Supply Disruptions Force Companies To Rethink Innovation, Ingredient Management

CPG brands are broadly split on whether the ongoing supply chain disruptions have fueled or hindered innovation, according to a new report by supplier management company TraceGains.

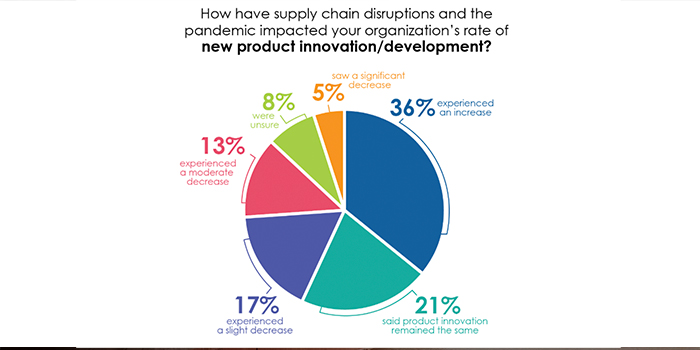

Around 35% of companies reported that they experienced a slight, moderate or significant decrease in product innovation since June 2020, while 36% said market conditions have led to an increase in innovation as brands have had to get creative with their formulations in order to navigate current and potential disruptions. Meanwhile, 21% of companies surveyed said their innovation has remained the same in the period and 8% were unsure.

The survey, conducted in June, polled more than 300 food, beverage and supplements operations and new product development professionals about the impact supply chain disruptions have had on their businesses. Of those surveyed, around 28% worked for large companies (over $500 million in annual revenue), 38% represented medium sized companies ($50-$500 million) and 34% were from small companies (under $50 million).

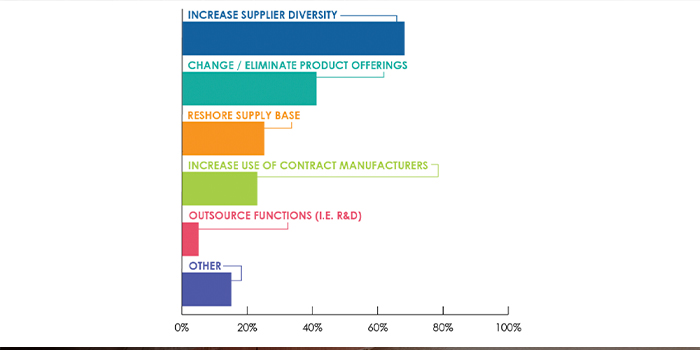

Speaking to BevNET, Gary Iles, SVP of marketing and business development for TraceGains, suggested there is a “paradigm shift” in how companies approach their supply networks that will likely lead to changes that last far beyond the current crisis. While most companies used to typically work with one primary ingredient supplier and maintain one or two alternate options on hand, brands are now diversifying their supplier network, many now working with 10 or more to prevent disruptions.

“Companies are starting to look at ingredients as a portfolio, and that portfolio spans not just sourcing, but where it’s being sourced from,” he said. “[It includes] alternate products that can fit into your formulation neatly, anticipating where supply chain disruption could come from and having multiple feeds even to the extent where they’re trying to manage their cost structure by having that portfolio approach versus just trying to find a low cost vendor, because that doesn’t work anymore.”

However, in addition to forcing brands to manage a wider breadth of supply partners, the uncertainty in procurement is also impacting companies from a label and messaging side, he added. Companies that have needed to reformulate products with alternate ingredients or sourcing non-Fair Trade crops, need to update ingredient listings, drop certifications or roll back certain health claims in order to remain compliant.

Since June 2020, a majority of survey respondents said they’ve had to reformulate products due to procurement issues. A plurality (37%) said they have reformulated 20 or more SKUs, while 12% have redone 11-20 different products, 13% reformulated 6-10, and 22% reported 5 or fewer.

As well, 49% of respondents said they have halted production of certain items in the same period and 47% were unable to produce enough product to meet consumer demand at some point.

“We kind of say ‘reformulation is the new product development,’ because companies were trying to prune unsuccessful products or marginally successful products to focus on the [core] products for their brands to get those and keep those on the shelf through the course of the pandemic, and even to date,” Iles said.

Iles was clear however that “new product development isn’t dead,” but is evolving. Many larger companies are increasingly moving away from internal R&D and towards startups they can either partner with or acquire. Smaller companies, meanwhile, are trying to tailor innovation around availability of ingredients.

Inflation is also taking its toll on brands – 90% of respondents said they’ve paid more for certain ingredients or materials over the past two years and 62% have paid more for labor. With costs rising, 65% said they have increased their prices.

While inflation has placed significant pressure on CPG companies, only 17% said cost of materials was the chief concern for their business, compared to 58% who still listed supply chain disruption as the top challenge. Additionally, 11% cited difficulty forecasting, 7% said cost of labor and 6% suggested change in consumer demand as their primary hurdles.

Geopolitical issues are also weighing companies and creating shockwave effects around the world, Iles said. The war in Ukraine has made sunflower oil more scarce, and Indonesia,a leading supplier for palm oil, has limited exports due to the surge in demand.

Issues of nationalism and climate change are also further complicating matters, he noted. Concern over the relationship between China and western nations could potentially impact the ability to source apple juice concentrate and other key ingredients, while extreme weather events are leading to crop failures in previously reliable regions, such as Florida’s orange supply.

But the new paradigm is also making companies more nimble and quick to adapt; in particular, new technology such as A.I. is helping brands identify potential sources for raw materials.

“The upshot … is that we see a lot of exploratory actions being taken by companies to solve supply chain issues in a variety of different ways,” Iles said. “Local sourcing, regional sourcing, new partners, portfolios, managing cost structure through portfolios and different vehicles, having ready contracts with alternate providers looking for substitute ingredients – both short and long term to keep products on shelves.”