Ampla Technologies Acquires Upside Financing; Opens Up B2B Buy Now, Pay Later Market

Tech-enabled finance platform Ampla Technologies announced this week it has acquired Upside Financing, a move it says will help the company open up a B2B buy-now, pay-later market. Financial details of the acquisition were not disclosed.

In buying Upside, Ampla completed the transformation of Nick Mares from food entrepreneur – he was a co-founder of bone broth company Kettle & Fire in 2014 – to one of those entrepreneurs clever enough to sell shovels at the Gold Rush.

Mares and his partners launched Upside in 2021 to help CPG brands scale more easily by addressing the pain points its founding team of executives had endured themselves at previous companies, especially poor cash flow. In November, the company received $10.5 million in capital during a seed funding round co-led by M13 and Infinity Adventures.

Upside’s “off-balance” financial product affords companies the needed time to convert inventory into cash and enables co-packers to even out collections with their brands. According to a recent report from CB Insights, nearly 40% of all startups, regardless of revenue or size, fail due to poor cash flow management.

“Working capital was always the problem that persisted throughout every stage of growth at Kettle & Fire,” Mares told NOSH. “Everyone always thinks once you get to a certain size that all of a sudden you’ve arrived at the Mecca, yet that is pretty inadequate and insufficient given the unique cash flows to a CPG brand.”

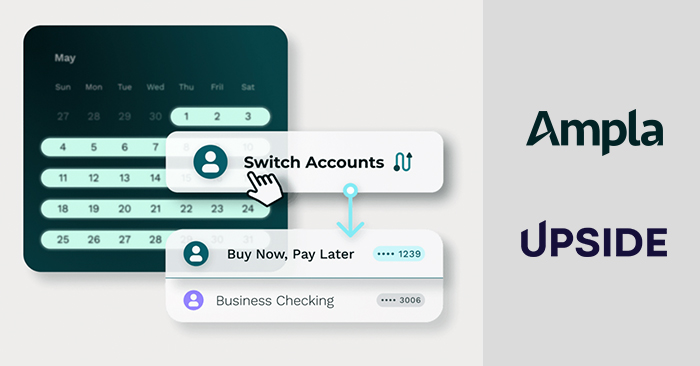

Ampla, which supplies a variety of credit services to growing CPG brands, will roll Upside into a new Ampla Pay Later product, part of the company’s broader financial solutions platform, including its recently-launched Banking and Bill Bay Platform.

“One of the big perks about integrating [Upside] into our platform in general is…[making] access to capital really streamlined for founders,” said Ampla vice president of marketing Michael Grillo. “This will make it so you’re able to use Ampla Pay Later, Bill Pay and Banking all in one.”

The acquisition comes amid a rapid growth acceleration for Ampla, fueled by its core product, a non-dilutive line of credit. Ampla surpassed $850 million in total funds deployed to customers this past September, according to the company.

Through the formation of Ampla Pay Later, Ampla will expand its addressable market by catering to brands that may not require a full fledged line of credit, but would benefit from extended payment terms for their manufacturing invoices during certain times throughout the year.

“The acquisition of Upside, and the formation of Ampla Pay Later, will provide brands with another lending option alongside our Growth Line of Credit that extends their runway and allows them free up cash to grow,” said Ampla Technologies founder and CEO Anthony Santomo in a press release. “Despite significantly fewer deals getting done in the current macro environment, Ampla has decided to double down on its support of emerging consumer brands.”

Mares added that the acquisition will enable Upside to further expand its customer reach in the B2B buy now pay later market. He has joined Ampla as a full-time employee and will help manage the Ampla Pay Later line of business.

The process for using Ampla Pay Later is as follows: connect your account (Ampla syncs all of your systems to pull the data needed to create an offer), see your terms (gain visibility into your credit limit and the transaction fee to unlock 30, 60, 90 or 120-day payment terms), let Ampla cover your invoice (Ampla Pay Later pays 100% of your invoice directly) and pay Ampla back later.

Ampla says it is now poised for “significant revenue acceleration” in the B2B buy now, pay later market, which is currently estimated at a value of more than $1 trillion.

According to Grillo, existing Upside clients will not face any business interruptions and will be able to enjoy a broader set of offerings from Ampla, including its Growth Line of Credit, Banking and Bill Pay and Analytics. Ampla Pay later is slated to open to new customers by Dec. 2022.