Start to Finish: Why Ingredient Companies Launch CPG Brands

An innovative, novel ingredient — such as a fermented protein found inside volcanic rock — can be difficult to explain. As a result, ingredient suppliers often find themselves creating or evolving into CPG brands to showcase their unique ingredients before outside brands are willing to commit. It’s a move that can help drive ingredient sales, but also requires new capital, skills, labor and time to execute.

Suppliers have different reasons for launching CPG products, but two are common: showcasing products that capitalize on consumer trends and quickly getting them into the marketplace.

Some ingredient types prompt the launch of CPG products under their own banner; for example, food technology company Joywell recently raised $6.9 million in funding from Evolv Ventures, largely to support the launch of a CPG product line using its proprietary sweet fruit proteins. The move is intended to allow the brand, like other ingredient companies, to speed up a route to market for its ingredient business.

“By launching our own products, we are able to control our ingredient’s destiny and ensure an optimal consumer experience, all while demonstrating the success of the ingredient,” said Joywell CEO Karen Huh. “Having our own products also helps gather consumer insights which will help drive how we formulate with CPG partners.”

Other suppliers launch or become separate brands, allowing for more streamlined storytelling that they hope will drive more sales — and help push clients to adapt the products themselves.

Show, Don’t Tell

As a baking ingredient startup, Renewal Mill has two conceptual challenges: ‘upcycled’ is a new category, and the brand’s first product, okara flour (made from upcycled soy pulp) is unfamiliar to many American shoppers. So the brand has created familiar vessels — a ready-to-eat okara-based cookie and a brownie mix — to help grow its ingredient platform.

“We see this as a dual strategy,” said co-founder and CEO Caroline Cotto. “CPG is a vehicle to build the B2B business, so we wanted to drive awareness as the go-to supplier for upcycled food ingredients.”

Once at scale, the company plans to generate 60% of sales through business-to-business sales and 40% through sales to consumers, according to Cotto. For now, though, longer timelines to develop ingredient sales have shifted the focus to the CPG side, which currently comprises 70-80% of the business, she said. The company’s gluten-free, vegan brownie mix, made with upcycled vanilla beans, pea starch and okara, helped the brand gain a “significant foothold” on Amazon since its launch last month, Cotto added.

Ingredient company SunOpta this month launched a separate CPG brand, Arbor, a line of all-natural fruit bars aimed at trends like sugar reduction and clean-label snacking. The hope is that Arbor will become a catch-all of sorts for ingredient platforms that don’t yet have a following among other brands, allowing SunOpta to still generate revenue from their development.

Some suppliers may aim to revive consumer interest in familiar ingredients via innovative product platforms. Chia seed supplier Benexia, for example, launched CPG brand Seeds of Wellness (SOW) to prove the mighty chia seed’s prominence via milks, pastas and other products, thanks to the company’s proprietary equipment and formulas. While chia-focused brands have used a variety of strategies to grow the love for the seed, this consumer-facing shift should help showcase new possibilities for the ingredient, said SOW commercial director Bas Ruijten. So far in 1,000 U.S. stores, the brand produces 24 items, with plans to launch a chocolate chia milk and three new pastas in the U.S. this fall.

Founded in 2005, Benexia bills itself as one of the top global chia producers. Even with the company’s passion starting at the seed, launching a CPG brand is a “huge project,” noted Benexia CEO Sandra Gillot.

“We’re a small company but have a huge vision at this time,” she said.

Becoming a Brand

Sometimes a bigger shift is required to promote novel ingredients. Chicago-based Nature’s Fynd, which launched as fermented protein supplier Sustainable Bioproducts, morphed into a CPG brand to tell its unique story: the company’s proprietary ingredient, Fy, is derived from Yellowstone National Park’s ancient ‘supervolcano.’ Although the company developed the protein under Sustainable Bioproducts, it ultimately decided that Fy’s founders are best suited to explain its creation story to consumers, said CMO Karuna Rawal.

“In particular for us, the complexity of our narrative means it needs to be told in just the right way,” Rawal said. “Once we establish the brand and narrative with our consumer, it will be easier for others to be able to share it as well.”

The plan is to use Fy, which can be in solid, liquid or powder form and applied to sweet and savory categories, for Nature’s Fynd’s own plant-based food and beverage products. Once the branded portfolio is established, there’s opportunity for partnerships with other brands, she added.

“We are not precluding the possibility of selling Fy to existing food companies in certain categories where we choose strategically not to introduce our own product,” she said.

The food industry, though, can be slower to adopt new ingredients, she noted, while consumers are “much more open and adventurous,” toward fermented products. For example, she said, kombucha and pre- and probiotics are categories “that have become ubiquitous in a very short amount of time.”

Power in Partnerships

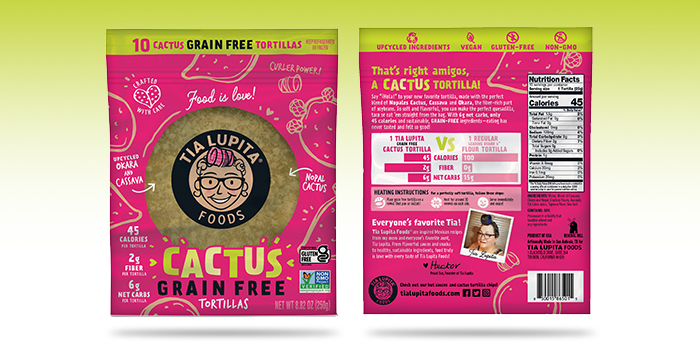

Another way to showcase ingredients — with perhaps less leg work — is via partnerships with other brands. Renewal Mill has also attempted to show its power across categories by partnering with Mexican-inspired food brand Tia Lupita last month on a co-branded okara-based tortilla. Renewal Mill handled R&D, developing the initial recipe before transitioning production to Tia Lupita’s copacker. It also agreed to provide PR and marketing support for the launch of the tortilla, which features Renewal Mill’s logo on the back next to the ingredient panel. Next the brand will partner with natural cookie company FancyPants to launch an okara cookie.

Cotto said that emerging brands can turn products around quickly: the Tia Lupita tortilla went from concept to product in just six months.

“Brands with established brand loyalty are going to be able to use larger volumes; they have more distribution and presence than we do,” Cotto said. “It helps us get to our goal by really working with them instead of just seeing them as competitors.”

Working with larger companies is also important, but those accounts can take up to three years to close, she noted.

What does it take?

Founded in 1973, Ontario-based SunOpta evolved to become an ingredient supplier, product developer and co-manufacturer for organic plant-based and fruit-based food and beverage clients in eight countries. While its plant-based product innovations drove 30% of the company’s growth in the past six months, Michael Buick, SunOpta SVP and general manager said the company now wants to bring similar attention to its fruit business. Launching Arbor, he said, should help do that. In 2015 the company acquired frozen fruit producer Sunrise Growers for $450 million to “reframe the value” SunOpta brings across categories, Buick said.

A small team is managing the CPG launch — similar to the entrepreneurial companies driving the industry’s growth so far in 2020, he noted, with some team members having launched CPG brands before. While developing and marketing the product was less of a challenge, securing distribution during the pandemic has been harder, he said. Eventually, SunOpta will add other fruit-based products to Arbor’s portfolio and may even create other CPG brands, said Buick.

To get products into consumers’ hands, partnerships with burgeoning ecommerce platforms, such as Good Eggs, Imperfect Foods and Misfits Market have been key for Oakland, Calif.-based Renewal Mill. Prior to the pandemic, 70% of the company’s sales were in foodservice; now they are almost entirely in retail. Although the company’s products are in almost 100 stores so far, including Whole Foods’ Northern California region, it will continue to focus its efforts online, Cotto said.

“There are unique challenges of bringing a novel product to market when you can’t do product demos or have shelf talkers or education in the store,” Cotto noted. “We’re looking at the [online] landscape and doubling down on platforms that really resonate with our audience.”

However, even the biggest backed brands can fail without enough support or the right efforts. In 2015 Terravia, formerly Solazyme, announced the launch of Thrive, a platform to highlight its algae-based cooking oils and technology. The brand, however, never saw the traction that its creators hoped for; the line and the entire Terravia ingredient platform was sold to Corbion after declaring bankruptcy. Even with new owners and a launch into retailers, including Whole Foods and Walmart, the brand was discontinued this year.

Differentiation is Key

Some ingredient companies might worry that launching a CPG line would create competition with current clients or bastardize potential ones. However, Cotto says brands are more interested in seeing the ingredient being used and that Renewal Mill “still sees competitors as [potential] customers.”

That’s also not the belief at SunOpta. Eventually, the Arbor Bar concept could be adapted by SunOpta’s clients, likely via a private label product, Buick noted, but retailers generally prioritize proven concepts for their private label launches.

“We think there’s an unmet need other manufacturers and brands are missing,” he said. “At the end of the day what we want to do is bring really good food to the market, and there’s a lot of different ways we can do that.”

Renewal Mill is also powering ahead with its next ingredient innovation: an oat flour upcycled from oat milk production. Meanwhile, the company is adding other brands into its supply chain. Tofu brand Hodo Foods will eventually become an ingredient partner for okara flour, requiring an investment in production that was delayed due to the COVID-19 pandemic, said Hodo founder and CEO Minh Tsai.

For now, Tsai is a shareholder and advisor for the brand while it gets its legs. Tsai said that Renewal Mill has succeeded in marketing and proving its value via the “alpha concept” of okara flour, noting the demand for the cookies and brownie mix as the “ultimate proof” to grow the business and attract investment. He added that the explanation of okara and upcycling will eventually catch on to a wider audience, similar to tofu and sushi.

Once the concepts are more familiar, Renewal Mill’s CPG line could eventually be nixed if the ingredient business takes off, Cotto noted.

“If we didn’t need the CPG piece I could see that potentially dropping off or handing it over to someone else,” she said.