Chobani Unveils Yogurt, Oat Milk Innovations in Wave of Product Launches

Building out their stake in rising consumer trends like gut health and plant-based diets, Chobani this month is releasing a broad slate of new products, including the Chobani Probiotics line of yogurts and drinks, and flavor extensions to its existing oat milk and creamers portfolio.

The innovation wave includes over a dozen new SKUs, all set to begin rolling out nationwide this month. According to the company’s chief innovation officer Niel Sandfort, the new products showcase a mix of both dairy-based and non-dairy innovations, reflecting the rise of “flexitarian” consumer habits, where shoppers may adopt plant-based milks but continue to purchase traditional dairy yogurts and cheese products.

“This flexibility of the consumers and their willingness to try different categories via dairy or non-dairy seems to really be sticking,” Sandfort said. “That’s how we want to be — we don’t see dairy and plant–based as being at odds.”

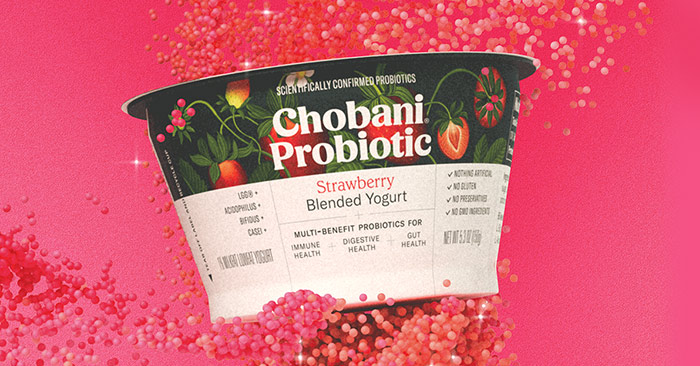

Chief among the new lines is Chobani Probiotic yogurt cups and drinkable yogurts. The cups, targeting adult consumers, are available in Blueberry, Vanilla, Strawberry and Peach flavors and will retail for $1.49 per 5.3 oz. cup. The drinkable line, priced at $5.49 per 6-pack, features Raspberry Acai, Blueberry Pomegranate and Passion Orange Guava varieties in 4 oz. bottles.

According to Sandfort, Chobani’s existing yogurt products already contain probiotics, but the new products “take it up a notch” by adding more and different types of strains.

“There’s a lot of snake oil salesmen out there in probiotics who are not using strains that have clinical human trials behind them,” he said. “We’re taking a quality approach here and going and our positioning is more than just digestion relief or bloating relief. It’s really for the younger consumer and holistic gut health, which implies immunity and digestion benefits among others.”

In addition, the company is also launching a line targeted at kids, called Little Chobani Probiotic. The drinkable products are available in Strawberry and Cookies & Cream flavors in 4 oz. bottles (6-packs) while Strawberry Banana, Mixed Berry and Strawberry & Grape flavors are available in 3.5 oz. pouches (4-packs). The line will retail for $4.49 per pack.

The focus on probiotics comes as consumers become increasingly aware of how gut health impacts overall health, Sandfort said. Amid the COVID-19 pandemic there has been a sharp rise in demand for immunity boosting products, helping drive sales. Additionally, the burst of at-home consumption has led to increases in sales for healthy snacks like yogurt cups, while drinkable yogurts have remained relatively steady.

Beyond the pandemic, Sandfort also noted that much of the awareness around gut health and probiotics has been generational: as they see their baby boomer parents age, millennials and younger Gen Xers in their 30s and 40s are becoming more active in a move to remain fit later in life, helping drive spikes in yogurt consumption that predate COVID. According to market research firm Nielsen, yogurt and yogurt drink dollar sales grew 4.4% year-over-year in the 52-week period ending November 29, while Greek Yogurt grew 8.1% in the same period.

In addition to probiotics, Chobani is also unveiling a bevy of new flavors on its existing plant-based milk and creamers lines.

Last year, Chobani took its first steps into both the beverage set and plant-based products with the launch of its oat milk line, which has rapidly scaled nationwide. Sandfort noted the line came with a steep learning curve for Chobani, which made additions to its Twin Falls, Idaho production plant in order to produce it in-house, but that after the first year on market has been “fully dialed-in”

As the line gains market share, the company is adding a Zero Sugar SKU, an addition Sandfort said will appeal to the product’s already educated consumer base who are concerned about high levels of sugar and oils used in other oat milks. The new product is priced at $3.99 per 52 oz. multi-serve carton.

“As we look at the larger non-dairy space, we’re seeing a pretty high food IQ consumer that’s in the space to begin with,” Sandfort said. “So in other words, this is the consumer that’s very woke on sugar.”

Chobani is further expanding its foray into oat with new Chobani Oat Coffee Creamers, available in original and vanilla flavors and priced at $3.99 per 24 oz. multi-serve.

According to Nielsen, oat milk sales have outpaced all other non-dairy milks in 2020, up 272% in the 52-week period ending November 29. Comparatively, almond milks grew 15.3% in the same period. Although the category has seen increased competition from manufacturers like HP Hood and Califia Farms over the past two years, Sandfort said Chobani is able to remain competitive, in part because its brand positioning is strong enough to help drive incremental sales in the space.

“We do have the permission from the consumer to go into the other spaces,” Sandfort said. “Typically what happens with our brands when we show up in oat milk, or in coffee creamers, is we are able to bring in an amount of incremental people [to the category] because they know and trust us so much from yogurt. So we love going into spaces like this, because otherwise the brands in there are not very well known.”

Within its existing product lines, Chobani will also launch a number of new flavors for its dairy-based creamers, Flip and Layered Greek Yogurt lines.

In creamers, the company is introducing a new flavor inspired by a top selling Flip yogurt cup SKU — Almond Coco Loco, with nut, coconut and chocolate flavor notes. The brand will also introduce a limited edition S’mores flavoring. In yogurt cups, Chocolate Trifecta and Peppermint Perfection join the Flip line, while Spiced Hot Chocolate and Raspberry Chocolate will be added to its Layered Greek Yogurt portfolio.

As Chobani expands its presence in creamers, Sandfort said the company aims to compete based on better-for-you positioning. Like oat milk, he noted that many leading creamer brands are high in sugar and also contain little actual dairy.

“It reminds us of yogurt in the early days when the consumer thought they were buying a healthy product, but in fact, it was very heavy and filled with sugar,” he said. “So enter Chobani — here’s what you probably thought you were buying originally.”