Beyond The Hype, Near Impossible Expectations: How Alt-Meat Is Performing in Fast Food

In their ongoing efforts to win the hearts and minds of U.S. consumers, emerging plant-based meat giants are looking to make their case at the drive-through.

When The Impossible Whopper first dropped in 2019, it became one of the first plant-based meat alternative available at a leading, national fast food chain in the U.S.. At the time, Beyond Meat had a handful of co-branded items in foodservice, but by 2021 it ramped up that channel strategy signing on with Yum Brands, parent company to fast food giants including KFC, Pizza Hut and Taco Bell in addition to announcing a Beyond Burger test launch at McDonald’s. But have these moves accomplished their purpose and contributed to ongoing success?

Test launches and limited time offerings (LTOs) are a popular strategy for many plant-based meat makers, providing them with feedback and actionable insights before committing to a hard retail launch, full scale production and finished packaging designs. However, these partnerships seem to have little sticking power, and, even when products make it to the permanent menu, the post-pandemic operating environment has changed what that means entirely.

“The Beyond Breakfast Sausage Patty was a permanent menu item at Dunkin Donuts – it is no longer,” stated Stephanie Lind, founder of Elohi Strategic Advisors (ESA), a plant-based focused foodservice advisory firm. “Impossible had an Impossible Whopper for kids, the Whopper Jr., and a breakfast sausage patty. Both were [marketed as] “permanent menu items,” [and] neither are there anymore.”

Thanks in part to a COVID-inspired move to QR-code menus, the concept of a “permanent” menu item itself has changed, she added.

“If they’re out of something, it just disappears from the menu… so unless you have a two-year contract with volume stipulations, and there’s a slot for it guaranteed by the distributor, you are as much an LTO as you might be permanent,” Lind explained.

Even collaborations between industry heavyweights have yielded uneven results. On its latest earnings report, Beyond Meat reported that the test launch of its exclusive McDonald’s offering, the McPlant burger, had “concluded as planned,” but did not specify if the item will return to McDonald’s menus in the future. Beyond has repeatedly reported that demand has not kept pace with expectations in key sales channels, including food service.

According to McDonald’s CEO Chris Kempczinski, the“McPlant is available for markets to pull down based on customer demand. As always, we’ll do what McDonald’s does best, listen to our customers. When people are ready for the McPlant, we’ll be ready for them.”

Meanwhile, Impossible Foods, which debuted the Impossible Whopper at Burger King in 2019, expanded its partnership with the fast-food chain in June with the launch of the Impossible King and Impossible Southwest Bacon Whopper. The chain also began selling Impossible chicken nuggets late last year. But after an initial sales bump, the Impossible Whopper didn’t sustain expectations either, leading Burger King to significantly lower the price and add it to its 2 for $6 menu about a year after its introduction.

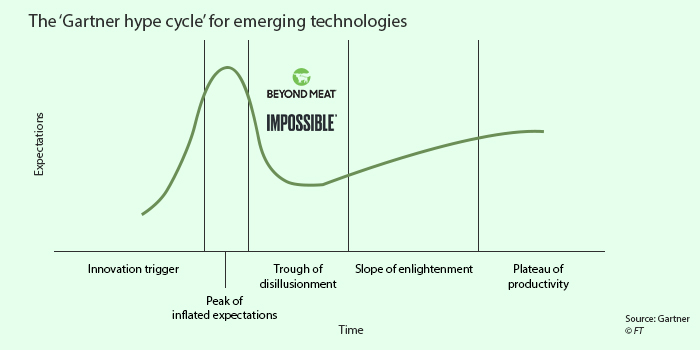

Despite the performance from the category leaders, beef and chicken analogues still show strong upward momentum and are leading plant-based protein sales in the channel. Food service experts believe the current state of plant-based meat signals the industry’s natural progression along the Gartner Hype Cycle (see graph). While some of the “noise” may begin to lessen and the crowded pool of new entrants may begin to thin out, plant-based meat alternatives are not going to simply disappear.

“There’s clearly a market out there that’s why it has grown as much as it has, but expectations and funding got ahead of where the market can get over the next couple years and COVID certainly didn’t help,” said T.K. Pillan, founder and chairman of plant-based QSR chain Veggie Grill. “It’s like how all those companies went out of business when the dot-com world crashed in the early 2000’s – they all existed five to 10 years later, when the market was ready for them, they just existed in a different form.”

A recent market research report projects this continued upward trek, estimating that plant-based protein will grow 7.3% by 2027 to reach a $17.4 billion valuation. Within foodservice, shipments of plant-based proteins increased 11% over the past year, compared to July 2021, and dollar sales were up 12% according to market research firm, NPD Group. Shipments of ground beef alternatives, the top selling plant-based protein in foodservice, grew 22% compared to a year ago, but the firm noted the number of units shipped still remains below pre-pandemic levels.

How has the channel changed?

Lind said she has brands coming to her every day saying they want to break into foodservice just as Beyond and Impossible did back in 2018. While she emphasizes the channel presents an easier point of entry than retail for plant-based protein makers, emerging companies often overlook the VC funding, resources and vastly different operating environment the two category leaders launched with. For example, one of Beyond Meat’s early investors was Cleveland Avenue, an investment firm founded by former McDonald’s CEO Don Thompson.

“Going into foodservice for Beyond and Impossible that early was smart because they had product iterations they needed to make, they had a story that was going to be very difficult to tell on a package – so they were going to spend an inordinate amount of money in consumer marketing – and they didn’t have full scale manufacturing,” Lind stated. “They had a lot of issues that were solved by going small and just amplifying it with PR early.”

She also emphasized that while debuting in foodservice did bring consumer attention onto the two, now category leaders, brands also often forget Beyond and Impossible had been in the market on a small-scale for nearly two years prior to these launches and overlook that they had been operating as a company for six to seven years. Lind also warns emerging brands that an early with a large QSR chain will set a feel for the product’s price, reduce its margins and often hurt brands for the “remainder of their lifecycle” in addition to putting a “halo” around the brand, at its own expense.

“You’re subordinating your brand to someone else but also hoping to get the advantage of their marketing and their consumers faster – that is a dangerous proposition,” she said.

Additionally, legacy fast-food giants have seen increasing competition from several new vegan-centric chains and fast casual concepts that have emerged over the past few years including Neat Burger, PLNT Burger, and most recently Kevin Hart’s Hart House, which opened its first store in California and said it is on track to open 10 locations by the end of the year. While these establishments don’t have nearly the geographic reach and presence as the leading fast food chains, they cater directly to consumers who would seek out plant-based products.

“What happens in the restaurant world is you can only be great at a couple of things,” said Pillan. “McDonald’s does burgers, Kentucky Fried Chicken does chicken, Taco Bell does tacos, Veggie Grill does plant-based. McDonald’s and Burger King – they’re never going to be great at plant-based. They might be decent, but because it’s such a small piece of their business [that] they’re throwing it together with regular mayo and regular cheese. When I’m on the freeway, it’s something else for me to eat, but if I want a decent, flavorful, high quality, plant-based burger, that’s not where I’m going.”

That approach informed Pillan’s strategy when he founded Veggie Grill back in 2006. He explained that a consumer seeking out plant-based options typically looks for higher quality products which are inherently difficult to produce in a fast food setting since menu items are low priced and need to be able to be prepared in minutes.

Brands also overlook the need to create proprietary versions of their products specifically for foodservice, said Lind. The version that works in retail, or even in one restaurant versus another, may not be efficient or feasible to prepare in a foodservice environment.

Solving that challenge could create a path for foodservice providers to take greater control and ownership of the plant-based meat served in its restaurants. Last week, Taco Bell announced it was testing a new plant-based meat that was created in-house; the product will be priced equal to animal-based meat and can be substituted into any menu item. The news comes ahead of the chain’s scheduled Beyond Meat test launch later this year, which it affirmed would still take place but have not provided details surrounding that test.

Given the low return rate for plant-based test launches and LTOs, the announcement may be an indication that the plant-based meat industry has reached a scale where it is more cost-effective for large-scale restaurant operators to create their own products or license products from lesser-known companies. A few years ago the technology, production equipment and concept of plant-based meat analogues were still synonymous with Beyond and Impossible, but now that is changing with numerous brand entrances and hundreds of analogue iterations.

Earlier this month, Nowadays launched its plant-based chicken nuggets with an undisclosed “award-winning restaurant,” while, elsewhere, global food company Sigma announced its Better Balance range of plant-based meat shreds and crumbles are now available in the U.S. at over 300 restaurants, theme parks, stadiums, music festivals and delivery platforms.

“With supply chain challenges, even the big chains are finding they need to switch things out or go to two to three manufacturers,” said Lind. “It’s a very different environment and everybody keeps trying to attack the channel as if it were 2018. It is not. [That being said], we have a lot of ‘Chicken Littles’ right now about plant-based, but it’s not going away.”