw State of U.S. Snacking,” that broke down how inflation, consumer interests, supply chain disruptions, channel opportunities and innovation continue to bring new obstacles and opportunities into the segment.

What do consumers want?

Convenient, at-home, and on-the-go snacks are in high demand. As consumers adapt to hybrid working models and snacking begins to play on the same ground as meals, IRI EVP and Practice Leader, Sally Lyons Wyatt said it is imperative for brand’s to deliver options – whether that be on flavor, pack size or product-related attributes.

According to IRI data, 45% of consumers consume at least three snacks each day, with the same rate reporting they often eat a snack instead of a meal at home; this figure has increased 3% over the past five years. Seventy-two percent report they don’t plan their snacks, instead saying they expect to be able to grab what they want, when they want it.

While the importance of permissible indulgence decreased, with unit sales dropping almost 1%, true indulgent snacks are taking the lead with a 3% increase in unit sales, despite expectations that interest in better-for-you would surpass conventional products. According to survey results, IRI found 64% of consumers view snacking as a way to “treat themselves.”

On the savory side, meat snacks are having a moment as Lyons Wyatt states that the category “has seen some of the most phenomenal growth of any category I’ve studied in recent years.” The segment has grown 13.5% over the past year while using flavor, better-for-you positioning, online consumer engagement and affordable price points to its advantage, she said.

These findings also support the below-expected interest in plant-based snacks with 10% of vegan consumers reporting they specifically seek out plant-based snacks. However Lyons Wyatt said specialty diet claims remain important to consumers, noting that halal, low sugar, low calorie, cholesterol friendly and ketogenic snacks were the only segments to see unit sales increase in 2021.

“I don’t want everybody running out of here and not putting healthy snack options on checkouts,” said Lyons Wyatt. “I’m just saying that, healthy overall, was trending down, but I think next year you’re going to see that pop back up.”

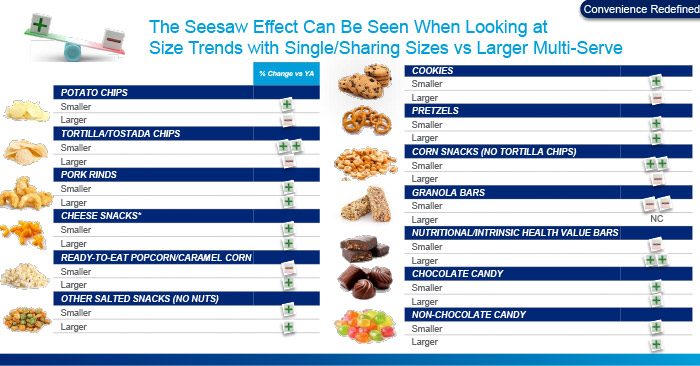

The importance of variety among pack sizes is also rising, due to both inflationary pressures and changing consumption habits, and marks one of the most notable transitions in snacking over the past year. Lyons Wyatt noted that while single-serve, portion-controlled packs often have accessible price points that may help drive trial, multipacks, especially variety packs, are currently leading the charge with 26% year-over-year growth.

“What I would say is that if you aren’t engaging in multipacks, and you have the production capability to do it, I would do it,” she said.

The survey found that consumers are drawn to the affordability, portion-controlled but bulk in-nature, and variety of multi-serve formats. Offering variety within the pack can satisfy the wants of multiple family members or cater to changing day-part snacking occasions, Lyons Wyatt added.

“There’s different categories that have been able to drive growth across all different sizes,” said Lyons Wyatt. “But it’ll be key as you think about your channel strategies, your convenience strategy, for in and out of home, to make sure that you have the variety of sizes available for your consumers where and when they’re snacking.”

What else can brands deliver on?

As interest in snacks continues to see-saw, Lyons Wyatt underscored the importance of managing shelf-sensitivities. This means brands need to monitor and take action against price increases (either through promotions or their own supply chain), leverage out of stock information to monitor their own risk and work out tiered pricing strategies, such as offering various pack sizes, if possible.

Despite price increases ranging between 8 to 10%, top snacking categories like potato chips, crackers and bars remained resilient with continued demand and solid growth. Although in the current economic state, inflation has outpaced wage growth, IRI found that consumers aren’t particularly sensitive to price increases.

Additionally, the firm reports that impulse remains important to snacking which has been enabled by the expansion of checkout areas and merchandising models surrounding them.

“Impulse is still very relevant and it’s needed for the industry to thrive,” she said. “In fact the checkout is part of that experience and it is definitely something that resonated, with 33% of the consumers saying that they indeed go-to and are influenced by checkout.”

She also highlighted the changing purchasing landscape including the convergence of channels like e-commerce and quick commerce with convenience. The survey found that snacking occasions are shifting to late night, with 60% of consumers saying they have an evening snack at least three times a week, and in the convenience channel, snacks purchased during evening hours saw 26% dollar sales growth on a two-year basis.

These habits have redefined convenience causing quick commerce to become increasingly important to the growth of the snack category, said Lyons Wyatt while citing conversations with convenience channel representatives.

“They said they’ve been able to really maximize late night through these quick commerce delivery groups,” she said. “So you want to make sure that you find a way to develop your strategies to include quick commerce. You want to make sure that you are part of their websites, a part of the searches. It is absolutely one of the fastest growing areas and could be a $25 billion industry.”