Acosta Predicts Online Grocery Sales To Continue Rising

Sales and marketing agency Acosta released a study last week that found that almost a quarter of online grocery shoppers in the U.S. believe they will increasingly use e-commerce platforms to purchase groceries over the next year. According to the survey results, which includes 1,447 respondents from Acosta’s proprietary Shopper Community located across the country, the majority of respondents cited convenience as the primary factor driving the adoption of online grocery.

“COVID-19 significantly accelerated shoppers’ reliance on eCommerce,” said Colin Stewart, Executive Vice President of Business Intelligence at Acosta, in a press release. “Half of all online grocery shoppers developed their current preferences after the pandemic began.”

According to the survey, 34% of shoppers who leaned into online grocery during the pandemic also reported trying an increasing amount of new products while shopping on retail platforms. Prior to COVID-19, online grocery sales were mainly driven by non-edible household items such as paper towels and laundry detergent, according to Acosta; however, the survey found shoppers are broadening their use of e-commerce across categories with salty snacks, condiments and coffee and tea ranking in as the top shelf-stable products purchased online this year.

26% of online shoppers say they use e-commerce platforms all or almost all of the time for groceries. However the report notes a few points of tension, highlighting that the in-store experience is not entirely moot. The survey found 48% of shoppers still run into the store when picking up an online order to purchase items that are not sold online and 60% said they will still go in-store to purchase items they prefer to pick out themselves. Only 26% of respondents said they never go into the store when picking up an online order.

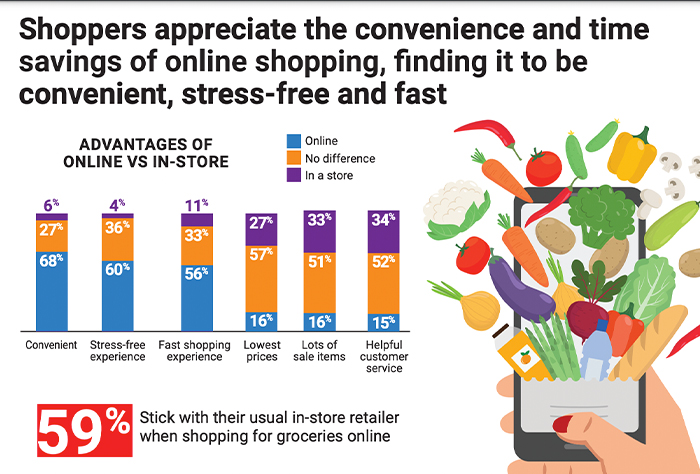

Additionally, the majority (59%) of online shoppers say they are loyal to their usual in-store retailer’s e-commerce platform. The report notes that the increase in online grocery shopping has allowed consumers to develop new shopping habits and to discover new brands and categories, with 29% of consumers reporting that it has expedited shopping trips, and cut down on overall time spent grocery shopping.

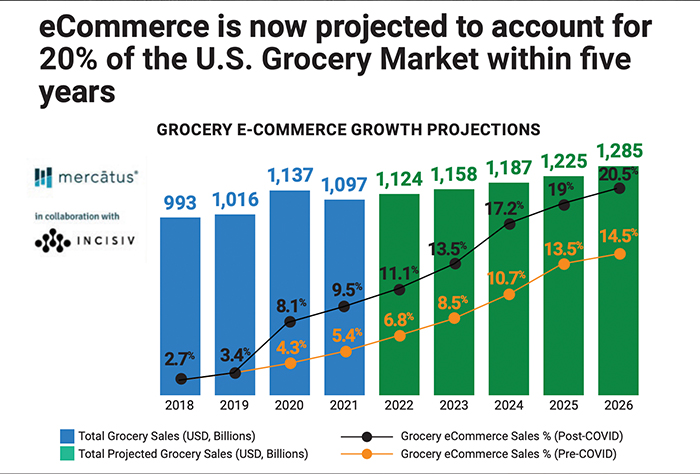

“This widespread embrace of online grocery platforms is expected to notably impact the CPG industry, with Mercatus and Incisiv projecting that eCommerce will account for 20 percent of the U.S. grocery market in the next five years,” Stewart said in a press release. “Shoppers who have grown accustomed to the convenience of online grocery shopping will likely maintain their new habits long after the pandemic ends.”

According to the data from Mercatus and Incisiv, e-commerce grocery sales are predicted to reach $1.285 billion by 2026, a 6% increase from pre-pandemic predictions. Prior to the pandemic, the e-commerce grocery market was anticipated to grow at a steady rate of 1.25% over the next five years. The data shows a sharp upward, 5% spike in online sales at the onset of the pandemic and although the pandemic expedited the increase in online grocery’s share of sales, the growth rate in the channel is anticipated to remain around pre-pandemic levels.