Circana: Rising Food Prices’ Impact On Shopping Behavior

Inflation got you down? Shoppers are continuing to struggle with how to mitigate the higher prices at grocery stores. According to an August food inflation report from Circana, 94%of consumers are (unsurprisingly) concerned with the cost of food even as shoppers are beginning to expect those prices to start ticking down.

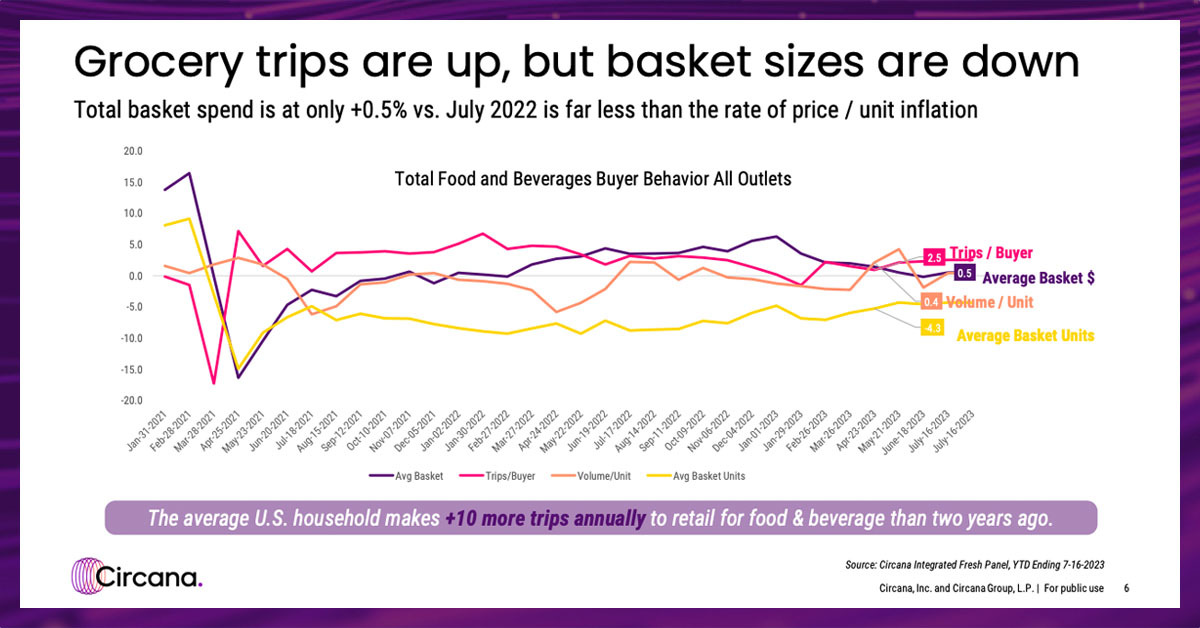

How is that playing out at the checkout? According to Circana’s data, food prices have been on the rise on average about 5% per year since 2020. Much of this is related to producers seeing the cost of production go up and passing that down on the price of goods at the store. Yet, as economic data hints at price increases to level off, shoppers are still feeling the pressure at checkout.

As prices have gone up – +12% compared to a year ago – so has the amount shoppers are spending on food and beverage (+10%) reducing discretionary spending. At the same time, unit volume is down 2%

Consumers are also prioritizing fast meals with little-to-no prep, which has benefitted the frozen category. Consumers spending 8.4% more per trip in the frozen aisle in 2022 than the year previous, according to data from the American Frozen Food Institute. That trend has continued into 2023 with frozen proteins and entrees seeing a bump. That coincides with a reduction in out-of-home meals as well which was down to 14% in 2022, a 2% reduction from the previous year, according to Circana.

There remain “pockets of indulgence” in grocery, from perimeter bakeries to butcher shops and other specialty stores, where shoppers are still spending on higher priced items, Circana reported in last week’s retail spending results.

When will the pricing pressure end for shoppers? The future remains hazy as the Federal Reserve has teased that it might not be done raising interest rates as it tries to cool the economy.