From Meat Snacks to Protein Powders: Stryve Looks to Nutrition Segment After Going Public

Fresh off its IPO, meat snack company Stryve Foods is already making moves to enter new categories. While the company previously indicated it planned to first enter adjacent salty snack categories such as crackers and chips, it has instead turned its attention to the supplement set, launching new protein powders with a new line called Stryve Nutrition.

Founded in 2013, Stryve launched with a line of biltong, a South African air-dried beef snack, before expanding into meat sticks. It subsequently acquired natural biltong brands Kalahari Snacks and Braaitime in 2020, and also launched Hispanic focused meat snack brand Vacadillos. The company, which had raised $26.5 million, not only tried to differentiate itself by focusing on one small segment of meat snacks, but also by acquiring or building USDA certified biltong production facilities.

In early 2021, the company announced its intention to combine with SPAC Andina Acquisition Corp III, and began officially trading last month. Currently the company is trading at $7.49 per share.

Debuting last week, the new Stryve Nutrition line includes Chocolate, French Vanilla, Superfruit and Unflavored varieties of collagen protein powder, each containing 20 grams of collagen and 18 grams of protein per serving, with an MSRP of $23.99 per 10.6 oz container. The company also launched a bone broth-based protein powder, offered in Chocolate and Vanilla flavors, with 22 grams of protein per serving and an MSRP of $43.99 per 19.12 oz. container. Both lines will debut on the brand’s website to start, before expanding to Amazon and select retailers, the company said.

Stryve co-CEO Jaxie Alt told NOSH in a statement that while the brand continues to see opportunities in snacking, the protein powder line serves as a “natural extension” of its meat snacks offerings.

“Stryve has always been a healthy snacking company, and while snacks are at the root of what we do, the brand also has extensive expertise in nutrition product development,” she said. “We have all of the capabilities and intentions to continue to grow in the snack sector, but the brand also has the opportunity to rapidly diversify into functional foods and new food categories that will help Stryve Foods grow into a healthy eating platform.”

The line capitalizes on the nutrition supplement experience of its co-founders, co-CEO Joe Oblas and chairman Ted Casey, the company said in a press release. Oblas is the co-founder and former COO of sports nutrition brand ProSupps, while Casey is founder of nutritional supplement maker Dymatize.

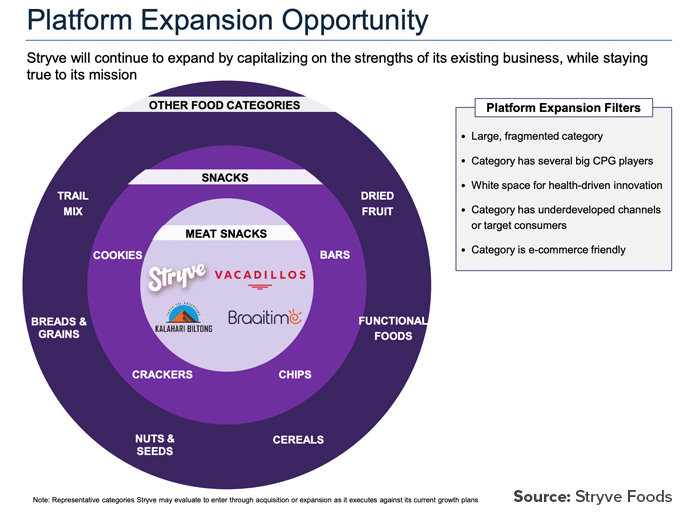

Still, protein powder is a departure from the company’s initial category expansion plans first announced in January. On an investor call discussing the combination with Andina, the company highlighted its interest in becoming a vertically integrated platform brand focused on healthy snacking in e-commerce friendly categories, both through internal product development and acquisitions. Cookies, bars, crackers and chips were named as immediate expansion opportunities, with categories like trail mix, dried fruit and vegetables, nuts, seeds and grains also named as possibilities.

“Our vision is to help America snack better,” Alt told NOSH in January. “And what does America snack on: chips and crackers. These are really massive categories that we think there’s a lot of white space for health driving innovation to really drive our mission. We want the name Stryve to be synonymous with healthy snacking.”

On the same January call the company also highlighted the importance of being vertically integrated, noting that self-producing snack items would help it achieve higher margins and increase the speed to market of new products.

However, in another apparent change in strategy, the company said it will not manufacture the new protein powders in-house. Leaders declined to comment on future manufacturing plans.

In recent months Stryve appeared to broaden its horizons beyond snacks. An investor presentation in June reiterated the majority of its target categories first outlined in January as possibilities for expansion, but added functional foods, breads and cereal as additional opportunities to target in the future.

Alt cast an even wider net for expansion opportunities during a “fireside chat” with IPO Edge in July, saying the company was open to expanding to “any category where we believe we can really make a difference” as it ultimately sees itself as a “as a healthy snack and healthy food company.” While meat snacks will continue to be the company’s main focus, she said at the time, in addition to crackers and chips as immediate options for expansion, “broader food categories” such as bakery and supplements were also on the table.

During the same interview, Stryve COO and CFO Alex Hawkins said the company will look to utilize a similar strategy previously utilized to grow its meat snack business for any future product launches.

“Right now we’re focused on meat snacks and growing within…the runway that we have in front of us,” he said. “We have a number of fantastic brands that we can continue to knock the cover off the ball. We’re going to opportunistically look at other categories and, obviously, if something comes up for us to expand it, we can do that…We have a team across the board that has the ability to manage a much larger enterprise, and it has the experience in doing so.”