Mars Acquires KIND

Roughly three years after it invested in the upstart brand, snack company Mars Incorporated announced today that it had acquired KIND Snacks. Terms of the deal were not disclosed but sources told The New York Times that the agreement valued KIND at roughly $5 billion.

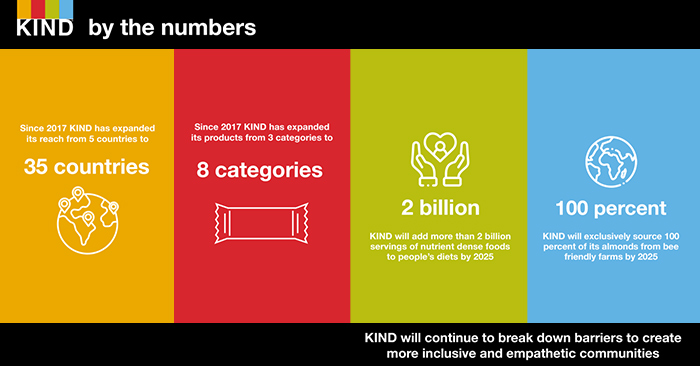

According to a release, Mars acquired KIND North America, which now has “joined” KIND International to form one organization operating across 35 countries. The move comes almost exactly three years after Mars placed a minority investment in KIND, a deal which gave Mars the rights to “lead the growth of the business” outside of the US and Canada. At that time, The New York Times reported that deal put a $4 billion valuation.

KIND founder and executive chairman Daniel Lubetzky will play a “key role” in the future development of the company, which will operate as a “distinct and separate business” within Mars, according to the release. Lubetzky will maintain a financial stake in KIND; however, the majority of his shares were already previously donated to charity. Over the past years Lubetzky has built his own presence outside the food business, joining TV show Shark Tank as a guest judge and becoming an outspoken advocate for racial and social justice equality. The deal, he said, will set KIND up to continue his legacy.

“We are now well positioned to further advance our efforts and continue building a foremost health and wellness platform,” Lubetzky said in a release. “As we said in 2017, Mars is a company that shares KIND’s passion for business as a force for good, and I am confident that together, we will be able to make our small contribution to make this world a little kinder.”

Prior to the Mars investment, KIND had a mixed relationship with fundraising partners; VMG Partners invested in the brand in 2008, but eventually sold its shares back to the snack company in 2014, a transaction that reportedly valued the company at $728.5 million.

Since announcing its partnership with Mars, KIND has rapidly grown its product portfolio — expanding into the freezer set (with frozen bars and bowls), confection (KIND Bark), functional foods (KIND Energy bars), and breakfast (KIND oatmeal and cereals). The company also made its first acquisition last year, picking up Creative Snacks Co, a producer of nut clusters, trail mixes, granolas, and pretzels. Mars meanwhile expanded the brand into countries including China, Germany and France.

Lubetzky told The New York Times that KIND’s annual sales have reached $1.5 billion in 2020.

As the company has transitioned from a fruit and nut bar brand to a healthy snacking platform, CEO Mike Barkley told NOSH earlier this year that its new products will always lead with a “nutrient-dense food recommended for daily consumption.”

In a LinkedIn post last year, Lubetzky added that KIND would only launch products that would “meaningfully elevate the consumer experience,” rather than me-too products. To hone its innovation, KIND has also adopted a new distribution strategy, launching new category entries in test markets before national rollouts, doing so with its frozen and bark products (both developed in partnership with Mars) last year before going national earlier this year.

The company has been mission oriented from the start, distilling it into the “KIND Promise”: a pact, that among other tenets, the company will make sure that the first and predominant ingredients in its products are a “nutrient-dense food,” such as nuts or oats. The company has also pledged to never use artificial sweeteners or sugar alcohols and to use “as little sugar as possible while achieving great taste.”

However, for some, the promise has rung hollow, with accusations that KIND has watered down its commitment to healthy foods, for example, launching confection items, and that its investment from Mars supported the very brands it sought to disrupt.

KIND has recently had a run-in with fellow natural brand Clif. After Clif ran a full-page ad in The New York Times last year challenging KIND to switch to organic ingredients in its products, KIND called out the brand for its use of organic brown rice syrup and launched a “Sweeteners Uncovered” initiative, specifically pointing out Clif Bars’ 31 percent sugar content. KIND renewed this rivalry last month in a TV spot supporting the launch of its new energy bar line, which the brand said contains 35% less sugar than Clif bars and also counts oats, rather than sugar or other sweeteners, as its leading ingredient.

KIND has also taken on the Food and Drug Administration (FDA) in recent years, lobbying against what it believes are outdated regulations around its core marketing terms. In 2015 KIND refused to comply with a warning letter from the FDA stating the brand needed to remove the term “healthy” from its labels due to its bars high total and saturated fat content. Ultimately, in 2016, the FDA reversed course, allowing KIND to continue.

Last year, the company filed a Citizen Petition pushing for label transparency, urging the FDA to address “misleading nutrient content claims,” and advocating for disclosure levels of nutritional content such as added sugar and trans fat.

KIND has also undergone leadership changes over the last several years, moves which may have helped prepare the company for an eventual sale and integration. Mike Barkley joined the company as President and COO in 2018, then later assumed the role of CEO, replacing Lubetzky, in summer 2019. Barkley had robust experience working with and for strategics, holding VP/general manager roles at The Campbell Soup Company and Johnson and Johnson, as well as serving as president of Boulder Brands following its acquisition by Pinnacle Foods.

Over the summer of 2019 the company also brought on Dan Poland, also formerly of Pinnacle Foods, as COO, along with Doug Behrens, formerly the president of Amplify Snack Brands, as president and chief customer officer. After announcing his new role, Behrens was the subject of a lawsuit by Hershey’s, Amplify’s parent company, which alleged he stole trade secrets from the company to benefit KIND. Those claims were eventually dropped.

Now with new owners, a wider portfolio and established core leadership, it seems KIND is ready to play on a global scale. The deal will give the brand access to distribution, sales and marketing efforts that will allow it to compete directly with larger brands, some of which, such as Annie’s and RxBar, represent other emerging companies previously acquired by major players.

Mars, meanwhile, gains a foothold into what could become an anchor brand for the company. Though it has other food brands, they largely are regional players, such as Seeds of Change, Tasty Bite, Miracoli and RÁRIS. It’s largely the company’s confection brands, such as M&M’s and Snickers, under the Mars Wrigley division that have been able to see more global adoption.

“After three years, you can see the impact, as together we have grown the healthy snacking category and brought KIND and the KIND Promise to 35 countries and into new categories,” Grant F. Reid, CEO of Mars, said about the potential for growth. “We’re delighted to continue to build on this success and welcome KIND North America into the Mars Family of Companies.”