Good Food Institute: Innovation and Accessibility Key to Sustained Plant-Based Momentum

Despite challenges presented by the COVID-19 pandemic, the plant-based food industry continued to gain momentum in 2020 with increased sales, a strong interest in investment and manufacturing advancements. The Good Food Institute’s (GFI) 2020 Plant-Based State of the Industry report highlighted some of these major achievements in the space last year, while also offering plant-based companies actionable insights for the future.

Although the category is buzzy and crowded, there’s still opportunity for companies to innovate and bring new consumers into the category, according to GFI research analyst Kyle Gaan.

Continued Innovation and New Formulation

While there were no shortage of product launches in the plant-based meat category in 2020, the majority of innovations, including launches from Tofurky and Before the Butcher, were beef alternatives. Although brands are continuing to build their manufacturing technology and test new beef-alternative formulations, they should expand their horizons beyond burgers, nuggets and sausages into subcategories with whitespace and demand, such as whole cut meat alternatives, Gaan said.

“We really do encourage research and development in that whole muscle texture area because it would allow alternative protein companies to start tapping into that demand that currently companies don’t have access to just because they’re primarily focused on ground type products,” Gaan said.

Beyond Meat and Impossible Foods have dominated the plant-based meat conversation in burgers and grounds, leaving smaller players such as Simulate and Meat opportunities in the whole muscle meat alternative space, Gaan noted.

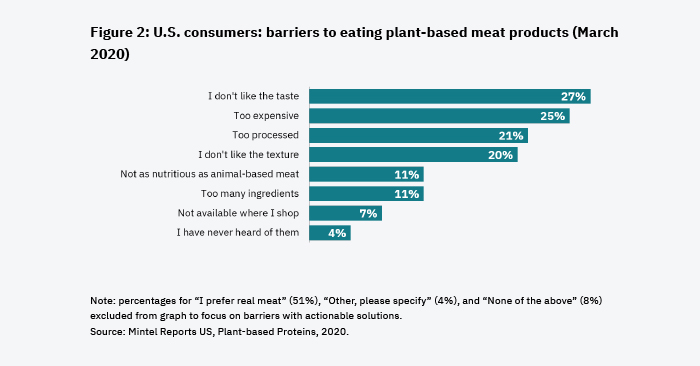

Taste remains a key motivator for plant-based consumers. Gaan said brands offering products that closely match conventional meat will see the highest growth. He cited a Mintel study from last year that found that 27% of respondents didn’t like the taste of plant-based meats, and 21% said they were too processed. As such, brands should work to create “high-fidelity, plant-based products” that mimic their animal-based counterparts, the report said.

“Consumers recognize the health halo around plant-based meat, but ultimately, it’s that taste and texture and eating experience that that’s really going to drive their decision making,” Gaan said.

This may be particularly true post-pandemic, Chris Kerr, CIO at Unovis Asset Management, added in the report. He stated that “mediocrity will not suffice” as the country returns to normal, as “true joy of food will drive eating decisions”

“This is the year that plant-based offerings must put their best foot forward, or we could lose hard-won gains of the last decade,” Kerr said.

Environmental concerns are also an important factor for plant-based shoppers, with the percentage of consumers citing sustainability as a driving factor for plant-based eating jumping from 31% in 2018, to 48% in 2020, according to a 2020 Mattson survey.

Although “there is value” in highlighting the sustainability aspects of brands’ products, brands should not “over focus” on those attributes at the expense of taste and texture, Gaan said.

Reaching Price Parity

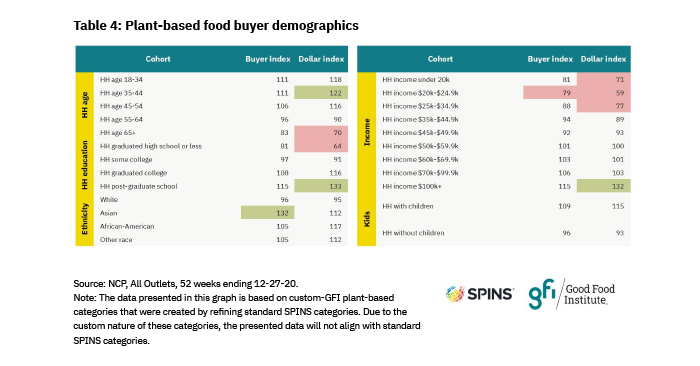

Reaching price parity with conventional meat should be a main goal for plant-based brands, the report noted. Larger players have already made strides in the last year, with Impossible Foods cutting foodservice costs and Beyond Meat rolling out value packs. According to a 2020 Mintel study, a quarter of respondents cited the expensive price tag of plant-based meat was a deterrent. Plant-based consumers typically have an annual income of more than $50,000, GFI found, citing SPINS data.

Both larger players and smaller emerging brands must contribute to the long-term goal of price parity, developing production capacity and achieving economies of scale to drive down prices, Gaan said.

2020 was a record year for equity financing, with six-figure funding rounds for Impossible, LiveKindly and Califia Farms. However, the report stated that debt financing was underutilized last year, except for Oatly’s $78 million debt round. This type of funding presents a “clear gap that investors can look to fill in 2021,” as a nondilutive capital source that can fund construction of a manufacturing facility or assist in scaling production, the report added.

Additionally, in order to improve plant-based manufacturing, optimized production equipment and increased availability of contract manufacturing will also be essential, GFI wrote.

Accessibility Through Omnichannel Focus

An omnichannel presence is also essential for brands to both reach current plant-based consumers and bring additional consumers into the category. According to the report, brands should leverage opportunities in foodservice post-pandemic to cover more dayparts and consumer needs while increasing their familiarity with plant-based products. Online grocery is also an “increasingly viable channel to reach consumers,” Gaan noted.

“Accessibility is important,” Gaan said. “And so being where the consumer is, whether that’s in the grocery store, or on the menu at a quick service restaurant, to the extent a brand’s able to play in as many places as possible, I think that’s important just for consumers to see their products and know that’s an option.”

As plant-based brands work to make their products more accessible, Gaan predicted that consumer engagement in the plant-based category will remain steady and new products and formulations will continue to spark their interest.

“The industry is still fairly young, and there’s still so much potential,” he said. “It’ll be fascinating to see what new brands and products pop up. I think it will always keep consumers interested, engaged and trying new things.”