Citing Costs, Rowdy Ending Core Bar Line, Pivoting To Powders

Prebiotic protein bar maker Rowdy has announced it will halt production of its flagship product this year, blaming rising input costs, coupled with the pandemic-induced economic climate, that made the product too costly to manufacture. The brand’s 3-SKU line of grass-fed collagen protein powders will become its focus moving forward, according to founder Kellie Lee.

“Our bars have been the pathway to where we are today,” Lee said in a LinkedIn post. “However, due to the rising costs of what goes into making them, keeping them clean with premium ingredients and staying true to our morals by not adding damaging vegetable oils, natural flavors, or anything artificial has caused us to hit a roadblock.”

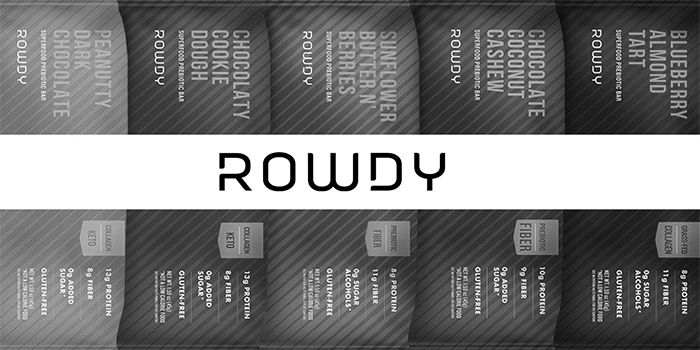

Founded in 2013 by Lee and her sisters Hannah and Lisa, Rowdy began as a line of nutrition bars centered around its hero ingredient, yacon root, and available in five varieties: Chocolaty Cookie Dough, Chocolate Coconut Cashew, Peanutty Dark Chocolate, Blueberry Almond Tart and Sunflower Butter N’ Berries. In 2021, Rowdy underwent a rebrand and formally dropped the word ‘Bars’ from its brand name.

Last year, the company introduced its first extension beyond bars: collagen protein powders, also made with yacon root. The powders are currently available in Snickerdoodle, Vanilla Bean and Chocolate flavors.

In an email to NOSH, Lee explained that the company first discontinued its two most expensive-to-produce bars, Sunflower Butter N’ Berries and Blueberry Almond Tart; however, costs for the remaining varieties as well as prices for packaging, freight and demand for trade spend continued to rise. The family-owned and operated business will keep the same structure, focusing only on reducing external expenses. Lee said Rowdy did not want to pass a price increase onto its customers either.

“We attempted to cut back on our trade spend to lower our distributor chargebacks, however, we were somewhat forced to keep the trade spend in place,” said Lee. “[This] can be devastating to a small brand like us. So, retail somewhat bit us in the booty.”

According to Lee, Rowdy’s co-packer has made its last batch of bars and believes it will deplete its remaining inventory either by or before May 2023. The price of the bars has been reduced from $12.99 to $8.99 per 4-pack. Made with a range of nut butter bases, the bars also feature chicory root fiber, tapioca fiber, whey protein, egg white protein and monk fruit sweetener.

While it is not uncommon for food brands to reformulate products to lower input costs, Rowdy decided discontinuing the bars was the only way to maintain its “morals and mission” for clean label food, Lee wrote.

In August the company expanded distribution of its bars to Market Of Choice stores, which was the first retailer to begin carrying its protein powders. In the same month, it also announced three new promotional partnerships with college and professional athletes.

Over the course of 2021, Rowdy had increased its points of distribution by over 345%, Lee claimed in a LinkedIn post. The bars had garnered national distribution through both UNFI and KeHE’s networks and were available at retailers including Ralph’s, Meijer, Sprouts, Whole Foods, Raley’s, Bristol Farms, as well as a range of independent grocers. Now Rowdy will shift its focus to ramping up distribution both DTC and in retail for its powder line, which are already available at a range of independent retailers.

Looking forward, Lee believes the powder line will allow Rowdy to continue sustainably growing the business as the product can be made in smaller runs so that Rowdy is not forced to sit on surplus inventory. Additionally, the input costs are lower due to a shorter ingredient deck and shipping the product is simpler since it does not require refrigeration during the summer months.

Lee said Rowdy hopes to expand the powder line with both its current whey-based formulation in addition to plant-based varieties. All future Rowdy innovations will continue to focus on gut-health and avoid ingredients like sugar alcohol, natural and artificial flavors, soy and vegetable oils.

“We may [also] bring back our two keto bar flavors, Keto Peanutty Dark Chocolate and Keto Chocolaty Cookie Dough, down the road, but no promises at this point,” she said. “Our goal has always been and will always be to provide honest food or supplement options for people to live their rowdiest lives. We pride ourselves on staying clean and true to our morals. We won’t compromise for profit, we believe too much in creating products that truly benefit and nourish our customers.”

Gut-health attributes have gained traction across numerous food and beverage categories in the past few years and Rowdy was not without company in the gut-friendly bar space. Supergut, formerly Muniq, recently expanded its fiber-focused, protein powder brand into bars. The brand, which also plays in both the nutrition bar and supplement space, has backed its functional claims with evidence from a clinical trial and is also positioned around its clean label focus.