CB Insights: Dollars Invested in Food & Beverage Reach ‘New High’

The last year has caused upheaval to many aspects of the food and beverage industry. But one element that doesn’t seem to be impacted is investing, with business analytics firm CB Insights finding that funding to the sector is on the rise.

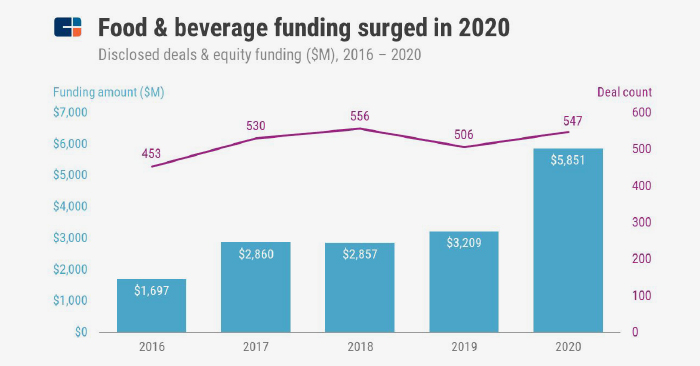

In 2020 food and beverage deals “surged,” the group found, with $5.9 billion in total funding, an increase of 82% from $3.2 billion in 2019. Deal count also rose, albeit not at the same rate, growing 8% from 506 deals in 2019 to 547 deals in 2020. Thomas Sineau, managing analyst at CB Insights, said the uptick in funding overall, and average deal size, is indicative of how the food and beverage sector has gained prominence in the minds of investors.

“We are seeing a lot more of what we call ‘mega deals,’ or larger deals,” he said.“ [This] indicates that it’s a sector that’s maturing and has become attractive for investors to put in a lot of money.”

Largely investors in the space were traditional VC firms, with AF Ventures, SOSV, CAVU Ventures, S2G Ventures and Unovis claiming the most deals between 2016 and 2020. Among corporate venture programs, only Danone’s Manifesto Ventures and General Mill’s 301 Inc made the top 15 investors by unique deals.

Sineau believes there are two reasons for the lack of corporate venture firms in that top 15. First, while large corporations may previously heralded their unique ability to provide strategic assistance, now other venture firms are developed enough that they offer the same assistance.

Second, there is still a lack of consensus, he said, as to whether big corporations are best served by investing in smaller brands, acquiring smaller companies, or simply launching their own products internally. For example, while PepsiCo has set up partnerships with Beyond Meat and Chobani, Nestle has established its own alternative protein platform, built off of its prior acquisition of Sweet Earth Foods.

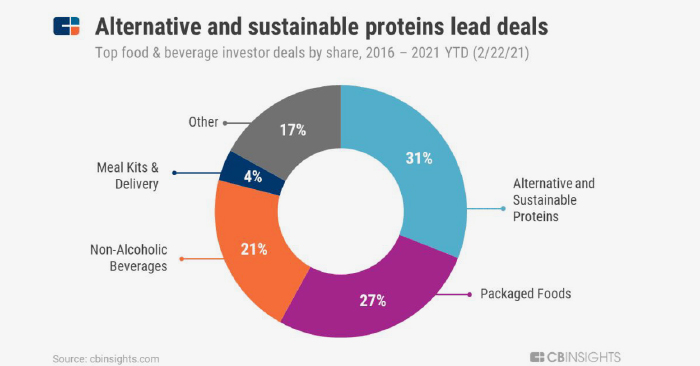

Looking at deal volume from 2016 to 2020, the segments that saw the most investment by CB Insights’ “top” investors included alternative and sustainable proteins (31%), packaged foods (27%), non-alcoholic beverages (21%) and meal kits and delivery (4%).

Deal trends among meal kits and delivery platforms are particularly interesting to observe over the four year window, Sineau said, because the segment has waxed and waned so dramatically. While meal kits were initially incredibly popular, that interest rapidly decreased. Then, during the pandemic, the category saw a resurgence with consumers looking for ways to make meals easier and for new sources of recipe inspiration. He added that CB Insights is particularly interested in observing how the appetite for hybrid meal kit/food delivery platforms, such as Imperfect Foods and HungryRoot, fare over the next few years.

From 2016 to 2020, alternative and sustainable proteins were also of particular interest by top investors, with the subset of alternative proteins taking 56% of deals in 2020 alone. In addition to sheer volume of deals (31%), they also accounted for significant dollars, accounting for 43% of all funding. Sineau thinks while years ago investors may have been unsure as to the size of the opportunity for alternative protein companies, that is no longer the case.

“In the alternative protein space, there has been high in-market valuation, meaning there is demand, it’s proven,” Sineau said. “On one side you do have these companies that kind of pioneered the space raising these huge amounts of money, and behind them you’ve got the new generation of alternative protein startups that are also raising big deals for their stage or for what they have produced [to-date].”

The size of deals in the subsegment is also reflective of what it takes to launch, and then scale, an alternative protein startup. Unlike some other CPG companies, Sineau said, many alternative protein companies have costly manufacturing processes, having to literally invent new ingredients and machinery or build their own factories.

“If [your raise] is only about marketing, you can start with small amounts, figure out if that works and then raise a bit more,” Sineau said. “Whereas with manufacturing you do need to have another few months ahead of you in terms of cash to get there and face any sort of delay in building your plant.”

At this point, Sineau said, the question for investors is now if they should look to alternatives for dairy products, chicken or seafood options, and if cell-based options can see as widespread success as their plant-based brethren. There’s also plenty of ingredient plays as well, he added.

One thing he thinks may change is how consumers evaluate their meat or dairy alternatives, which could lead to greater (or less) interest from investors. Particular interesting, he said, is if consumers begin to ask about the overall health or sustainability benefits, looking for bigger benefits rather than just simply being better than their animal counterparts.

“As with any trend, there’s always the first peak, then interest drops… and then it gets back into a longer term trend. Maybe we haven’t seen that drop yet, maybe we will never see that drop in valuation.” Sineau said. “Long term, this is a trend that is going to stick. But what is going to stick [remains unclear].”