RBC Capital: Consumers Seek Cooking, Immunity and Cost Cutting

Food brands should expect to see “structurally higher” growth heading into 2021, according to two recent webinars hosted by banking firm RBC Capital Markets.

In a webinar last week, RBC analyst Nik Modi shared insights on recent food trends, noting that as more consumers cook meals at home, a mere 5% consumption shift to in-home would mean a 3.4% lift in retail. This amounts to an added $135 per person — or $44 billion — flowing into the market annually, he noted.

Modi explained that societal, economic and educational factors have already impacted consumer behavior. Before the pandemic, Modi said, a survey by research firm Euromonitor International found that almost half of consumers globally reported a lack of knowledge or confidence — or a plain dislike — of cooking, instead preferring ready-to-eat meals. But during the pandemic, many have discovered cooking or started cooking again, he said, learning to do so through videos on YouTube and other social media channels. During the last recession, on the other hand, YouTube was only about three years old and had a 10-minute time limit for videos, making longer form content impossible. There’s now much more opportunity for consumers to educate themselves, and moving forward, many will likely stick with these habits.

Modi also reviewed how technological advances have changed consumer behavior around food in the past and how that looks now. For example, he said, during the 1940s, food shortages left consumers with more varied baskets, and the advent of cars helped them easily transport more items home. This, in turn, increased the size of the average shopping trip.

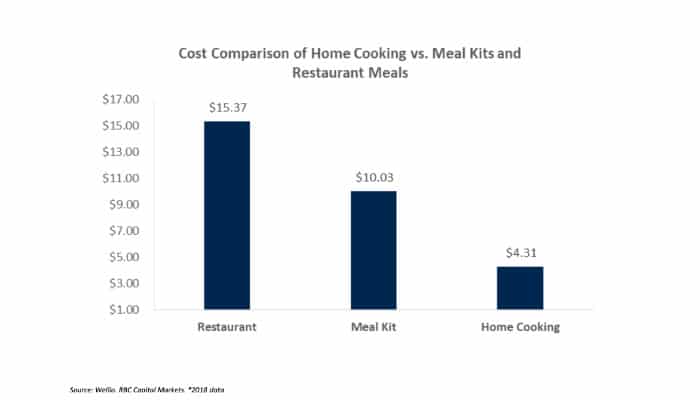

Similarly, during the pandemic many consumers have stopped commuting, which has allowed more time for eating breakfast at home. Consumers are finding, he said, that meals at home, including breakfast, are much more affordable, costing an average of $4.31 each compared to $15.37 on average for a restaurant meal. The uptick in food at home is expected to continue despite foodservice reopenings: a recent poll by analytics firm Harris found that 86% of consumers will wait up to a year before returning to restaurants.

How consumers buy is also changing. Modi said that as of March 55% of consumers reported purchasing groceries online. Although research has found that once a shopper purchases online they’ll continue to do so, consumers will increasingly seek value as the U.S. enters a recessionary period.

As consumers’ wallets were stretched during the 2008 recession, fresh and frozen foods performed best, Modi noted. At the same time, consumer interest in healthful, immunity-boosting ingredients for meals, especially at lunchtime, is growing, Modi said. As that happens, soup and frozen vegetables are likely to be high-growth categories, benefitting companies like Campbells and Conagra, but there’s plenty of opportunity for brands of all sizes to offer better-for-you options, Modi said.

Kobi Gershoni, co-founder and chief research officer of market intelligence firm Signal Analytics, added that the pandemic has accelerated the interest in boosting immunity and fighting stress and anxiety through food. Now, consumers are more concerned with functional criteria in everyday products rather than just ‘natural’ or ‘organic,’ he said, and the trend applies across the CPG landscape.

“It almost touches every CPG product in the way they’re experiencing that effect,” he said.

As consumers seek to eat healthfully and save money by cooking, they’re also looking toward more affordable products. In a second RBC webinar, Modi explained that during the last recession low and middle-income households bought more private label goods, which outpaced food and beverage brands in dollar sales. Currently, private label products represent 16% of all CPG sales, Modi said, citing IRI research.

Another way to save money is to plan ahead. In 2009, consumers avoided impulse buys and made 83% of purchase decisions before reaching the store, IRI found. Citing this data, Modi noted that today’s situation is much different as e-commerce use has surged — a move that should particularly help big brands.

“Big brands are overrepresented on most e-comm portals and tend to have more market share of eyeballs than [in] a physical brick and mortar environment,” Modi said.

However, Mary Mathes, market intel director at research firm Thriveplan noted on the webinar that price is not the only consideration in today’s shopper culture. There’s an emotional and physical element to shopping right now, she noted: consumers want to know products are safe and that they won’t be disappointed. Additionally, some may worry about what others think of their purchase decisions during a recession. Time, she said, is also crucial in this “mission-driven purchase environment” — shoppers want to get in and out of stores quickly.

But it’s not all stressful: Mathes noted that consumers will likely seek “affordable luxuries” like premium ice cream and snacks to bring some enjoyment into their lives.

“There is a role for premium brands to continue to play and position as a justifiable reason to indulge,” she said.