Vericast: Inflation Pushes Brands to Craft Marketing Around Generational Differences

Having a deep understanding of the generational differences among consumers will continue to be vital for CPG marketing strategies going forward as inflation impacts shoppers of all ages, according to a new report by marketing firm Vericast.

Last week, the San Antonio, Texas-based company released its “2022 CPG and Grocery TrendWatch” consumer report in which nearly 2,000 adults in the U.S. and more than 300 CPG industry professionals were surveyed about grocery marketing and shopping trends. In it, Vericast explained that brands who offer competitive pricing and promotions while optimizing the convenience of online shopping with the in-store experience are more likely to succeed across age groups during the current high inflationary period.

Price Increases Are Driving Consumer Behavior

According to the report, 64% of consumers surveyed expressed anxiety about the increase in inflation and 42% said they were struggling to afford essentials.

Understanding a consumer group and how to effectively communicate with that segment can keep brands competitive even amid record high prices. Consumers turn to private label alternatives when they are pinching pennies and it becomes dependent on brands to find innovative ways to reach them.

“It comes down to the basics of just understanding what your price gap is versus, for example, private label,” said Aimee Englert, executive director of client strategy at Vericast. “Then adjusting your strategies in order to ensure that you’re convincing them that your product is differentiated enough or perhaps you have a product improvement, that really would convince them to pay more for a product.”

Englert pointed out that retailers are leaning into amplifying private label over national brands and it is contingent on CPG companies to target promotions at these consumers to not lose market share.

Among Baby Boomers, “83% said the increase in prices is their biggest challenge when shopping for food, health and beauty, personal care or household items and 36% are most likely to switch products when preferred products aren’t available.”

Vericast’s data suggests that the best way to reach the Boomer demographic is to understand that they are less influenced by social media and digital marketing campaigns but still look for printed ads and coupons to guide their shopping decisions. Although this group is adopting more omnichannel shopping habits, 43% still favor circulars in the mail and 42% from newspapers.

Harnessing The Potential Of E-Commerce

E-commerce and online shopping continues to drive how and where to market to millennial and Gen Z shoppers; yet, for slightly different reasons.

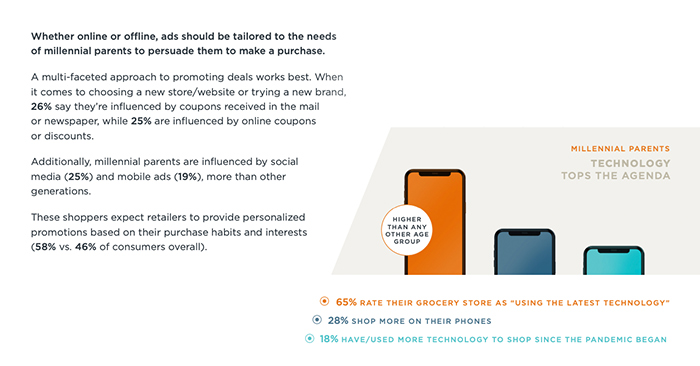

Millennial parents are seeing the price pressure and are using online shopping as a means to finding promotions and products that fit their lifestyles. Most importantly, convenience plays a huge role in millennial shoppers’ preferences, leading them to pay extra for delivery or subscription services that ease the burden of in-store shopping.

Yet, millennial parents still rate the in-store experience (70%) higher than the online experience (63%), according to Vericast.

The key is to target deal-seeking consumers with online marketing campaigns that encourage the same “discovery and inspiration” found with an in-store experience while playing to the convenience of e-commerce, Englert said. “What you can do to stay top of mind is serve ads to shoppers featuring those key impulse categories, snacks, cookies, desserts, seasonal items, for example and execute in some way on that to encourage more online shopping.”

The segment least concerned about price increases but rely on social media and mobile shopping in their buying behavior was Gen Z. Influencer marketing and the creator economy will continue to take a larger share of advertising dollars for CPG brands as this demographic takes up more and more of the spending power in the years to come.

“Seventy-five percent of marketers use it [influencer marketing] and project to spend $4.1 billion [in the future],” Englert commented in the report.

Moving forward, Vericast believes that there is room for advertisers and brands to explore the potential of the virtual and augmented reality, as well as the metaverse, to reach prospective consumers in innovative ways.