COVID-19 News Roundup: IRI’s Recession Lessons, FDA & USDA Supply Chain Update

As many states begin to reopen businesses, data firm IRI reflected on the 2008 recession to help brands prepare for the months ahead, while the FDA and USDA announced plans for supply chain management collaboration. Here’s the latest COVID-19 news from around the industry this week.

IRI: Lessons from 2008 Recession

Research firm IRI reviewed best practices for brands based on historical data from the 2008-2010 recession.

The report focused on 200 food and beverage brands that grew both in value and volume, with frozen brand LeanCuisine and snack brand CLIF in the top five for volume growth. At the time, IRI noted, fewer than half of all large brands saw both dollar sales and volume grow.

Importantly, IRI found, brands must understand changing consumer needs. To increase household penetration, which IRI noted as key for overall growth, successful food companies innovated, communicated new usage occasions and benefits for their products and grew their distribution.

It will also be crucial to offer proper pack sizes and price points as value becomes an even more critical purchase driver. Looking back at 2008, Birds Eye was noted as a high growth brand (CAGR over 6.6%), in part, because it utilized these strategies; the brand gained 5.6 penetration points after expanding its line of steamed vegetables to include microwave meals with grains, pasta and protein, and targeting boomers with ads promoting complete meals, rather than just side dishes.

While sales may dip, there’s also room for growth for brands who can convert new buyers to loyal fans, the report explained. To do that, brand messaging can offer comfort and should provide ideas around cooking and entertaining at home. Strong distribution across grocery and e-commerce, as well as value channels, will also be crucial, and innovation should prioritize value-based shoppers and premium products in select markets and categories, according to IRI.

FDA, USDA: Supply Chain Management Plans

The Food And Drug Administration (FDA) and U.S. Department of Agriculture (USDA) this week released a Memorandum of Understanding (MOU) and a letter to the food industry outlining plans to ensure supply chain safety and consistency.

The memorandum comes as peak produce season starts, with more fruits and vegetables making their way to manufacturing facilities for canning and freezing. As a follow-up to President Trump’s April 28 Executive Order 13917, which gave the USDA authority to utilize the Defense Production Act (DPA), the MOU clarifies how the FDA and USDA would work together to manage potential interruptions at FDA-regulated food facilities in the future.

The USDA will retain its exclusive authority to issue DPA orders for meat and poultry facilities that manufacture, process, pack, or hold foods; the MOU extends that authority to growers or harvesters under FDA’s jurisdiction as needed. If the FDA identifies a disruption “of sufficient likelihood, seriousness or significance,” it will contact USDA in order to utilize the DPA.

In a statement Tuesday, Mindy Brashears, USDA under secretary for food safety, and Frank Yiannas, FDA deputy commissioner for food policy and response, noted they are “extremely grateful” for the food industry’s work during COVID-19. Previously, the FDA stated the supply chain is safe and also loosened labeling guidelines to reroute food destined for foodservice to retailers and consumers. FDA commissioner Stephen Hahn noted in the letter the agencies are committed to “additional preparedness measures” to “help the industry maintain continuity of operations.” The FDA will also continue working to ensure the availability of PPE and sanitation supplies throughout the food industry, Hahn said.

“Although we hope the DPA authority will not need to be invoked, this MOU is an important part of our preparedness efforts to make sure there are processes in place to protect the food supply and prevent significant food shortages,” he said.

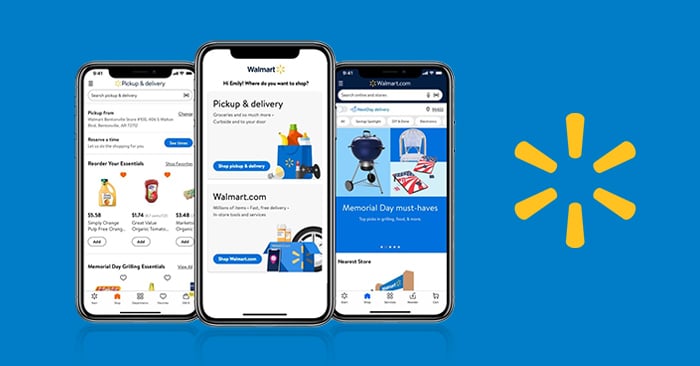

As Ecomm Booms, Walmart Updates App and Drops Jet.com

As more and more consumers shift to shopping online, Walmart is streamlining its services with an updated mobile app and discontinuing Jet.com.

On its first quarter earnings call Tuesday, Walmart EVP and CFO Brett Biggs said the retailer saw a 74% increase in e-commerce sales during Q1. Store pickup and delivery spiked in March and remained high in April, with peak sales growth at almost 300%. Analytics platform App Annie found that for the week ending April 5, Walmart’s Grocery App grew 460% in average daily downloads compared to January 2020. At the same time, shopping at Walmart locations slowed in the first weeks of April, Biggs noted.

“E-commerce sales remained strong throughout the quarter while store traffic was quite variable due to the various stay in place orders and social distancing around the country,” he said. “Pickup and delivery services continue to run historically high volumes.”

To accommodate the online rush, the retailer is making some changes: its two apps (for grocery and non-grocery items) are now one, a plan that was announced in early March. In a blog post, Walmart noted that half of its online orders are already coming through the refreshed app, which is also seeing an increase in non-grocery purchases.

“We walked in the shoes of our customers and selected their most pressing needs to solve for in days, not months,” chief product officer Meng Chee said. “This the beginning of our journey for the Walmart App.”

The new app promises “hundreds of thousands” of grocery pickup slots, as well as Express Delivery, which arrives in under two hours and contact-free service for both pickup and delivery. It also allows touchless payments in stores using Walmart Pay.

During Tuesday’s call, Walmart also announced it’s discontinuing online marketplace Jet.com, which it acquired for $3 billion in 2016. President and CEO Doug McMillon noted that Jet.com, which sold pantry staples, snacks and non-food items, was critical in boosting Walmart’s online delivery and pickup services, but research found that the Walmart name holds more weight with shoppers.

“Our resources, people and financials have been dominated by the Walmart brand because it has so much traction,” he said. “We’re seeing it resonate regardless of income, geography or age.”