With Renewed Focus on Ingredients, ReGrained Turns Away from Branded Items

Since its launch almost a decade ago, ReGrained has struggled to find a solution that can make a dent in the billions of pounds of spent grain left over from the beer brewing process. For years, that has meant attempting to reduce this food waste, both through its own CPG product lines and as an ingredient supplier.

But after seeing mixed results from its bifurcated business model, ReGrained is pivoting away from “resource intensive” CPG products in favor of focusing on ingredients. Earlier this summer, the company announced the launch of an “Upcycled Food Lab ” designed to help it collaborate with brands on innovations that feature its SuperGrain+ ingredient.

Launched in 2012, ReGrained first began as a side project for co-founder and CEO Daniel Kurzock when he started using spent grain to make bread. That process was labor intensive, and perishable, so in 2016 the company launched what it believed would be a more scalable product — snack bars, sold in over 1,000 retailers. The company went through several branding iterations over this time, finding packaging was just as important as product, and in 2018 secured funding from global ingredient developer and manufacturer Griffith Foods, along with pasta maker Barilla’s BLUE1877 venture group and Telluric Foods.

All of the company’s products use a base of what it calls SuperGrain+, an upcycled, nutrient-dense “superfood” made from brewer’s spent grains (which are desugared sprouted ancient grains). The company uses a patented process to turn this spent grain, sourced from a number of brewers in the California area, into a functional high fiber ingredient which is milled into a powder and acts as a flour in several different food applications.

Following the completion of its Berkeley, California production facility, where it manufactures SuperGrain+, the company announced its latest rebrand with a new logo and packaging ahead of the launch of its savory puff line in 2020. The puff line was distributed online through Thrive Market, REI.com, SnackMagic, Imperfect Foods as well as in retailers such as Fred Meyer and Raley’s.

But according to Kurzrock, after several years the company found that operating a food brand is “a very intense” business that ultimately diverted its attention away from where he believes it can make the largest impact: working with other brands.

While acting as an ingredient provider was always part of ReGrained’s business model, Kurzrock said he initially found that other companies wanted to see a proof of concept for products that could be made with SuperGrain+ and that there was consumer awareness around the concept. Still, while the branded product lines were intended to be a “marketing tool,” there also was hope that the CPG products could generate a second revenue stream to support its ingredient business, though this idea “didn’t exactly pan out,” Kurzrock said.

In December 2020, the company raised roughly $744,000 from investors on equity crowdfunding platform WeFunder, noting that the CPG side of the business would generate $1 million in revenue that year. The company also secured $1.5 million in funding from MolsonCoors TAP Ventures and Japanese online grocer Oisix last year to support the expansion of its ingredient business. Still, combined with financial impacts from the Covid-19 pandemic, that wasn’t enough to sustain the CPG business, nor was it offering a way to attack the problem of food waste on a larger scale.

“What we’ve learned is that it’s very difficult to do both of those things well,” Kurzrock said. “You’ve got to focus where you’re going to have the biggest impact and for us that’s on the ingredient side of the business.”

With that in mind, ReGrained is realigning its product portfolio: the bars were discontinued last year, while the puffs line is also set to be discontinued over the next few months (Kurzrock said the company may still produce small runs of that product and other CPG items to demonstrate product applications in the future). The company is also currently working with other snack companies on similar puff applications.

As part of this new focus, the company has given its food innovation platform a new identity — the Upcycled Food Lab — which will provide support for brands both as a development partner and ingredient supplier of upcycled food products. The company, Kurzock said, will take a three-pronged strategy for its ingredient business: developing co-branded products using SuperGrain+, selling SuperGrain+ to ingredient companies that supply the bakery industry and working with co-manufacturers to produce private label products.

“Our business is most focused on B2B and on ingredient partnerships, and the Food Lab is designed to give some structure to how we support those partners to ultimately create products that are leveraging the power of upcycled foods,” he said.

As an ingredient supplier, the company will face competition from companies like Anheuser Busch InBev-backed EverGrain, which turns spent grain into protein and fiber-rich barley ingredients for use in CPG products like protein bars and plant-based milks.

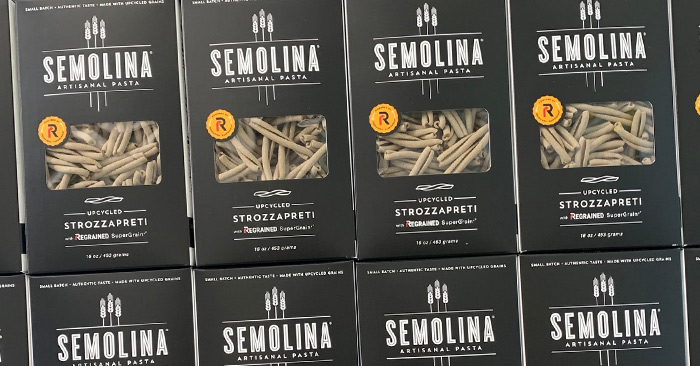

So far, that approach has allowed ReGrained to cast a wide net in search of collaborators. The company most recently partnered with artisanal pasta maker Semolina, using SuperGrain+ to create a pasta called Strozzapreti, which will be available for retail and in foodservice by October. ReGrained also worked with cookie dough brand Doughp in May to launch a “Beast Mode Brownie” flavor using its ingredient.

With 20 billion pounds of spent grain currently available in the U.S., the possibilities for ReGrained to introduce new upcycled ingredients are still largely untapped, Kurzrock noted, as current capacity for SuperGrain+ production is 10 to 20 million pounds per year. Forming partnerships with larger CPG companies, along with the Upcycled Food Certification launched in June, will also hopefully drive more demand, he said.

“The opportunity that we’ve been primarily targeting commercially with the brewers grain is still massive,” he said. “From an R&D perspective, there’s just so much still to be done. We’re continuing to go deep with what we’re doing with the brewers grain and helping it realize its full potential.”