Energy Drinks, ‘Elevated’ Foods Lead Circana’s New Products Pacesetters

While inflation may have hit consumers’ wallets hard last year, it hasn’t curbed their appetite for new CPG innovation, according to the 2023 New Product Pacesetters report from market research firm Circana.

The annual report tracks the top 100 food and beverage and top 100 nonfood product launches that completed a full year of sales in 2022, which combined reached $6.8 billion in year-one sales, up from $6 billion the year before. Within food and beverage alone, “New Product Pacesetter” brands reached nearly $3.5 billion in sales, a 19% increase from 2021.

According to a survey of consumers included in the report, nearly 17% consider themselves to be “early adopters” seeking out cutting edge CPG innovations – a 1.6 point increase from 2021.

“Consumers want products that meet their wants, needs and desires, some of which they can’t even identify until they’re presented with an innovative product that makes their life easier, tastier or healthier,” the report states. “Manufacturers that deliver on those needs and provide solutions, along with retailers that give these products space and attention have a better chance of connecting with consumers to drive sales and loyalty.”

Carbonated Beverages, Energy Leads Food and Beverage Performance

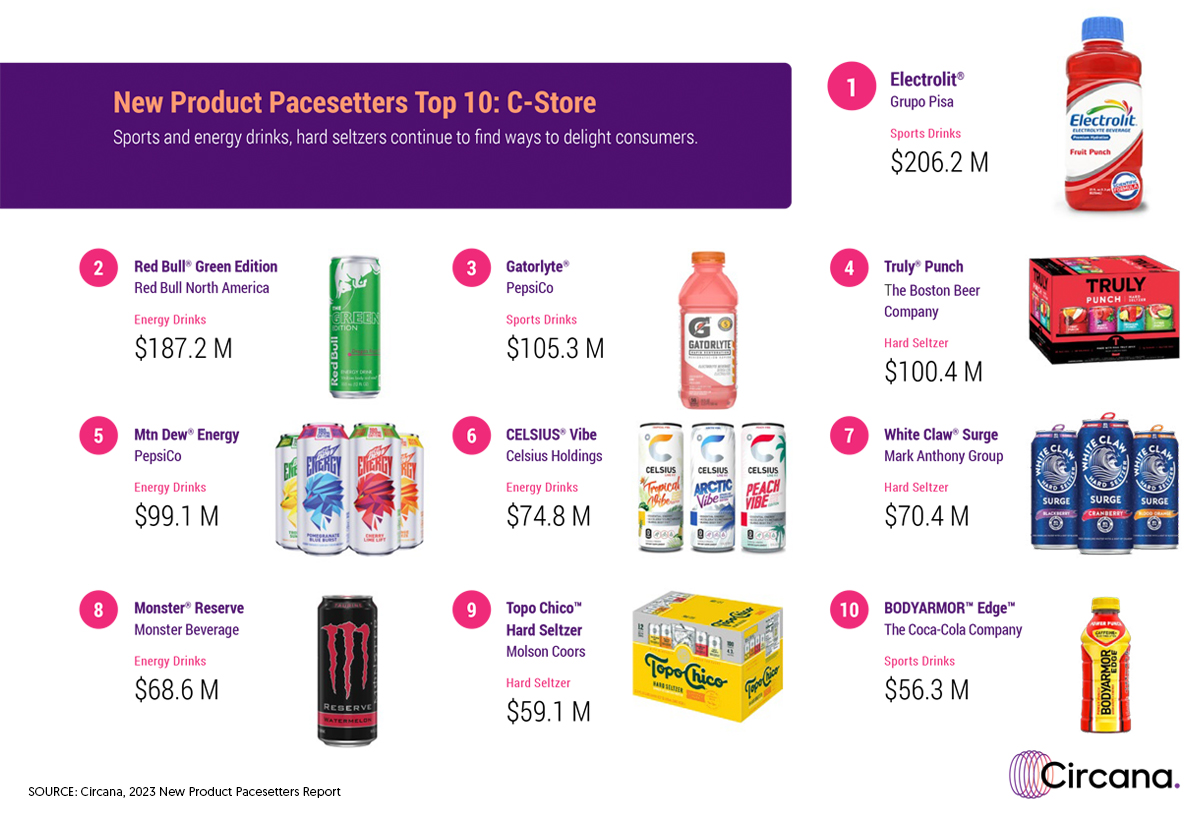

The combined category of Carbonated, Sports and Energy Drinks led all food and beverage categories in dollar sales, with 13 brands ranked among the top 100 Pacesetters totaling $927.1 million in sales – a 339% increase from the 2021 report in which just five brands from the category were counted.

The category accounted for 27% of the entire food and beverage Pacesetters list and five of the top 10 food and beverage products, including the number one product, performance energy brand Alani Nu. Other top 10 launches included Dr Pepper Zero Sugar, MTN Dew Spark, Red Bull Green Edition and Gatorlyte, the electrolyte formulation product launched by Gatorade.

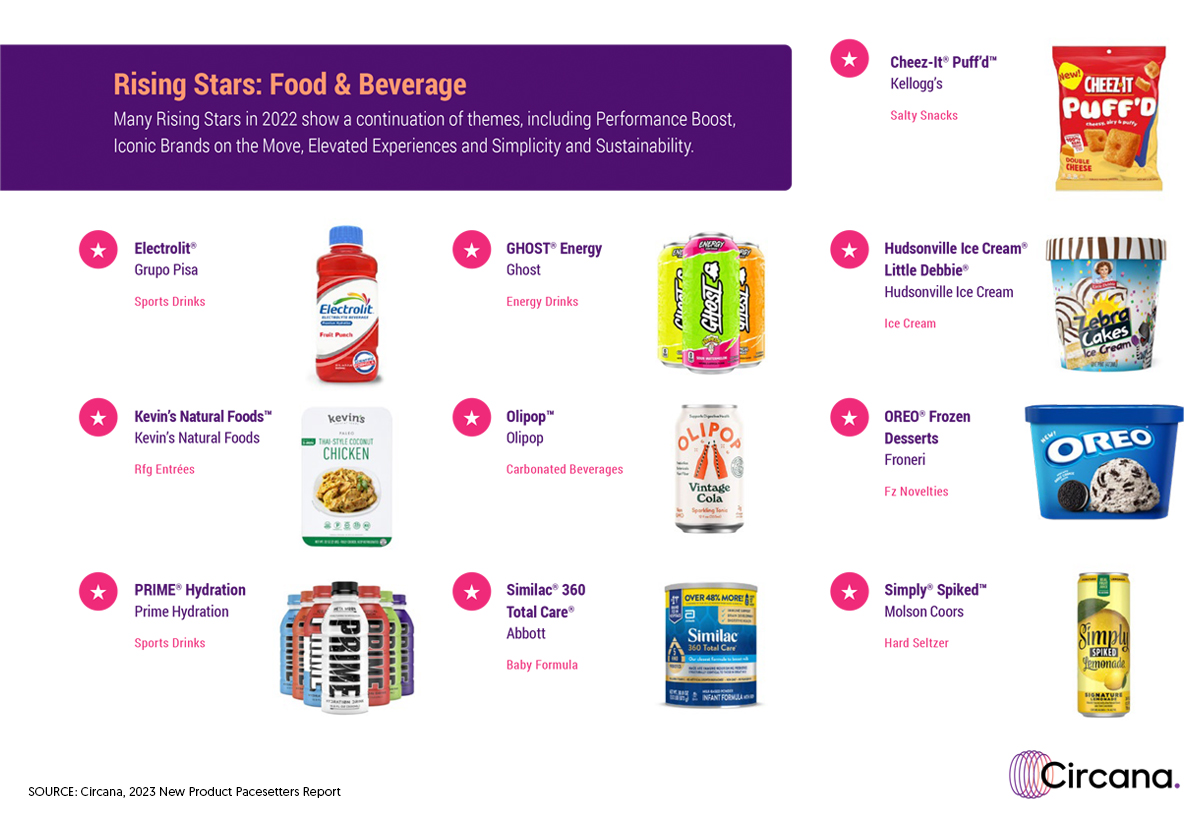

The strong performance of these drinks, Circana noted, contributed to a trend for performance boosting products, with additional beverages like Starbucks’ Premium Instant and Cold & Crafted coffees and CELSIUS’ Vibe and On-The-Go lines also making the top 100.

“Energy beverages are more nuanced than ever, as they are enhanced with benefits including vitamins and a hyperfocus on hydration,” the report stated. “More than 41% of consumers say they want new beverages to help with hydration, better than 25% of consumers want more than basic nutritional benefits and nearly 17% want an energy boost.”

Elevated Experiences Matter

The average price of foodservice is now four times higher than at-home products, Circana reported. While 80% of survey respondents said they had purchased food from a restaurant in recent weeks, as of March, consumers are becoming more aware of “elevated” solutions in retail.

“During the pandemic, many transitioned to more enhanced experiences and do-it-yourself, restaurant-style meals and parties, whether they entertained or fed their own family in new ways,” the report states. “Some 20% of consumers, and a notable 27% of early adopters, report they look for new products that are restaurant quality they can prepare at home, according to New Product Pacesetters Survey data.”

Among the top performing innovations was the number three ranked Chick-fil-A Sauces line, which generated over $140 million in sales, “emphasizing the appeal of re-creating interest restaurant experiences at home,” according to Circana. Other brands like ecommerce meal kit maker Purple Carrot also broke into the top 100 thanks to an emphasis on improving the at-home dining experience.

Circana also pointed to strong performance for alcohol products that deliver “an at-home entertaining and party experience” like hard seltzer brand Truly’s Punch and Margarita Style flavors and Topo Chico Hard Seltzer (all in the top 10 for food and beverage) as well as lower ranked launches such as White Claw Surge, Bud Light Seltzer Hard Soda, FitVine Wine and FLIGHT by Yuengling.

Plant-Based and Sustainability Remain Key Drivers for Innovation

Consumers’ commitment to sustainability has stayed strong. While plant-based products may still be a smaller piece of the overall food sector, products like Gardein Ultimate, Impossible Chicken, Daring plant chicken and Violife vegan cheeses were among the best performing innovations of 2022. The number seven brand, frozen meal maker Tattooed Chef, reported more than $93 million in sales.

“As shoppers speak with the money they spend, they support brands that align with their philosophy and values,” the report stated. “This desire to understand a brand and its goals is evident in the increase in plant-based options. With so many new plant-based products on the market addressing variety and occasion needs, they’re driving a trend for sustainability clearly reflected by several impressive Pacesetters.”

According to Circana, 25 million people eat plant-based food and beverages occasionally or regularly and one in five people said they want more plant-based options to be available to them. Overall, plant-based products made up 14 of the top 100 Pacesetters totalling around $411 million in sales, up from just five slots in 2019 totalling $185 million.

Meanwhile, products marketed as sustainable represented 17.3% of all New Products Pacesetters in 2022, but were responsible for 30% of growth. These products have an average price premium of 28% over conventional products in the same categories. Circana’s consumer survey found 67% are “highly interested” in sustainability.

Small Brands Lead Innovation But Trail in Dollar Sales

In 2022, small ($100M to $1 billion in revenue) and extra-small companies (under $100M) made up 51% of all New Product Pacesetter products, but represented only 30% of dollar sales, Circana said. Comparatively, in 2021 small and extra-small companies represented 47% of the list, while still maintaining 30% of dollar sales.

Medium-sized companies ($1B to $6B in revenue) made up 28% of the list and saw an outsized share of dollar sales share of 35%. In 2021, they made up 30% of the list but accounted for just 21% of the dollar share. Part of the anomaly, Circana noted, is thanks to the performance of Alani Nu, launched by medium-sized portfolio company Congo Brands. The firm tracked over $228.4 million in sales for the energy drink line.