Mary’s Gone Crackers Looks To Packaging, Ingredients As Source For New Innovation

After nearly three decades on the market, Mary’s Gone Crackers’ spot in the organic, gluten-free cracker set has yet to go stale. In fact, after only five months into his role as CEO, Michael Finete told NOSH in an interview that the company is working on building new internal processes to keep fresh ideas and innovations flowing.

New innovations could range from evolved packaging to new product formats utilizing unique ingredients. Finete said Mary’s brought in external partners to help build and accelerate the company’s new internal processes and believes these adjustments will be essential as the company continues to scale up production of new products.

“What we’ve done and continue to do is build an innovation process so that we can continuously provide new products and a steady pipeline of innovations for our customers and partners going forward,” Finete explained.

Finete assumed the CEO role from Taki Fujii, the brand’s chairman of the board, in July. He brings over 30 years of food industry experience from roles at General Mills, HJ Heinz and Sensient Natural Ingredients. Mary’s Gone Crackers has been owned by Japanese rice cracker manufacturer Kameda Seika since 2012.

Beyond Finete, Mary’s is in the process of ushering in “a new era of leadership,” which includes bringing in new employees and creating new positions. Quickly following Finete’s appointment, Nate Lindsay officially joined as VP of Operations in August. Lindsay has over two decades of operational experience and has served as plant manager for Ready Roast Nut Company, Made in Nature, Aramark, Land O’Lakes and more.

Finete noted that Mary’s has also created a new VP of business development role aimed at strengthening Mary’s base business. The individual who fills the role will play a key part in identifying new distribution channel opportunities, support the company’s growing e-commerce focus and contribute to the success of new innovations.

“We know that convenience is very important to many consumers,” Finete explained. “We know that a cost per ounce basis is very important to other consumers, for instance, in the club channel. And we know that offering the right size, the right packaging, and the right product in the right place to consumers is basically a recipe for success.”

To that end, Mary’s continues to expand its retail reach, with recent distribution deals in both natural and conventional channels with Publix, Albertsons, HEB, The Fresh Market and Safeway. As Mary’s plans for additional expansions in 2024, Finete said club and convenience will come into greater focus.

While Mary’s has a well-established presence in natural natural grocery, Finete said the brand’s customers are much more “broad based” than its distribution has been to-date. Future growth efforts will see the brand innovate with pack sizes that are better suited for expansion into channels like club and convenience.

But beyond the physical world, Mary’s is also deepening its expertise in the e-commerce realm where Finete believes it has an untapped opportunity to connect with new consumers, share the brand’s history and inspiration and educate consumers as the company continues to grow with new products and formats.

“It’s a great channel not only in terms of incremental sales, but also to really communicate and connect with consumers in a more direct way – we’re trying to do much more of that,” Finete said.

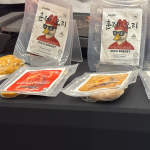

Over the past year, Mary’s has introduced two new product lines – Kookies and Cheezee – more kid-friendly divergence from its previous seedy crackers and cracker thins. With Lindsay on board, the company will continue expanding and scaling up its selection of gluten-free snack offerings. Finete said he sees plenty of room for the brand to disrupt the category with new recyclable packaging formats as well as with products made from a range of novel ingredients.

“We’re very familiar with different tastes, different fruits, different vegetables, different seeds, that are not very common in the U.S. [and] we see opportunities to provide U.S. consumers and international consumers with a lot of new exciting tastes with great nutritional attributes.”