IFF and DuPont to Become a $45B Ingredient Powerhouse

Two ingredient development and innovation companies are joining forces: International Flavors & Fragrances (IFF) and DuPont Nutrition & BioSciences announced yesterday that the two will merge via a $26.2 billion deal. The new company is valued at $45.4 billion, with a projected combined revenue of over $11 billion for 2019, morphing the two into a single global ingredient powerhouse for food and beverage CPG brands.

“With highly complementary portfolios, we will have global scale and leading positions in key growth categories to capitalize on positive market trends, drive strong profitable growth for our shareholders and create opportunities for our employees,” IFF chairman and CEO Andreas Fibig said in the release.

The deal marks IFF’s largest purchase to date, topping last year’s acquisition of natural flavors and ingredients firm Frutarom for $7.1 billion. Under the DuPont deal, expected to close by early 2021, Fibig will continue leading the company under the IFF name: DuPont shareholders will own a 55.4% stake, and existing IFF shareholders will own the rest.

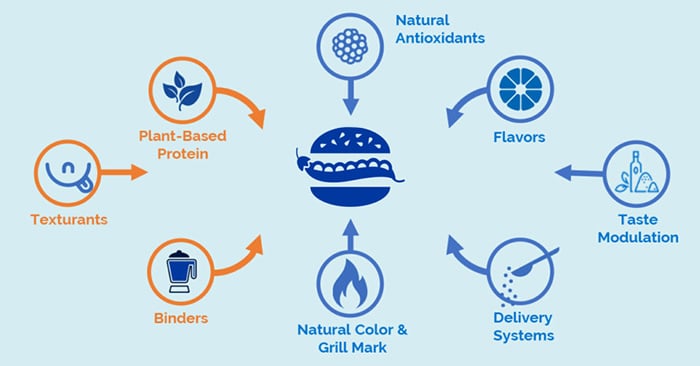

Founded in 1833 and based in New York, where it will remain after the deal closes, IFF provides flavor and fragrance solutions to 33,000 clients via 110 manufacturing facilities and 100 R&D centers. Copenhagen-based DuPont’s ingredient division (DuPont goes back centuries as a chemical company) comprises 57% of its business, via broad offerings across functional ingredients, protein, emulsifiers and sweeteners. Together, the two firms have granted and filed over 12,000 patents, and their dual capabilities will likely fuel quicker development for functional food products and plant-based products. For example, with the latter category, brands will be able to benefit from IFF’s coloring and flavoring options (such as natural colors and grill marks) alongside DuPont’s soy protein, texturants and binders offerings, according to the companies.

The release further notes the deal will provide better services for IFF’s large multinational clients, but also for its “fast-growing small and medium-sized customers,” which represent 60% of its global business. Enhanced efficiencies include faster customer speed-to-market and critical consumer insights for growing CPG brands quickly and skillfully.

“Our expertise together with IFF will best position us to address customer needs and ultimately redefine our industry,” DuPont president Matthias Heinzel said in the release. “IFF’s innovation and customer-centric culture is remarkably similar to ours.”