What’s Driving Consumer Interest In Better-For-You Snacks

Consumers looking for better-for-you products traditionally stay far from the high fat, sugar- and salt-filled foods that fill the snacks and sweets categories. Yet, as functionality and wellness continue to make up an increasingly larger role in eating trends, the grocery store aisles lined with candy, chips, and other in-between meal munchies are putting better-for-you on the front of the label.

In a webinar hosted by The Sweets and Snacks Expo, Mintel food and drink director of insights Marcia Mogelonsky explained that as consumers are reaching more for the snack bag during the day they are looking for healthier options to satisfy the craving for salty or sweet.

Better-for-you is a common term that “doesn’t come with rules,” as Mogelonsky put it. “Let’s face it, few consumers snack to eat healthier.”

In fact, only about 30% of consumers snack to eat healthier whereas 69% snack because they’re hungry, according to Mintel’s findings.

The question is how to define and market a better-for-you product? The attributes differ depending on the consumer. Some are looking for low- to no-sugar or salt whereas others are trying to reduce their fat intake or only consume plant-based products. Many consumers have adopted keto or paleo diets that focus on high protein, low carbohydrate foods.

The main driver behind sweet and salty snack purchases is familiar flavor. Functional attributes like added vitamins, added protein or organic labeling lag behind, according to Mintel’s data.

How do snack food makers appeal to a better-for-you shopper?

Thirty-four percent of consumers want to see a mix of indulgence with the health benefits on salty snacks, said Mogelonsky. She points to products that boast heart health, probiotics, or other better-for-you attributes on package labels.

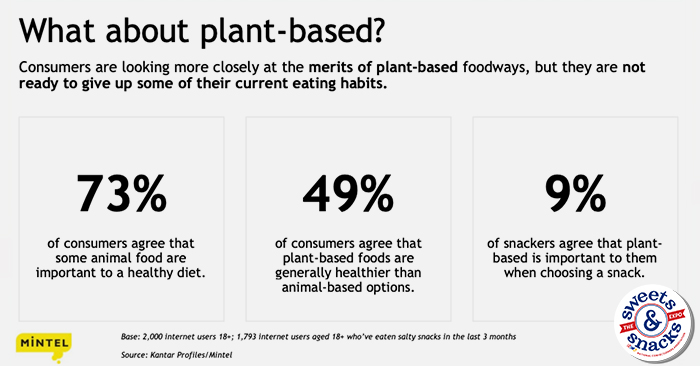

Another food trend that remains to be seen is if the plant-based movement is gaining traction in the sweets category.

The market for plant-based food grew 6% in 2021 to $7.4 billion, with 62% of U.S. households buying plant-based products, according to SPINS data provided to the Plant-Based Foods Association. But the penetration of these products into the salty and sweet snack category is still minimal.

Mintel found that “only 6% of chocolate eaters consider ‘non dairy or vegan’ to be a major purchase driver when choosing a chocolate product and only 5% of sugar confectionery eaters feel the same way about candy.” And only 9% of snackers agree that plant-based is a driving force for trial.

“It’s a very mixed up, confused place to play,” Mogelonsky admitted. “It’s hard to know what to do.”

There has been some gains in animal-based protein being replaced by plant-based proteins in snacks but the adoption of plant-based dairy in milk chocolate has seen much slower growth, Mogelonsky said.

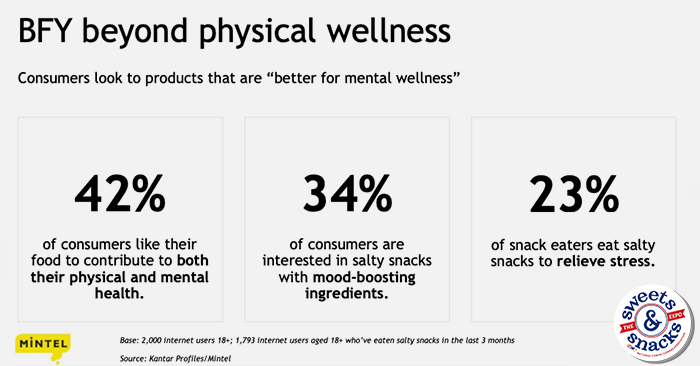

What is driving better-for-you snacks and sweets are products that are not solely focused on physical health but on mental wellness. During the pandemic, the focus of more healthy eating revolved around immune health, but better-for-you foods that boost mental health have become a driving force in the market.

That makes it confusing: foods that offer benefits like stress-reduction or relaxation bleed into the indulgence aspect that many consumers find in sweets and snacks, Mogelonsky noted. Sweets and snacks that claim to boost consumers’ focus or mood are also a growing segment in the candy and sweets categories.

One thing to keep an eye on is how better-for-you snacks and sweets might change as trends that developed during and as a result of the pandemic begin to wind down. Mogelonsky suspects that sustainability will become more of a driving force in the snacks and sweets categories but will be impacted by inflationary pressures. Balancing staying healthy while staying healthy financially could become a big issue.

“People are going to be choosing better-for-you products that cost more in one category while tapering down in another category,” she said. “This is where we’re going to see the trading and it’s going to get very interesting to see who’s going to give up what, when everything gets so expensive.”