FMI: Shoppers Adjust Holiday Grocery Habits to Navigate Rising Prices

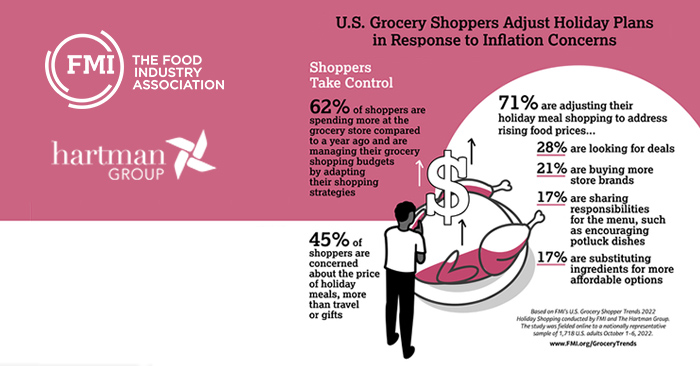

In response to ever-increasing prices, consumers are adapting to the evolving economy by modifying both their everyday and holiday grocery habits. According to the Food Industry Association’s (FMI) latest report, shoppers’ holiday stress has been amplified by inflationary concerns, with 62% of shoppers reporting increased year-over-year grocery costs.

However, despite inflation-induced concerns, average weekly household grocery spending is currently at $148 per week, down from the $161 peak during the height of the pandemic. Additionally, progress made by food retailers and suppliers to curb widespread food shortages has “kept up consumer confidence” ahead of the holiday season, according to FMI.

“Food is the centerpiece for so many of our holiday gatherings. Despite inflationary pressures, consumers are determined to enjoy the festivities this year as they normally do,” said FMI president and CEO Leslie Sarasin in a press release. “The food industry is working tirelessly to keep costs down and to ensure that our timeless traditions can continue during this holiday season.”

Forty-five percent of consumers reported being most concerned about rising meal prices as compared to other holiday expenses including gifts (43%) and travel (34%).

Still, most shoppers indicated feeling “in control” of their grocery budgets, with 71% making adjustments to their holiday meal shopping to adapt to the changing economic climate. According to the FMI report, this demonstrates that consumers are still apt to find cost-effective items that satisfy their needs.

To combat inflationary headwinds, shoppers are employing a multitude of strategies, including: looking for deals (28%), choosing store brands (21%), making fewer dishes overall (17%), substituting more affordable options (17%) and encouraging guests to bring dishes (17%).

Meanwhile, just 27% consumers reported being “very concerned” about food items needed for holiday meals being out of stock. If faced with stock issues, 50% of shoppers said they would try something new while 36% would try a new recipe.

As the pandemic continues to subside and the world reaches some sense of “normalcy,” though shoppers seek to contain costs this holiday season, they plan to get together with more people, increase travel and shop earlier than usual to a greater degree than last year. Far fewer shoppers this year believe COVID-19 will impact their holiday plans, according to the report.

“Last year, as pandemic concerns had eased leading into fall/winter celebrations, an elevated enthusiasm and plans to celebrate all holidays ‘to the fullest’ was pervasive. This year, enthusiasm for the season ahead is down, but this is offset by plans to celebrate more than usual, and shoppers report that COVID-19 will have much less of an impact on holiday plans than last year.”

Reduced concern over the pandemic has also reduced online grocery shopping as a portion of overall grocery sales, with just 38% of shoppers reporting being “very” or “extremely” concerned about COVID-19, down from 48% in August. In addition to diminished concerns about shopping in person, visits to the store are viewed as a “helpful way to manage the shopper’s basket,” enabling consumers to make adjustments at shelf (58%) and save on shipping and delivery fees.

Notable takeaways for each holiday include:

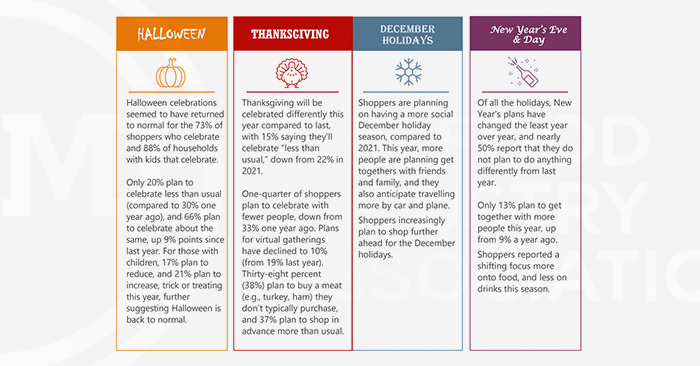

Halloween: Celebrations have seemingly returned to normal for the 73% of shoppers among households with kids, with 28% planning to buy more candy and 27% planning to buy less candy/give out less candy this year.

Thanksgiving: The vast majority of shoppers (94%) plan to celebrate Thanksgiving to the same extent they usually do, up 7 points from 2021. Thirty-seven percent of shoppers say they plan to shop further in advance than usual while 33% say they do not plan to shop any differently on this holiday.

December Holidays: Ninety-three percent of surveyed shoppers plan to celebrate the December Holidays (Christmas, Hanukkah and Kwanzaa). Similar to Thanksgiving, 34% of shoppers plan to shop further in advance than previous years, including both food and gifts. Additionally, 34% of shoppers plan to buy a meat product they don’t typically purchase, up four points from 2021.

New Year’s Eve/ New Year’s Day: Younger shoppers are more likely and more excited to celebrate the New Year, though the festivities elicit less excitement than the December holidays. As a reflection of this, just 21% of shoppers plan to shop further in advance while 46% say they will not shop any differently for the holiday.

The primary focus this year has shifted away from concerns about stock issues to planning ahead and shopping early, with 37% of shoppers planning to shop earlier than usual this Thanksgiving and 34% planning to do so for the December holidays. Looking ahead, more than two-thirds of shoppers say they plan on engaging in the holidays “about the same as last year,” representing a year-over-year increase for every holiday.