GFI: More Capacity Needed To Grow Fermentation Food Tech

Companies using fermentation technology for food are continuing to grow market share in bringing new plant-based, protein alternatives to consumers but the industry remains hampered by a lack of funding and production capacity to push it into widespread adoption, according to the Good Food Institute’s 2022 State of the Industry: Fermentation .

Innovation by fermentation food companies comes in three ways: traditional, biomass and precision fermentation. The traditional method has been used for thousands of years in cultivating live microorganisms to make bread, cheese, yogurt or beer. Biomass fermentation used by companies like Quorn leverages faster growing and high protein microorganisms to produce large quantities of protein. Precision-based fermentation uses synthetic biology to genetically modify microorganisms to produce specific ingredients like casein, whey or even honey.

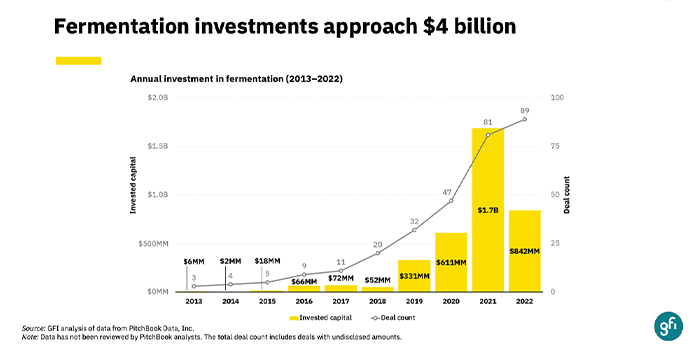

According to the Good Food Institute’s 2022 State of the Industry: Fermentation report there are currently 136 food companies dedicated to fermentation across 30 countries. Investment in the food tech innovation has grown steadily in the past three years, rising from $611 million in 2020 to $1.7 billion in 2021 and contracting to $842 million last year.

The investment decline in the space can be attributed to a challenging funding environment that includes “falling public equity markets, rising interest rates due to high inflation, ongoing impacts in the pandemic, and the invasion of Ukraine,” said Daniel Gertner, GFI’s corporate engagement business analyst, during a Tuesday morning webinar exploring the yearly report. Yet, fermentation-based food companies still account for nearly a third of all funding in alternative proteins during 2022.

There were about 30 total retail precision fermentation products sold in the U.S. last year, about half of which were new to the market in 2022, GFI reported.

Many fermentation food companies have found success working as ingredient providers or licensing technology to food and beverage makers that can showcase fermentation’s potential to bring better texture and taste to animal-free products. GFI counted 21 new strategic partnerships in the space that included major food makers like Unilever, The Bel Group and Nestlé.

Last May, Tomorrow Farms launched its Bored Cow product using Perfect Day’s animal-free whey protein. Perfect Day followed that with two more partnerships: one in June with Mars on CO2COA, an animal-free milk chocolate bar, and another at the end of the year with Nestlé on an alt dairy beverage Cowabunga. However, neither of the latter two products appear to still be in the market. Beyond Perfect Day, functional fermented juice brand Pulp Culture partnered with EVERY in October using the brand’s animal-free proteins in Pulp’s BUILD beverage.

Industry collaboration has extended to the founding of the Fungi Protein Association, the first ever trade body for fermentation enabled proteins which includes brands like Prime Roots, Nature’s Fynd, The Better Meat Co. and My Forest Foods among others. Additionally, at the beginning of 2023, nine companies including Motif Foodworks, New Culture, Perfect Day and EVERY, co-founded the Precision Fermentation Alliance. Both trade groups were established to lobby on behalf of the fermentation industry for fair regulatory policies, consumer research and messaging.

Manufacturing capacity remains one of the “most significant bottlenecks” for fermentation to move into more widespread adoption, said GFI corporate engagement project manager Maille O’Donnell during the webinar.

One reason for that is that many existing precision fermentation facilities are configured for pharmaceutical production which uses smaller equipment than what would be needed for large-scale food production, the GFI report noted.

O’Donnell pointed to recent gains in contract manufacturing with the announcement of two co-manufacturers devoted to precision fermentation technology: U.S.-based Liberation Labs and Switzerland-based Planetary. These large production facilities will help brands launch new products at scale.

Other companies like mycelium meat analog Meati opened its own 100,000 sq. ft. facility in Thornton, Colorado in January which is expected to produce more than 45 million pounds of product a year.

Yet, more capacity is needed and some speakers on GFI’s webinar alluded to the need for the U.S. government to do more by publicly funding the industry to help it scale quicker.

GFI’s report did offer two bright points on the federal government’s role in helping move the industry forward. One was a $5.5 million appropriation for alternative protein research, potentially including fermentation, that was approved in Congress through the USDA’s Agricultural Research Service. The other was the White House’s Executive Order on Advancing Biotechnology and Biomanufacturing Innovation for a Sustainable, Safe and Secure American Bioeconomy that was signed in September, which prioritizes the biotechnology sector to cultivate alternative food sources.