FMI: Shoppers Are Confused What Constitutes Plant-based

Despite a rising consumer interest (+40%) in meat, dairy and seafood alternatives, a new report released by the Food Industry Association (FMI) last week – titled The Power of Plant-based Food and Beverage – revealed that shoppers are still confused about what products are considered plant-based.

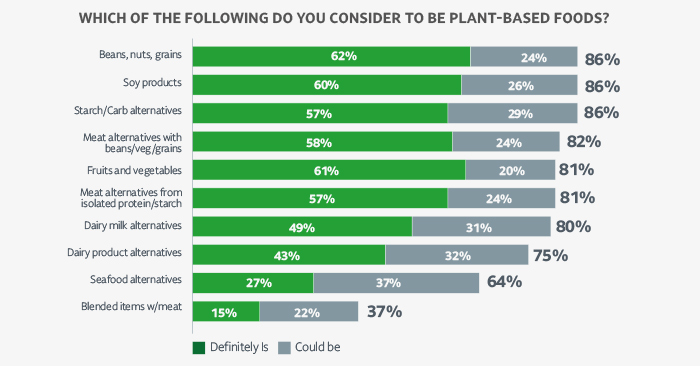

Regulatory bodies such as the Food and Drug Administration (FDA) have begun working on draft guidance for sectors within the category like alt-meat and dairy, but in the meantime, consumers are still in the dark about what exactly “plant-based” covers. Within the space, in terms of consumption, the report found the leading category to be fruits, vegetables and other produce (75%); followed by beans, nuts and grains (47%), dairy milk alternatives (24%) and dairy product alternatives (21%).

The report — which includes insight from a national survey, interviews with consumers, retailers and manufacturers, in addition to sales data from NielsenIQ — states that Gen Z and Millennial shoppers are increasingly seeking out these types of products compared to older generations like Baby Boomers who report that they rarely seek out plant-based products specifically. Most respondents across all generations (43%) say they do not consider themselves vegetarian, vegan, pescatarian, flexitarian, stating they “just eat what they want.”

While the two leading consumption categories – produce and beans, nuts and grains – are considered “naturally” plant-based foods, the report said most consumers believe plant-based to mean an alternative to meat, seafood or dairy rather than a product that just happens to be from plants. Consumers associated the phrase with words like “healthy,” in addition to “vegan,” “vegetarian,” “organic” and “natural.”

For the purpose of the report, FMI broke the term plant-based down into ten groups, two of which looked specifically at meat alternatives, but from two different angles. The ‘Veggie-Type’ option was defined as products made from beans, vegetables, and whole grains and the second, ‘Look-Alikes’ option meant products such as the Impossible Burger and was defined as being made from protein isolates, starches and fats. Both alt-meat groups garnered approximately equal interest from consumers (18% versus 16%).

Survey respondents did not largely identify with a single diet like Keto, Paleo or Whole30, but rather seem to gravitate towards more flexible eating styles. Plant-based ranked as the second most popular “approach to eating” falling behind “heart-healthy” and followed by “low-carb.” However, the survey found 42% of shoppers are actively looking to avoid soy products like edamame, tofu or tempeh in their diet, which has long been one of the more popular meat alternative ingredients alongside pea protein.

“The pandemic seems to have inspired healthier eating, but consumer trends show that it may also have prompted a more practical and realistic approach to eating,” the report noted. “As more restrictive approaches like Keto and low-carb became less popular, more balanced approaches like the Mediterranean diet and a whole foods diet gained popularity. The flexitarian diet remains a popular choice, followed by adherence to the Dietary Guidelines. These are all approaches to eating that align with a plant-based mindset for better health.”

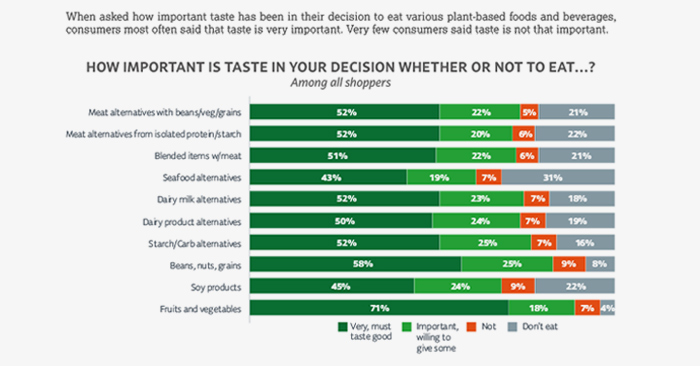

NielsenIQ noted that the plant-based industry needs to remain in tune with consumer perspectives, finding that taste and cost are the two main factors inhibiting repeat purchases of plant-based products.

According to the research firm, “plant-based alternatives have had a dramatic two-year run and now they seem to be leveling off quite a bit, as shoppers evolve behaviors and become more discerning about which foods to embrace. Nielsen still sees this sector as important for the future, but it won’t be a rising tide lifting all boats.”

About one-third of consumers believe their plant-based food and beverage consumption will rise “a little” over the coming years, but that rate does not compare to the brand momentum behind the category. Over the past three years, there has been a 72% increase in food and beverage items carrying the ‘plant-based’ claim, specifically within dairy milk alternatives, diet and nutrition, frozen fully cooked meat, fresh meat and other dairy product categories.

Looking forward, retailers will also play a key role in the category’s growth as more consumers look for plant-based products on shelf. Currently, most shoppers know where to locate the leading plant-based categories (produce, beans/peas/grains, and alt-dairy) but a small group of shoppers (less than 5%) say they know where to find alt-meat products in store.

“There’s no consensus among shoppers about where to find plant-based alternatives, which demonstrates the opportunity for both cross-merchandising in addition to creative in-store messaging,” said Rick Stein, FMI VP, Fresh Foods, in a press release. “For example, for meat alternatives, the top choice is not the meat department – it’s a designated plant-based foods section and the frozen foods section, followed by the meat department.”

Lastly, innovation will have to ramp up with an emphasis on better tasting products. Although some survey respondents think of plant-based food as “good,” many cited words including “tasteless,” “expensive,” “fake,” “nasty” and simply: “yuck.”

“Perhaps there is opportunity to elevate the public health of the nation by helping consumers include more beneficial nutrients from plants,” the report states. “Perhaps there is opportunity to connect business and innovation to well- defined and sought-after solutions on grocery store shelves. Perhaps there is opportunity to advocate, educate and collaborate.”