TikTok Shop 101: What the App’s Newest Feature Means for CPG

Although users may primarily flock to TikTok to jump on the latest dance trends, the short video social media platform is seeking to become one of American consumers’ go-to ecommerce destinations with the launch of TikTok Shop.

Almost a year after ByteDance Ltd. began testing the shopping feature nationwide in November 2022 and following its beta version in April, TikTok Shop rolled out to all 150 million users across the U.S. on September 12.

TikTok Shop is expected to open up new commercial opportunities for the app, which raked in over $350 million in in-app revenue last year, as reported by Forbes. But what does it mean for CPG brands looking to grow their ecommerce sales? With the shopping feature still in its infancy in the U.S., questions remain about TikTok Shop’s viability in an increasingly saturated ecommerce market.

How Does TikTok Shop Work?

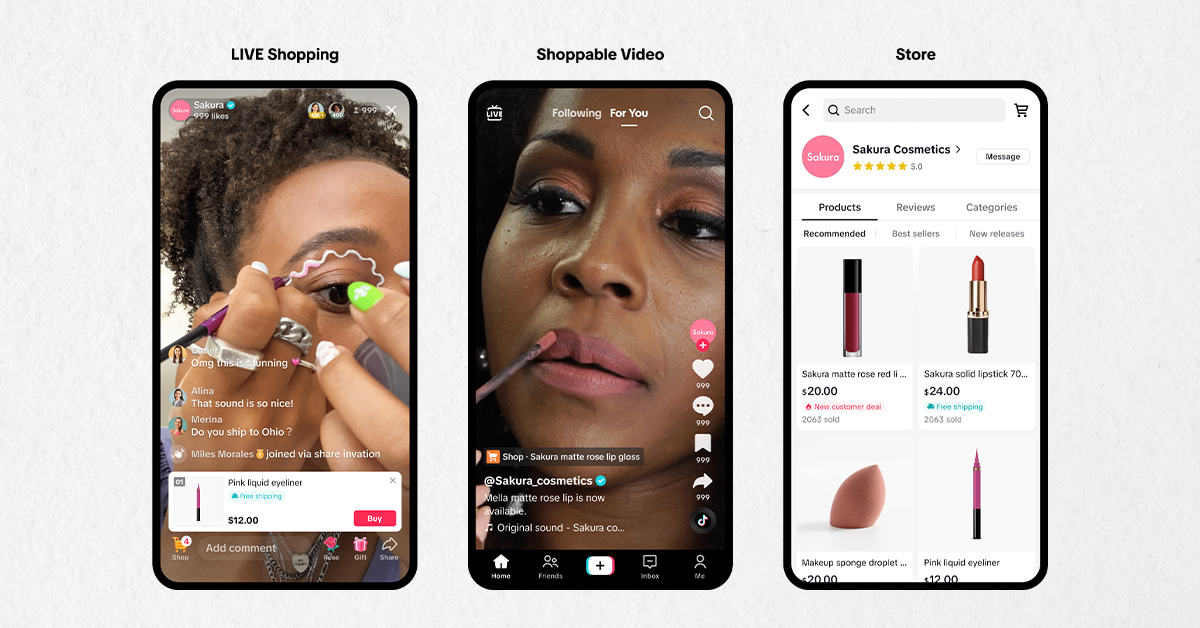

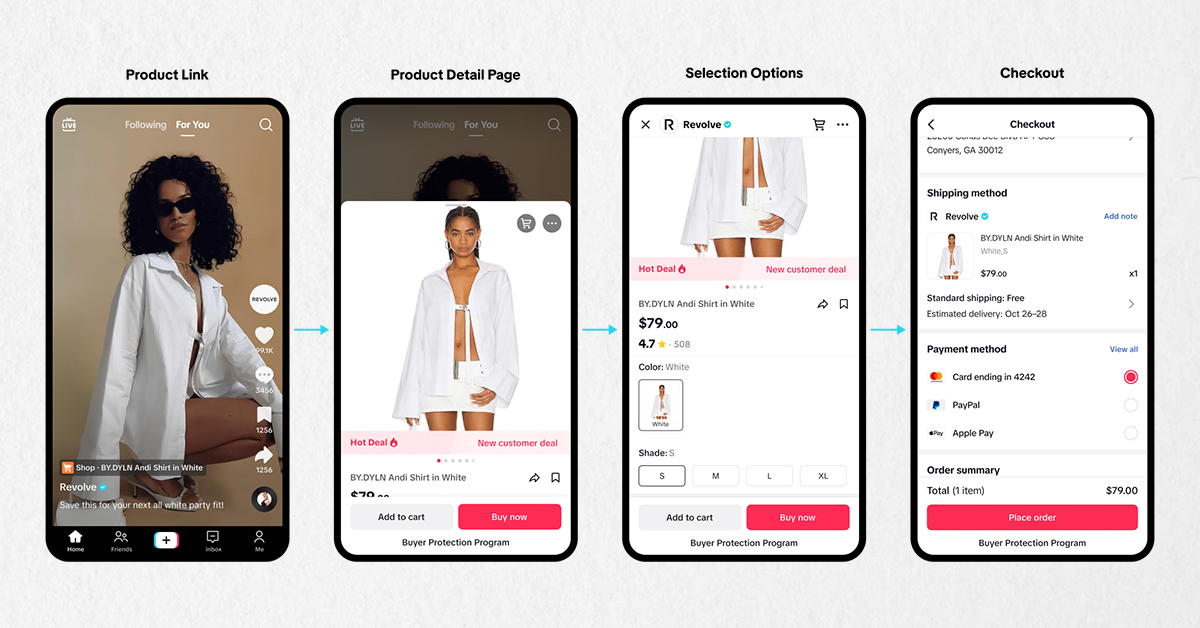

As of this month, over 200,000 brands (sellers) and 100,000 users are on TikTok Shop. The shopping feature offers four main “products” including live shopping streams, shoppable videos, product collections and the shop tab, the latter of which is still being tested and currently appears on the app’s homepage for approximately 40% of users, according to a TikTok spokesperson.

TikTok Shop’s Affiliate Program enables creators to connect with sellers through new commission-based marketing opportunities. The shopping feature also includes Fulfilled By TikTok, a logistics solution that allows brands to focus on their products while TikTok Shop stores, picks, packs and ships sellers’ products to customers. A spokesperson declined to disclose the fee for the service.

Brands can register for TikTok Shop for free as a seller, though the social media giant currently takes a 5% commission fee from merchants, as reported by Insider.

“With community-driven trends like #TikTokMadeMeBuyIt inspires people to discover products they love, TikTok is creating a new shopping culture,” the company wrote in a blog post on its website. “TikTok Shop empowers brands and creators to connect with highly-engaged customers based on their interests, and it combines the power of community, creativity and commerce to deliver a seamless shopping experience.”

On the plus side, according to Chris Moe, founder and CEO of ecommerce-focused agency Cartograph, TikTok Shop is “one of the better brand discovery sources and true exploration sources right now.” But it lacks a structure that supports repeatability and scalability, two characteristics that brands look for from an advertising standpoint, he noted. Yet overall, he believes testing the feature “in a speculative way is worthwhile.”

“U.S. brands won’t be social [media]-concentrated until the tools on social [media] are as good as the tools outside of it,” said Moe.

The project comes at a steep price for parent company ByteDance. Citing the sizable investments to hire staff, build a fulfillment network and incentivize brands to join by offering free listings and free shipping, the Information reported that TikTok Shop is expected to lose ByteDance over $500 million in the U.S. this year.

Impact on CPG Space

From the “girl dinner” trend to the viral “tinned fish” niche on the app, there’s no denying the power TikTok holds in making brands go viral.

Clean energy drink brand Gorgie, granola butter producer Oat Haus and gourmet cookie maker Crumbl are part of a cohort of CPG brands that began trialing TikTok Shop’s beta version back in April. Though their experiences are far from identical, they believe the shopping feature is helpful in raising brand awareness and capturing new demographics.

Crumbl (7.1M followers, 72.4M likes), is using TikTok Shop to push its merch (versus its cookies) to what it has dubbed its “dancing teen audience.” The brand’s product showcase is overflowing with vibrant pink sweatshirts and bucket hats, dog bandanas and golf tees.

“I think that being able to have your brand on all omnichannel [shopping platforms] is really important. The more convenient you make it for people to buy your product, the more people are going to buy your product,” said Nicole Mackelprang, Crumbl’s senior paid media manager.

Having introduced the product concept on TikTok prior to launch, Gorgie (7.1K followers, 308K likes) is certainly no stranger to the platform. Now, the vitamin-infused clean energy drink brand is utilizing TikTok Shop to learn what products excite consumers while keeping up with the latest trends in the beverage space.

“The hope is that as the content goes viral, you will drive more consumer behavior directly toward the app rather than sending people over to Amazon and create [an] ecosystem where you’re not only getting your eyes on trends via TikTok but also completing the purchase cycle,” said founder Michelle Cordeiro Grant. “We’re really focused on direct product integration in our content.”

Elsewhere, Oat Haus (71.6K followers, 2.4 million likes) is enabling consumers to peek behind the curtain and feel they are part of a movement. Founder and CEO Ali Bonar posts videos of the day-to-day happenings of the brand, from a final visit to Oat Haus’ former facility in Philadelphia to baking adventures featuring its granola butter.

“If you think about TikTok, that’s what separates it from Instagram […] people love the rawness and realness. It’s not curated,” said Bonar. “In terms of product, I think granola butter is inherently a product that could pop off on TikTok because it’s so unique.”

Oat Haus’ TikTok Shop feature is temporarily unavailable as the brand transitions out of its 11,000 sq. ft. facility in Philadelphia and into a 45,000 ft. sq. facility in Cleveland.

Social Commerce Challenges

Social commerce, the buying and selling of goods directly in a social media platform, is still getting its legs in the U.S. According to a recent report by Insider, social commerce is projected to account for just 5.9% of U.S. ecommerce sales in 2023 and 7.8% come 2026.

Platforms such as Facebook and Instagram have tried and ultimately failed to build up a sufficient demand for social commerce in the U.S., with Meta killing both apps’ live shopping features and instead primarily relying on ads.

So what makes TikTok different? According to ecommerce strategist Betsy McGinn, of McGinn eComm, the platform is extremely successful at creating virality. She said, “The greatest success is going to be for brands that are trending because of an influencer or [other factors] that create a buzz on TikTok.”

McGinn said the availability of an internal fulfillment option is a considerable factor in whether TikTok Shop, or any third-party shopping platform, sinks or swims.

TikTok Shop’s future remains uncertain as the app remains under fire by the U.S. government. In March, a bipartisan group of Senators introduced the Restricting the Emergence of Security Threats and Communications Technology (RESTRICT) Act. The bill would give the Department of Commerce more power over reviewing, preventing and mitigating information communications and technology (ICT) transactions that pose “undue risk.”