Coefficient Capital: Economic COVID is Over, But Inflation Plagues Market

As concerns about the economy worry consumers and investors alike, consumer brand investment firm Coefficient Capital and analyst firm The New Consumer have released a mid-year 2022 Consumer Trends report, based on four surveys of more than 3,000 U.S. consumers.

Heading into the back half of the year, the report found that a return to pre-pandemic behaviors is being impacted by rising inflation, while younger consumers are fueling trends like plant-based meats and sustainable goods. Here are some of the key takeaways.

“Economic COVID” is Over, But Inflation Plagues Consumers

Although the pandemic is far from over, consumers are by and large acting like it is. As of June 2022, consumer mobility was down just -7% from the pre-pandemic baseline, reflecting significant recovery from 2020, while spending has normalized in CPG sectors considered to be “COVID categories,” such as home furnishings (up nearly 125% in spring 2020 and still elevated today) and luggage and bags (down over 75% during the beginning of the pandemic and now up 25% from the Q1 2020 baseline).

Meanwhile, restaurant dining is “effectively back to normal” in the U.S. Despite an approximate 25% slide during the Omicron wave this past winter, data from OpenTable showed on-premise dining was down only -2% from the baseline in June. The travel channel has also surged, with air travel recovered around 90% to 2019 levels.

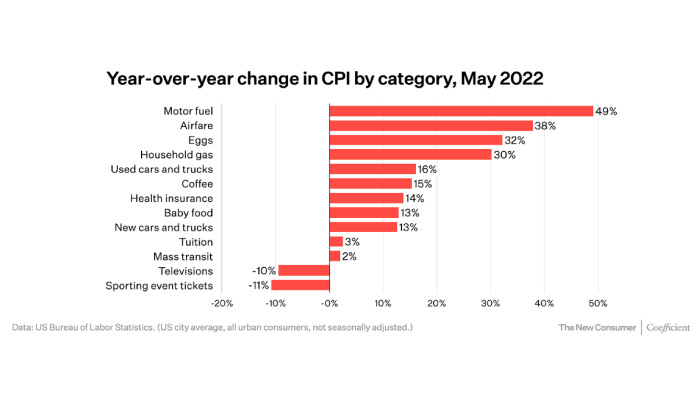

But even as consumers are returning to old routines, inflation is set to disrupt any sense of normalcy. The U.S. Consumer Price Index was up 8.6% in May 2022, compared to a 2% average increase throughout the 2010s. A plurality of consumers – 49% – cited rising prices and inflation as the most important problem facing the country today, while only 22% cited the pandemic, ranking behind poor government leadership (25%) and violent crime (24%). About 72% of survey respondents said prices have increased “a lot” over the past six months, up from 58% in November.

Inflation is also hitting various categories in different ways. Within the food and beverage sector, eggs (+32%), coffee (+15%) and baby food (+13%) are among the most impacted.

The uncertain economic environment is now promising “Weird Times Ahead,” as one subhed in the report stated. Most consumers now believe a recession is likely to happen within the next year, with 40% saying it is very likely and 36% saying it is likely. Only 7% of respondents believed a recession was somewhat or very unlikely. This perception is being accompanied by a sharp rise in media reports on a likely recession, despite continued spending activity.

Ecommerce Growth Settles

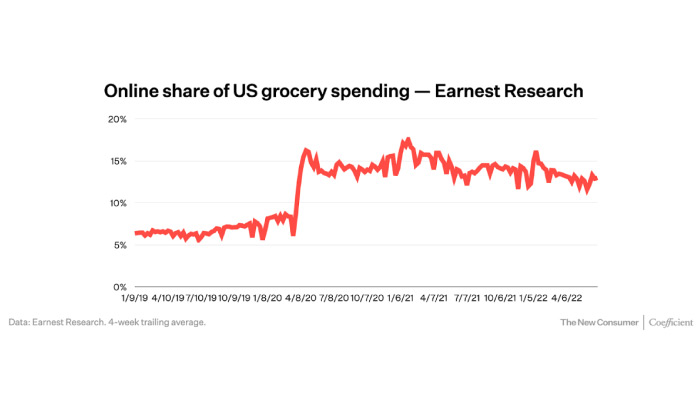

After record spikes in 2020, ecommerce growth for grocery purchases has slowed as consumers return to in person shopping, albeit online sales are still elevated as about 40% of grocery shoppers said they switched buying online more often due to the pandemic.

Among those shoppers, only 74% said they’re still using ecommerce more often than brick-and-mortar stores compared to pre-pandemic, down from 85% in November. The number of shoppers who say they prefer online grocery shopping is also lower – 55% as of June compared to 61% in July 2021 and 60% in November.

But ecommerce is still poised to play a major role in food and beverage sales in the future, as a majority of millennials (64%) and Gen Zers (57%) report that they plan to do 50% or more of their grocery shopping online over the next 12 months, compared to lower amounts for Gen X (42%) and baby boomers (24%, an increase from 16% in July 2021).

New 15-minute delivery platforms like Fridge No More, JOKR and Gorillas provide even more options for consumers and more competition for platforms like GoPuff and Thrive Market.

Plant-Based and Sustainability Are Still Important

Although plant-based meat sales are experiencing a near-term plateau, the trend still has momentum behind it as younger consumers continue to seek out alternatives.

Millennials are leading the charge here, as 48% said they plan to eat more plant-based foods over the next 12 months, compared to only 36% who said they do not. Comparatively, 41% of Gen Zers said they would eat more plant-based foods, and an equal amount said they would not. Among older consumers, 30% of Gen Xers and 16% of boomers are looking for plant-based items versus 50% and 62% respectively who said ‘no.’

There may be a class element to the trend as well: the higher a consumer’s income bracket the more likely they are to be embracing plant-based foods. Just 23% of respondents who make under $25,000 a year are avoiding meat and animal products compared to 55% of consumers who make over $150,000 a year.

But the reason consumers are eating their veggies is not exactly great news brands like Beyond Meat and Impossible Foods. Only 11% of consumers going plant-based found alternatives that mimic the taste and texture of meat to be “most appealing” while 51% prefer vegetables in their original form and 29% prefer classic veggie burgers. Just 9% prefer meat alternatives like tofu or tempeh in their original form.

Still, most say they’re “at least somewhat interested” in plant-based: 77% of millennials, 74% of Gen Zers, 57% of Gen Xers and 34% of boomers are open to trying meat or dairy alternatives. Health (62%) is the top driver of interest, global food supply (48%), environment (44%), taste (44%) and animal welfare (38%) ranked lower. Younger shoppers – 78% of Gen Z and 77% of millennials – said they are more likely to switch to plant-based to save money, presuming the alternatives were cheaper than animal products.

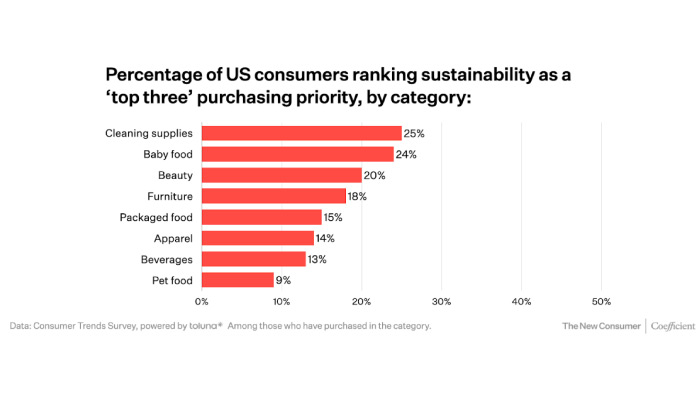

Meanwhile, while sustainability is not the key factor driving consumer behavior, it is increasingly an important part of decision making – 64% of millennials and 58% of Gen Zers said they prioritize environmental sustainability when making purchasing decisions, compared to 44% of Gen Xers and 34% of boomers.

And a potential recession is not going to change things much – among sustainability loyalists, a 36% plurality said they will make environmentally friendly purchases a “much bigger priority” during an economic downturn and 27% said it would be a “slightly bigger priority.” Only 13% said they would de-prioritize sustainability in hard times.