Daily Briefing (Insiders Only): Report Claims Pace of M&A May Increase

While the pace of food and beverage acquisitions has slowed from previous years, recent deals reflect two key themes – portfolio reshaping and increased snack demand – that are expected to continue, according to a new report from CoBank, a national cooperative bank and agricultural export credit agency.

Manufacturers are streamlining portfolios by shedding non-core businesses. For example, General Mills divested its Yoplait, Go-Gurt and Oui yogurt brands in September to focus on cereal, snacks and pet food.

“Food and beverage manufacturers are increasingly applying the 80/20 rule and devoting more attention to the 20% of their core brands and categories that account for the lion’s share of company revenue,” said Billy Roberts, food & beverage economist with CoBank.

Meanwhile, the latest deals appear to be driven by growing demand for grab-and-go convenience and healthier snacking. This trend is underpinned by two of the biggest transactions announced this year – Mars’ $36 billion acquisition of Kellanova and PepsiCo’s $1.2 billion purchase of Siete Foods – as well as Our Home’s shopping spree for spun-out snack brands Pop Secret, ParmCrisps, Sonoma Creamery, R.W. Garcia and Good Health.

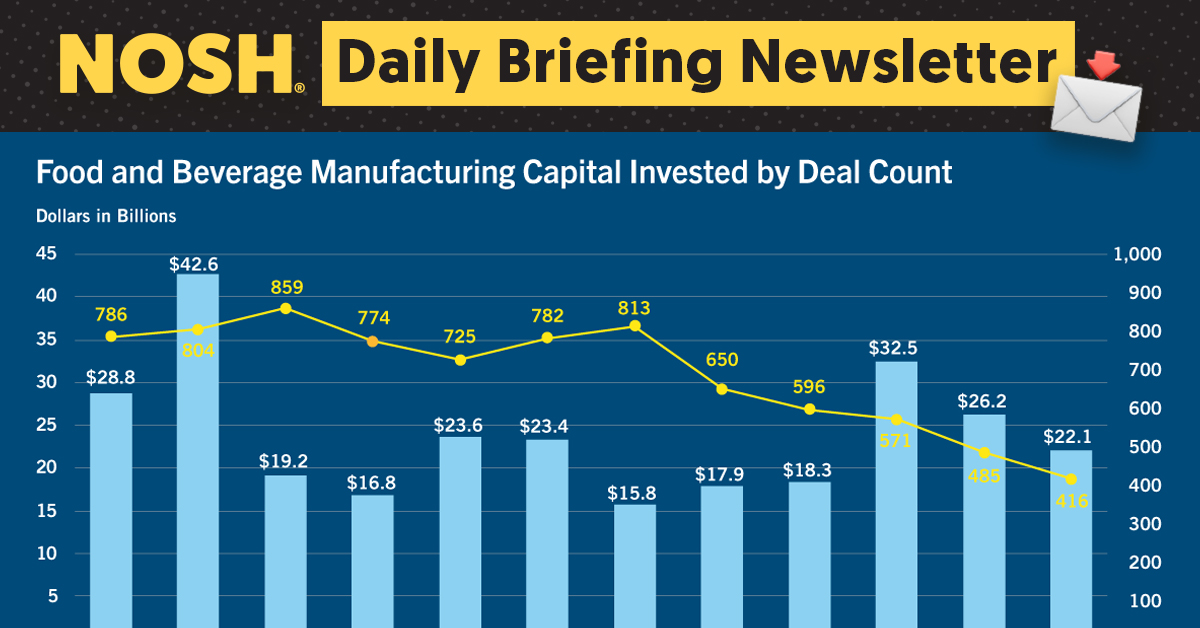

The number of deals within the sector have dwindled steadily on a quarterly basis since the beginning of last year, per Pitchbook data. Deal count totaled 3,140 in 2022 and 2,630 in 2023, with the amount of invested capital reaching $83 billion and $84.5 billion, respectively. By comparison, 901 deals were completed in the first half of 2024, representing a total of $48.3 billion in invested capital.

M&A activity is poised to accelerate behind interest rate cuts and as companies feel pressure to return to volume-led growth following a period of price inflation, Roberts explained. Executives of Mondelēz International, General Mills and Flowers Foods indicated at investor conferences this year that acquisitions remain a strategic priority.

The report pointed to innovation and growth among smaller companies as a driver for potential acquisition of smaller brands. What’s not clear is the size of those smaller companies referred to in the report, however. Although strategic-driven M&A of late has been for brands with revenue in the hundreds of millions of dollars, as opposed to the relatively tiny “proof of concept” investments that characterized the corporate incubator days of the 2010s. Another recent report, from Capstone Partners referred to these smaller acquisitions as $1 billion or so.