The High Shelf: How CPG Will Play A Part In On-Premise Cannabis

Whether you choose to sip it, snack it or smoke it, consuming weed in any form in a public setting has been illegal – until recently.

Slowly but surely, cannabis-friendly lounges, or social consumption spaces, are coming into existence: Ten out of the 23 states that have already legalized recreational marijuana have also passed consumption lounge laws. Just like bars and alcohol, cannabis companies have unlocked a new, uncharted sales channel with huge potential, one that can actively generate consumer awareness and support cannabis education beyond the dispensary walls. But it also opens an exciting opportunity for non-infused CPG brands to play an integral, complementary role in the on-premise experience as well as the future of product development.

A Brief History of On-site Cannabis Consumption

In chronicling the history of weed lounges, we don’t have to look too far back: the first legal spot in the U.S., appropriately named The Original Cannabis Cafe b/k/a Lowell Cafe, opened in West Hollywood in 2019. But with the cafe “temporarily closed” since the pandemic, two new ventures have popped up to fill the void: Santa Monica Boulevard-based dispensary The Artist Tree opened “The Studio” above its store in April 2022 and Woody Harrelson’s Sunset Strip dispensary, The Woods, annexed some outdoor space behind its store to open the Ganja Giggle Garden late last year.

Yet, like nearly everything in the cannabis industry, the process of opening new lounges appears to take more time than expected. In the Fall of 2019, West Hollywood dished out 16 lounge licenses which were on track to open at some point in the then-near future. A new rooftop lounge on Santa Monica Boulevard is set to open by the end of the year, but otherwise, that pipeline is in need of repacking, and many who received licenses are now struggling to keep just their dispensary doors open. Even other mature markets are far behind: Colorado still requires individual municipalities to vote to opt into on-premise cannabis policies, while Washington does not allow consumption lounges at all.

Chris LaPorte, founder of RESET Vegas & Hospitality, believes the consumption lounges, once open, will eventually look similar to common entertainment venues – ranging from fine dining to concert halls to a Bed & Breakfast. The goal is to avoid narrowing this new type of space to certain existing models, with LaPorte citing both the dark, illicit feel of Amsterdam’s Coffee Shops and the surveillance-heavy vibe of many adult-use dispensaries in the U.S.

“If we want to provide a high-end cheeseburger and fries with a cannabis-infused dipping sauce during the big game, or a tastefully garnished artisan sandwich at happy hour with a bong rip – or close the whole place down and do a fine dining private offering where we use local Las Vegas chefs and traveling cannabis chefs – we will do it,” said LaPorte. “The end goal is to develop the ideal experience, integrate cannabis culture, foodie culture, and really fucking good entertainment… I don’t think that’s too far out of the equation to ask for. It’s time – we deserve those niceties.”

LaPorte’s hospitality business has partnered with Las Vegas-based Thrive Cannabis Marketplace – the largest independently owned cannabis company in Nevada – to get the ball rolling on Sin City legal consumption sites, the first of which is expected to open by the end of the year. He worked closely with regulators as social consumption laws were being drafted and now believes the city is ready to usher in an era of legal and regulated cannabis tourism, in the place where most all other illicit activities go to enjoy a semblance of safe haven.

Originally, Vegas was supposed to begin opening lounges by the end of 2022, but thus far only one has opened its doors – NuWu Cannabis Marketplace, which sits on tribal land and is owned and operated by the Las Vegas Pauite Tribe. Dozens of lounges are under construction but progress has stalled due to hefty build out costs – particularly for the air ventilation systems required for operation.

Walk Into A Bar Weed Lounge And….

All of this space for activities leaves plenty of room for CPG to get in on the fun. According to Sara Stewart, co-founder and CEO of Ritual Hospitality, a cannabis lounge consultancy firm, coffee culture has a strong presence within the lounges she’s worked in and helped set up. For beginners, pairing caffeine and cannabis is likely a recipe for an anxiety attack, she said, but for more experienced guests, it’s common sense.

“We’ve served coffee in almost every single lounge that we’ve built,” said Stewart. “People generally think that coffee culture is only a morning [routine], but for cannabis consumers it’s all day long, and it’s a major revenue driver for the lounges. [For new users] it’s also important to be able to control that experience and if somebody orders something we can give them the awareness that [isn’t a smart choice]. It definitely helps us understand how the normal consumer is going to behave in these environments.”

In addition to the potential for coffee/cannabis CPG crossovers, lounges give non-infused brands a new channel to play in. In the case of the OG Cannabis Cafe, menu items once spanned a THC-infused Impossible Burger to plates of keto Nachos.

Both of the newer WeHo spots have opted against in-house kitchens and instead partner with local restaurants and food delivery services. This has allowed them to circumvent the need for additional food service licensing, but with a whole audience suffering from the munchies, the channel could present unique opportunities for CPG brands spanning virtually every category to find some shelf space as the potential to offer pre-packed foods has not been tested.

The real opportunity, LaPorte and Stewart believe, may lie in some kind of collaboration between the broader cannabis and CPG industries. New food formats, beyond the traditional candies and confections edible brands currently favor, are going to become increasingly important to these spaces. Innovation should also skew toward lower-dose, faster-acting products that are intended to be enjoyed out-of-home for both their taste and effects, said Stewart.

“There’s so much opportunity for brands that have really cool products that maybe aren’t performing in a dispensary the way they’ll perform in a social-use lounge,” said LaPorte. “One of my goals is to develop brand loyalty to these new infused food and beverage concepts, and with the right experience at our venues, there’s going to create demand, and then one day [hopefully] those options can be found on a supermarket shelf.”

Crafting The Consumer Experience

“If you ask the question – ‘what comes first, a bar or a retail liquor store?’ The answer is ‘bar,’” said Stewart.

Through that question she explained that it is up to lounge operators to help craft cannabis experiences that bring new users in to help grow the industry. In simple terms, a consumer who has never sipped a beer likely isn’t going to walk into a store and buy a 6-pack off the shelf. Focusing exclusively on private events for cannabis brands, a wish Stewart said she’s heard from many soon-to-be lounge operators, is not quite viable either, as “the cannabis industry just doesn’t have that much money for these brands to be spending on big buy-outs like that.”

“We’re not really building these places for cannabis consumers,” she explained. “Obviously, they’re our target demographic, to a degree, but we want to build this for the masses and be as normalized as possible. We’re not just attracting cannabis consumers. We’re attracting influencers. We’re attracting foodies, we’re attracting tourists.”

That may mean a change in tactics for brands. Stewart suggested producers look to create bulk-sized beverages for cost-efficient serving in lounges, noting that canning and bottling costs can outweigh profit margins, especially on lower-dose products. She said there are a few cannabis groups working to create a compliant keg-style option specifically for lounges, but that is still in the works.

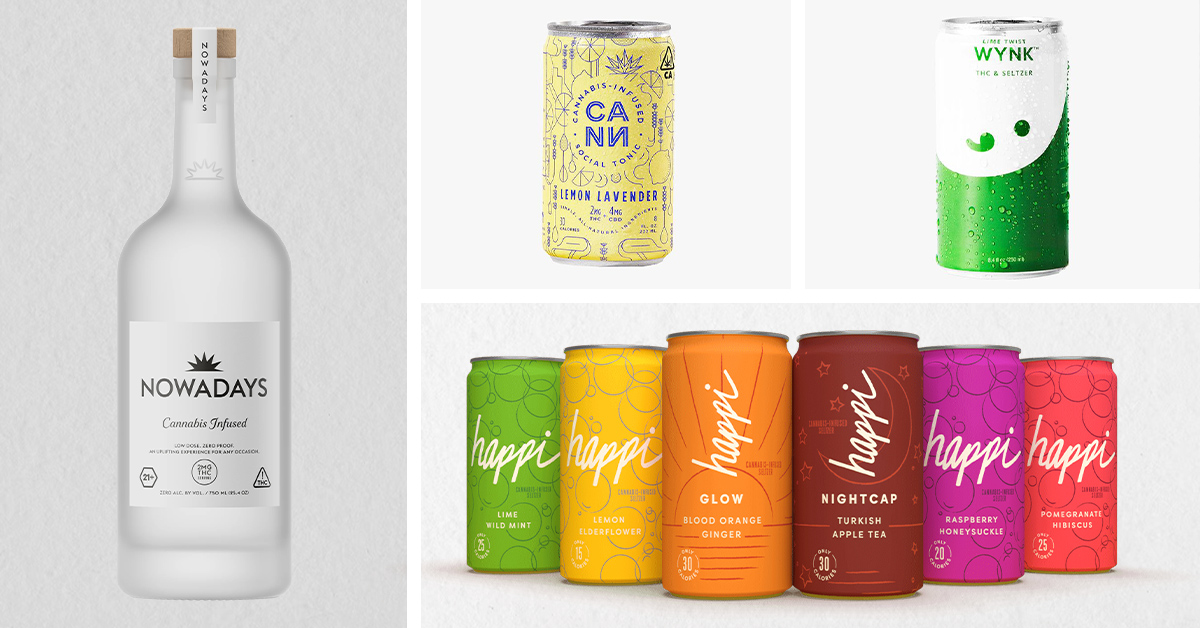

Naturally, there will be winners and losers. Cannabis beverages, many of which have a quick 10 to 15 minute onset, are positioned to perform well in these venues. The development of nano-cannabinoid technology in beverages – as touted by suppliers like SORSE and Vertosa – has allowed drinks specifically to become faster-acting and to flex into new formats.

Guests will also be seeking sustenance. But according to Stewart, the commonsense answer – edibles – are actually less-than-ideal for lounges and are never allowed on the menu in the venues she sets up.

“It’s not a regulation, it is a company policy for us,” said Stewart. “I worked in a consumption lounge in West Hollywood that served edibles and we saw about eight to ten [people] pass out a week due to overconsumption. It’s really just not worth it because edibles hit your bloodstream so much differently than other products do. With beverages being low-dose and fast-acting we feel there is a little bit more control over the situation.”

Prohibiting edibles is also a matter of protecting profits. “If you think about eating one [5 mg] edible – it doesn’t really feel like an experience, and how many of those edibles can you really take?” she asked. “Whereas for beverages you have to order two or three of them to feel the effects of it and we’re getting your average spend up from what might have been $10 to look more like $20 to $25.”

Cannabis Consumers Will Come, But Who’s Next?

The wait may feel interminable, but more states are expected to begin opening up lounges, and the industry has its eye particularly focused on the Northeast. In New Jersey, the city of Hoboken was the first, and so far the only, municipality to opt into the state’s social consumption lounge law. In New York, where recreational cannabis use was legalized in 2021, the state has taken a different approach – initially granting all adult-use dispensary license holders the ability to also open a social consumption space. So far, only 20 dispensaries and no lounges have opened.

On a macro level, the Northeast region has the most states that have legalized adult-use cannabis, though it is often associated with having stricter regulations at the retail level. An on-premise pilot program in Massachusetts was canceled earlier this year, leaving the state with just a single space where people can legally consume cannabis in public: Summit Lounge in Worcester. Unlike the West Coast lounges that require in-house purchasing and no outside product, Summit patrons must bring their own bud. Stewart and LaPorte worry that strict regulatory environments like this could tamp down its potential for the industry.

“A lot of the lounges that currently exist are very masculine and really only catered to “super stoners,” said Stewart. “You can see that because most lounges that are built, you have to go through a dispensary to get to the lounge. That right there deters half of the population because it’s not a normalized experience… going into a dispensary [may seem] taboo for some people.”

Though more mature than most markets in the Northeast, Nevada’s cannabis industry sales have begun to decelerate compared to the emerging industries in Massachusetts, New Jersey and Pennsylvania. But when it comes to lounges, the Sin City state is positioned to set an important example by allowing operators the choice between two types of licenses – including one that allows for lounges that are not attached to, or associated with, a retail dispensary.

“These lounges, they’ll be a learning experience for the operators and the regulators alike,” concluded LaPorte. “While my end goal is to operate no different than a restaurant, or perhaps a corner pub or a fast casual dining experience, I’m excited because the opportunity for the cannabis industry at large is what we discovered during these first few months [of working with the regulators].”