Raaka Seeks Next Phase of Growth

Bean-to-bar chocolate brand Raaka is looking for the right ingredients to reach its next stage. The company, known for single-origin, Fair Trade chocolate bars in unique flavors, this week released its first products beyond bars: a line of baking chocolate, cacao powder and nibs. Looking ahead, the company is hiring a new CEO to lead the charge of growing the brand’s retail footprint.

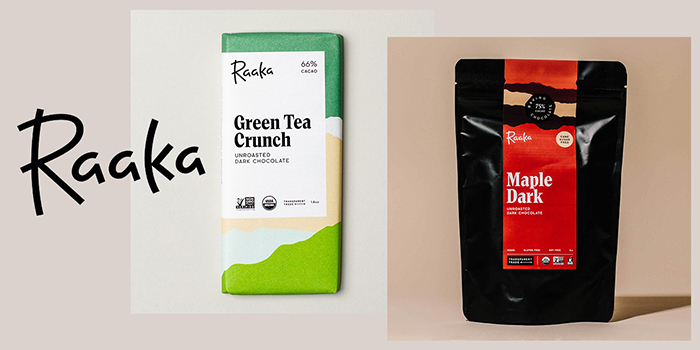

Founded in 2010 and first sold at local farmers markets, the Brooklyn-based brand moved into a 4,000 square-foot factory in Red Hook five years ago. Already production there is “bursting at the seams,” said co-founder and current CEO Ryan Cheney, and the company, which grew 30% year-over-year and expects to generate $3 million in annual sales this year, needs to expand the space. The brand’s bars, which retail for $5.99, are sold in flavors like Green Tea Crunch, Bananas Foster and Oat Milk in about 2,500 stores, including most Whole Foods locations, Big Y and Raley’s as well as specialty shops. Since 2017, it has also sold mini chocolate bars online and in select stores. According to Cheney, the company has always been a “garage operation,” having only received financing from friends and family, most recently a $1 million round in 2019.

As Raaka aims to double its revenue in the next three years, Cheney, whose background is in digital media and computer programming, thinks a CEO with more CPG experience is crucial; once a CEO is hired, Cheney will shift to the role of executive chairman. Co-founder Nate Hodge will remain on as head chocolate maker.

“I’ve learned a whole bunch,” Cheney said. “[But] I also haven’t been at consumer companies that have grown from where we are to where we can go.”

In terms of immediate expansion, the brand is headed into the baking aisle, this week launching baking chocolate disks in Maple Dark and Oat Milk flavors (MSRP of $14 per 8 oz.) as well as cacao powder (MSRP of $10 per 10 oz.) and cacao nibs (MSRP of $10 per 8 oz.) A 100% Cacao baking chocolate will launch next week. To start, the products will be sold on Raaka’s own website, Food52.com and in other independent accounts. Producing the baking chocolate is even more labor intensive than Raaka bars, which already require more labor per item than larger chocolate companies, so the launch will start small, Cheney said.

Though the company had previously considered launching these items, the baking frenzy during the pandemic caused it to “step on the gas,” said Cheney. Like its bars, the baking product is made using unroasted chocolate, which has bright, fruity and citrus tones, he said.

Adding more products to an already stretched facility required more planning, but there was no thought of using a copacker, Cheney said.

Meanwhile, the company hopes its flavor-centric model can move from direct-to-consumer efforts into brick and mortar retail. In 2014 the brand launched First Nibs, a subscription service that sends customers either two new bars for $19.95 per month or three new bars and one existing flavor for $24.95 per month. Beginning October 1, the brand will offer independent retailers one First Nibs flavor per month to add to shelves as a limited time offering.

”We’re looking at how we can be more flexible, adaptable and kind of groundbreaking by offering things in different ways than standard distribution channels,” he said.

Raaka in 2018 rebranded its packaging, with a bolder logo and the bar’s flavor front-and-center, which helped gain traction both in stores and online, Cheney said, as part of efforts to stand out on shelf.

Raaka has also tried to further emphasize its transparent supply chain, an effort other brands have aimed to call out as well, Cheney acknowledged. The bean-to-bar market has grown since the company’s inception, as consumers increasingly care about where their food comes from. Still, most chocolate makers remain small and struggle with accessible pricing, Cheney said. Others have turned to outside financial help to advance their missions: for example, investment firm Verlinvest and venture capital fund JamJar earlier this year took a minority stake in Fair Trade brand Tony’s Chocolonely.

Thanks to the company’s transparent model (it sources directly from farmer coops) there were no major supply chain setbacks during the pandemic, he noted. The company’s website provides information about its farmer partners along with a breakdown of its pricing structure, so customers understand why Raaka’s products command a premium price.

Cheney added that recent months have also seen the company’s e-commerce sales surge as many specialty stores were closed. Though in-store sales are now slightly above last year’s levels, e-commerce remains a major focus, said Cheney, with the brand planning to spend more on online marketing.

“We’re growing both D2C and wholesale sales to retailers,” he said. “We want them to reinforce each other.”